Home » Services » Door to Door » IMEA » Saudi Arabia » Local Solutions Saudi Arabia

Building strong logistics ties between UAE and Saudi Arabia for a seamless, efficient trade relationship.

UAE - Saudi Arabia

Local Solutions

Enabling businesses in Saudi Arabia to thrive locally and globally with efficient logistics solutions.

Transport

Whether you need more warehouse space or more flexibility in your distribution & delivery network, we have the solution.

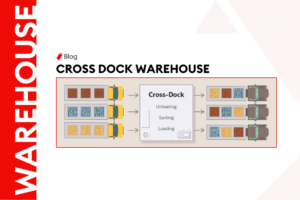

Warehouse

Whether you need more warehouse space or more flexibility in your distribution & delivery network, we have the solution.

Trade Solutions

Whether you need more warehouse space or more flexibility in your distribution & delivery network, we have the solution.

Frequently Asked Questions (FAQ)

What major airports support cargo shipments between the UAE and Saudi Arabia?

Major airports include King Khalid International Airport in Riyadh, King Abdulaziz International Airport in Jeddah, and King Fahd International Airport in Dammam. These airports are equipped with advanced cargo handling systems, cold storage, and specialized facilities for perishable and dangerous goods.

What are the key seaports for trade between the UAE and Saudi Arabia, and what capabilities do they offer?

Key seaports include Jeddah Islamic Port, King Abdullah Port, and Dammam Port. These ports feature modern facilities, high cargo handling capacities, and automation for efficient logistics. Jeddah Islamic Port is the largest, King Abdullah Port is highly automated, and Dammam Port connects to global markets with integrated logistics zones.

What documents are required for importing goods into Saudi Arabia from the UAE?

Required documents include a Commercial Invoice, Certificate of Origin, Packing List, Bill of Lading or Airway Bill, Import Permit for restricted goods, Health Certificate for food items, Insurance Certificate, and a Letter of Credit if applicable.

What are the customs duties and taxes for goods traded between the UAE and Saudi Arabia?

In the UAE, customs duties are typically 5% on most goods, with a Value Added Tax (VAT) of 5%. Excise taxes range from 50% to 100% on specific items. In Saudi Arabia, customs duties can vary between 0% to 25%, with a VAT of 15% and excise taxes up to 100% on certain goods.

How can businesses ensure smooth export processes from Saudi Arabia to the UAE?

Businesses must comply with Saudi Arabia's customs regulations, secure an Export License, and provide accurate documentation, including a Commercial Invoice, Packing List, Bill of Lading or Airway Bill, Export License, Certificate of Origin, Safety and Quality Certificates where applicable, Export Declaration, and an Export Permit for restricted goods. Compliance with Saudi quality standards and securing specific permits are also crucial for a smooth export process.

Related Articles

Anything you need, We’re here to Help

Chat With Us

Effortlessly schedule your next shipment with us for reliable and timely delivery.

Request a Quote

Receive a personalized shipping quote that meets your specific logistic needs.