Retail Logistics in the Age of E-commerce and Innovation in the UAE

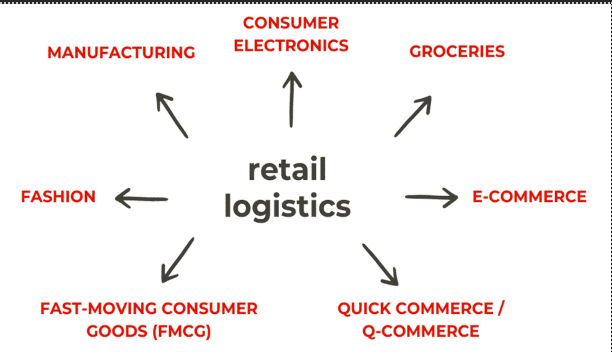

Retail logistics is the backbone of e-commerce success, driving fast and efficient delivery. As consumer expectations rise, companies must adapt to remain competitive, with innovations like automated warehouses and omnichannel fulfillment strategies. This analysis dives into the latest trends, challenges, and solutions transforming the retail logistics landscape, focusing on both global and UAE markets.

Global Retail Logistics Overview

Market Size and Revenue

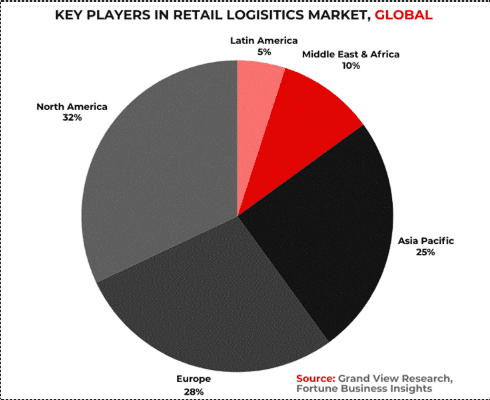

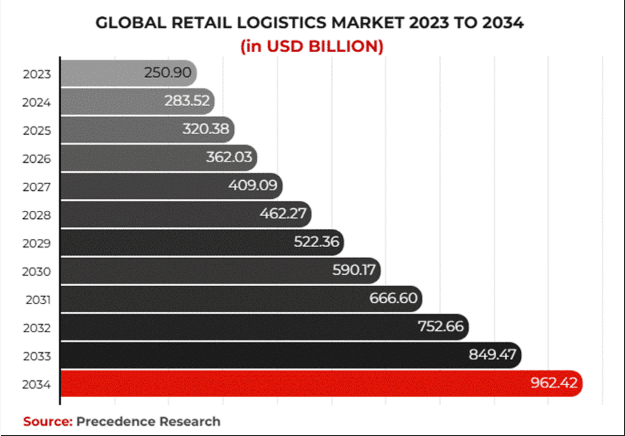

The global retail logistics market has grown significantly, with the expansion of e-commerce, evolving consumer expectations, and technological advancements. In 2023, the market was valued at USD 250.90 billion.

Industry Drivers

E-commerce Growth

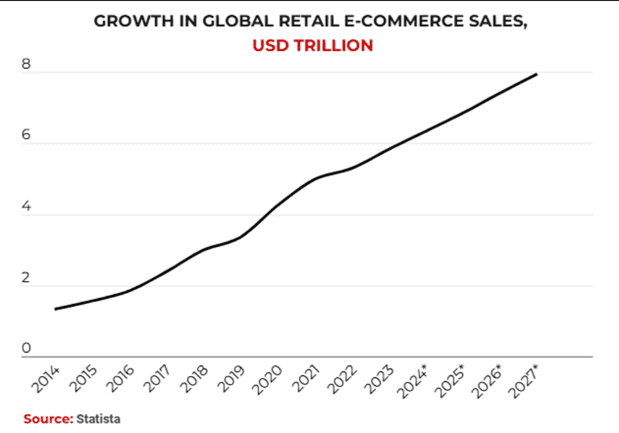

E-commerce has profoundly reshaped the retail logistics landscape, revolutionizing fulfillment strategies and intensifying competition among logistics providers. The rapid expansion of online shopping, projected to account for over USD 6 trillion in global sales by 2024, has necessitated the adoption of more agile and scalable logistics models. Fulfillment centers now operate around the clock, leveraging real-time inventory management to handle surging order volumes.

Retailers are also integrating omnichannel strategies, combining online and in-store shopping experiences to enhance convenience. For instance, “Buy Online, Pick Up In-Store” (BOPIS) models have grown popular, requiring robust logistics systems to synchronize inventory across channels.

Advances in Technology

Artificial Intelligence (AI) has been pivotal in optimizing supply chain processes, including route planning, demand forecasting, and inventory management. By predicting consumer demand patterns, AI helps reduce costs and minimize wastage.

IoT sensors are widely used for real-time updates on shipments, ensuring timely deliveries and mitigating risks like temperature fluctuations for perishable goods. Robotics and automation have also gained traction in warehouse operations, expediting order picking and packing processes. Autonomous robots, such as those deployed by Ocado, are reducing human error and increasing throughput in fulfillment centers.

Consumer Demands

Modern consumers expect faster, more reliable, and flexible delivery options, reshaping the priorities of retail logistics. A recent survey by Fortune Business Insights revealed that 80% of shoppers prioritize same-day or next-day delivery, pressuring retailers to enhance last-mile delivery capabilities.

Sustainability is another growing demand, with consumers favoring eco-friendly practices. Retailers are responding by adopting green logistics solutions, including electric vehicles, carbon-neutral shipping, and biodegradable packaging. Additionally, the emphasis on real-time tracking capabilities reflects the modern buyer’s need for transparency and control over their purchases.

Challenges in Global Retail Logistics

Rising Fuel Costs

Rising fuel costs remain one of the most significant challenges facing the retail logistics industry. The fluctuations in global oil prices, driven by geopolitical tensions, supply chain disruptions, and demand-supply imbalances, directly impact transportation costs. As of November 2024, fuel prices have risen by 6% year-over-year, further straining logistics budgets for both large-scale operations and small businesses.

To mitigate the financial burden, many companies are turning to alternative energy sources and technologies. The adoption of electric delivery vehicles, hydrogen-powered trucks, and renewable energy systems for fleet operations is gaining momentum. Additionally, businesses are optimizing delivery routes using AI and predictive analytics to reduce fuel consumption and enhance efficiency.

Global Supply Chain Disruptions

Global supply chain disruptions have become increasingly common, with the COVID-19 pandemic exposing vulnerabilities in traditional logistics systems. During the pandemic, widespread lockdowns, factory shutdowns, and port congestion led to severe delays and shortages of essential goods. Even now, the aftereffects of such disruptions linger, exacerbated by ongoing geopolitical tensions and unpredictable natural disasters.

Last-Mile Delivery Complexities

Last-mile delivery remains challenging in retail logistics. Urban congestion, high delivery costs, and environmental concerns hinder the efficiency of delivering goods to consumers’ doorsteps. Research indicates that last-mile delivery accounts for approximately 41% of total supply chain costs and contributes significantly to carbon emissions.

UAE Retail Logistics Landscape

Market Overview

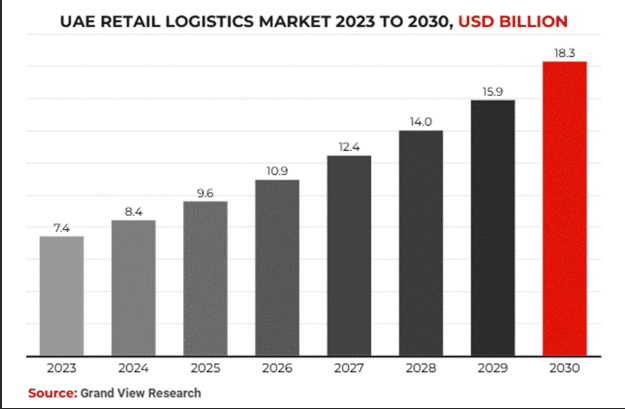

The UAE’s retail logistics market is currently valued at approximately USD 8 billion, reflecting its substantial role in supporting the nation’s economic diversification initiatives. The sector contributes significantly to the nation’s GDP, serving as a vital component of the country’s non-oil economy, which has been prioritized under national strategies such as Vision 2030.

E-commerce has been a major driver of growth in the UAE’s retail logistics landscape, with the sector experiencing a compound annual growth rate (CAGR) of over 23% between 2018 and 2024. The rapid adoption of digital platforms by consumers, coupled with increased internet penetration and smartphone usage, has transformed supply chain dynamics.

Key Drivers in the UAE

Strategic Location

Strategically located along some of the world’s most vital trade routes, including the Strait of Hormuz and key maritime pathways to the Indian Ocean and Mediterranean, the UAE is a gateway for goods traveling between continents.

Ports like Jebel Ali, one of the Middle East’s largest, and Khalifa Port, a leading deepwater terminal, handle millions of containers annually. Similarly, Dubai International Airport and Zayed International Airport handle billions of dollars’ worth of air cargo each year.

Government Initiatives

The UAE government has been instrumental in driving the growth of the logistics sector, with initiatives such as Vision 2030 being crucial. It aims to diversify the country’s economy by encouraging innovation, increasing non-oil revenues, and investing in critical sectors such as logistics and e-commerce.

Massive investments in free zones, including Jebel Ali Free Zone and Dubai South, have also transformed the UAE into a magnet for global trade and logistics companies. These zones offer tax incentives, advanced facilities, and streamlined customs processes, creating a business-friendly environment that attracts multinational corporations.

Technology Adoption

The adoption of cutting-edge technologies such as blockchain, artificial intelligence (AI), and automation has revolutionized the UAE’s retail logistics industry. Blockchain technology ensures transparency and security in supply chain transactions, reducing fraud and enhancing trust among stakeholders.

Meanwhile, AI is being used to optimize demand forecasting, route planning, and warehouse management. AI-driven predictive analytics allow companies to preempt potential disruptions.

Automation technologies, including robotics in warehouses, streamline tasks such as sorting, packing, and inventory management. Companies like DP World and Aramex are investing heavily in these technologies to address the rising demands of e-commerce.

Challenges Specific to the UAE

High Operational Costs

The cost of real estate in key logistics hubs like Dubai and Abu Dhabi is among the highest in the region, making warehouse leasing and development expensive.

Additionally, rising labor costs, driven by the UAE’s high living standards and the need for skilled professionals, further increase operational expenses. Transportation costs are also significant, particularly with volatile fuel prices adding unpredictability to logistics budgets.

Sustainability Concerns

Sustainability is an increasingly pressing concern for retail logistics in the UAE. The logistics sector contributes significantly to greenhouse gas emissions, primarily through transportation and energy-intensive warehouse operations.

With global and regional calls for reducing carbon footprints, businesses are under pressure to adopt environmentally friendly practices. However, transitioning to sustainable logistics—such as using electric vehicles (EVs), renewable energy in warehouses, and biodegradable packaging—often involves high initial investments, making it a challenge for many companies.

Regulatory Compliance Issues

The country’s strict customs regulations, import-export policies, and compliance requirements can create bottlenecks, particularly for companies unfamiliar with the region’s legal landscape. Regulatory delays at ports and checkpoints often disrupt supply chains, leading to increased costs and customer dissatisfaction.

Additionally, the UAE’s commitment to international trade agreements means businesses must comply with a wide range of standards and documentation requirements. While free zones such as Jebel Ali Free Zone (JAFZA) provide streamlined processes, companies operating outside these zones often face more complex compliance procedures.

Emerging Trends in Retail Logistics

Global Trends

Sustainable Logistics

As environmental awareness grows, consumers and regulators are pushing companies to adopt green practices. Retailers are responding by optimizing their supply chains with measures such as reducing packaging waste, deploying electric delivery vehicles, and investing in energy-efficient warehousing.

Circular economy practices are also gaining traction, with retailers embracing reusable packaging and reverse logistics to reclaim and recycle products.

Sustainable Logistics

As environmental awareness grows, consumers and regulators are pushing companies to adopt green practices. Retailers are responding by optimizing their supply chains with measures such as reducing packaging waste, deploying electric delivery vehicles, and investing in energy-efficient warehousing.

Circular economy practices are also gaining traction, with retailers embracing reusable packaging and reverse logistics to reclaim and recycle products.

Autonomous Vehicles and Drones

Autonomous delivery systems, including drones and self-driving vehicles, are revolutionizing retail logistics by offering faster, more cost-effective last-mile delivery solutions. Companies like Amazon, Walmart, and UPS are investing heavily in drone fleets, with trials showing significant reductions in delivery times for e-commerce orders.

Meanwhile, self-driving trucks are transforming long-haul logistics, enhancing safety and operational efficiency.

Omnichannel Strategies

Retailers are implementing systems that synchronize inventory across physical stores, warehouses, and e-commerce platforms, ensuring real-time visibility and improved efficiency. “Buy Online, Pick Up In-Store” (BOPIS) and curbside pickup have gained significant traction, particularly after the pandemic reshaped consumer expectations.

This shift requires advanced fulfillment strategies to manage inventory complexity and meet delivery demands efficiently. Major players such as Target and Zara have successfully implemented these omnichannel models to reduce delivery times. The adoption of omnichannel strategies also benefits from data analytics and AI advancements, which help retailers anticipate customer needs, optimize supply chains, and personalize the shopping experience.

UAE-Specific Trends

Express Delivery Services

With consumers increasingly expecting same-day or next-day delivery, logistics companies have prioritized speed and efficiency. The introduction of hyperlocal fulfillment centers in cities like Dubai and Abu Dhabi has further streamlined the delivery process.

The implementation of advanced technologies such as AI-driven route optimization has also enhanced the speed and reliability of express deliveries. These innovations are crucial in maintaining customer satisfaction and loyalty, especially in a market where competition among e-commerce platforms is intense.

Smart Warehouses

Smart warehouse technology is revolutionizing logistics operations in the UAE, addressing the need for efficiency, scalability, and precision. These warehouses employ advanced automation tools, including robotic arms for picking and packing, automated guided vehicles (AGVs) for transportation, and IoT sensors for real-time monitoring of inventory levels.

Sustainability Initiatives

Sustainability has become a critical focus area for the UAE’s retail logistics industry, driven by global environmental goals and the UAE government’s Green Agenda 2030. Companies are adopting eco-friendly practices, such as using electric vehicles (EVs) for last-mile delivery and incorporating renewable energy sources in warehouse operations.

Circular economy principles are also gaining traction, with companies implementing recycling programs for packaging materials and reducing waste in supply chain processes. The UAE government’s emphasis on sustainability, coupled with consumer preference for environmentally responsible brands, is encouraging logistics players to innovate and adopt green solutions.

Comparative Analysis - Global vs. UAE Logistics

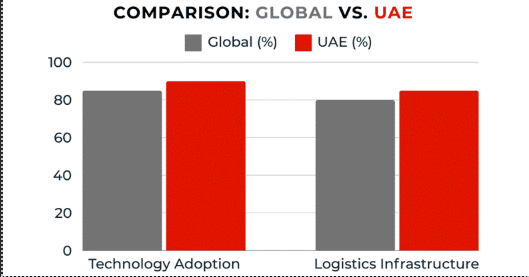

Technology Use

Globally, the retail logistics sector has rapidly embraced advanced technologies to enhance efficiency and responsiveness. For example, Walmart employs AI for demand forecasting, inventory management, and route optimization, while its robotic systems in warehouses streamline order picking and packing. Blockchain technology, adopted by companies like Suning, ensures supply chain transparency and security, enabling real-time tracking of shipments and reducing errors.

The UAE, despite operating on a smaller scale, is at the forefront of technological innovation in logistics. The country has focused on smart warehouses equipped with Internet of Things (IoT) devices and robotics to optimize operations. Landmark Group, for instance, employs centralized logistics hubs with advanced systems for monitoring and managing inventory across the region. Similarly, Carrefour UAE has implemented AI-driven demand forecasting and solar-powered warehouses to support its retail operations.

Infrastructure

The global retail logistics market benefits from well-established infrastructure, particularly in regions like North America, Europe, and East Asia. These markets employ vast networks of highways, rail systems, and ports. For example, Walmart’s U.S. logistics network includes over 150 distribution centers connected by advanced transportation systems that allow seamless product movement from suppliers to retail stores. Similarly, China’s infrastructure investments have supported companies like Alibaba and JD.com in building efficient logistics systems capable of handling immense order volumes.

In contrast, the UAE leverages its strategic geographic location at the crossroads of Africa, Asia, and Europe to serve as a logistics hub. World-class facilities such as Jebel Ali Port, the largest container port in the Middle East, and Al Maktoum International Airport, designed for high cargo capacity, position the UAE as a gateway for global trade. The ongoing development of Etihad Rail is expected to enhance regional connectivity further, reducing dependency on road transport and increasing efficiency.

Growth Potential

The growth trajectory of retail logistics globally is fueled by the rapid expansion of e-commerce and the increasing emphasis on sustainability. Markets like India, Brazil, and Southeast Asia are emerging as growth hotspots due to rising digital penetration and infrastructure development. By 2030, the global retail logistics market is expected to grow at a compound annual growth rate (CAGR) of 11%, reaching an estimated value of over $960 billion.

In the UAE, growth potential is equally robust but driven by different factors. Government-led initiatives such as Vision 2030 aim to diversify the economy and position the country as a global logistics leader. The UAE’s retail logistics market, valued at $30 billion in 2024, is projected to grow at a CAGR of 12% by 2028, supported by rising e-commerce demand and the adoption of green logistics solutions.

Revenue Opportunities and Future Growth

Global Perspective

The global retail logistics industry continues to experience robust growth, driven by the expansion of e-commerce, technological advancements, and increasing consumer expectations. By 2030, the global market is projected to exceed $960 billion, growing at a compound annual growth rate (CAGR) of approximately 11% from 2024.

One of the primary drivers of growth is the e-commerce sector, which has witnessed unprecedented acceleration globally. As digital penetration deepens in emerging markets like India, Brazil, and Southeast Asia, retail logistics providers are investing heavily in infrastructure and technology to meet the rising demand for fast and efficient deliveries.

FMCGs and pharmaceutical industries also present significant opportunities, particularly in population-dense and urbanized regions. Africa and Latin America, where infrastructure is rapidly improving, are emerging as attractive destinations for retail logistics investments.

UAE Focus

The legacy of Expo 2020 has left a profound impact on the UAE’s logistics infrastructure, leading to significant investments in technology and sustainability. These advancements have been repurposed to support the retail and e-commerce sectors, with new facilities and technologies driving future growth.

Cross-border e-commerce has emerged as one of the most lucrative opportunities in the UAE retail logistics market. Retailers and logistics companies are leveraging free zones like Jebel Ali Free Zone (JAFZA) to streamline operations, benefit from tax incentives, and tap into global markets efficiently.

Additionally, the UAE’s focus on sustainability is creating new revenue streams in green logistics. Initiatives like solar-powered warehouses, electric vehicle adoption for last-mile delivery, and investments in circular economy principles are not only reducing environmental impact but also attracting environmentally conscious businesses and consumers.

Challenges and Solutions

Addressing Challenges Globally

The global retail logistics industry faces numerous challenges that complicate supply chain operations and impact overall efficiency.

One significant challenge is the reliance on traditional long-distance supply chains, which are often vulnerable to geopolitical tensions and disruptions, as evidenced during the COVID-19 pandemic. To address these issues, many businesses are adopting nearshoring strategies, moving production and distribution closer to their primary markets. Nearshoring also minimizes the environmental footprint associated with long-distance shipping.

Another solution lies in the adoption of digital tools and technologies. Artificial Intelligence (AI) and predictive analytics enable better demand forecasting and inventory management, reducing waste and improving efficiency. Blockchain enhances supply chain transparency, while ensuring compliance with global trade regulations and reducing fraud risks.

UAE-Specific Solutions

In the United Arab Emirates, retail logistics faces challenges unique to the region’s economic and geographic context. One potential solution is optimizing delivery networks through integrating smart technologies. IoT-enabled systems and AI-driven route optimization can minimize delivery times and fuel consumption, addressing both cost and environmental concerns.

Leveraging partnerships with third-party logistics providers (3PLs) and carriers is another viable strategy. These connections enable businesses to scale operations efficiently, reduce overhead costs, and focus on core competencies.

Strategic Recommendations

Recommendations for Global Players

Rising operational expenses, fueled by high energy costs and inflation, demand innovative solutions to maintain competitiveness. One effective approach is leveraging advanced technologies like AI and automation. AI-driven predictive analytics can optimize inventory levels and route planning, while automated warehouses enhance efficiency and minimize labor costs.

Strategies such as nearshoring and diversifying supplier bases enhance supply chain resilience while ensuring continuity during crises. Digital twins and real-time tracking systems further bolster resilience by providing visibility into supply chain operations, enabling swift adjustments to tackle disruptions.

Tailored Strategies for UAE Businesses

Situated at the crossroads of Europe, Asia, and Africa, the UAE offers unparalleled access to regional markets. Businesses should leverage this geographic advantage by establishing centralized logistics hubs in key locations such as Jebel Ali Port and Khalifa Port.

Partnerships with third-party logistics providers (3PLs) and carriers also allows businesses to tap into specialized expertise and scalable resources. For instance, working with carriers that offer sustainable delivery solutions, such as electric vehicle fleets, aligns with the UAE’s sustainability goals and enhances operational efficiency. Additionally, integrating blockchain and IoT in supply chain processes ensures compliance with international trade standards.

Conclusion

The retail logistics industry, both globally and in the UAE, is undergoing a transformative period. Globally, strategies such as nearshoring, digitalization, and sustainable practices are enabling businesses to enhance efficiency while building resilience against disruptions. The UAE’s strategic location, advanced infrastructure, and government initiatives has positioned the country as a hub for regional and global logistics operations.

Looking forward, businesses must prioritize innovation through AI, blockchain, and automation while adopting green logistics practices. For Emirati businesses, forming third-party partnerships and embracing emerging trends like cross-border e-commerce will ensure sustainable growth and a competitive edge in the dynamic retail logistics landscape.

Related Articles

Events in Motion: Unlocking the Future of Global and Regional Event Logistics

As global demand for large-scale and hybrid events rises, event logistics has become a strategic nec

Retail Logistics in the Age of E-commerce and Innovation in the UAE

Retail logistics is the backbone of e-commerce success, driving fast and efficient delivery. As cons

Future of FMCG Logistics: Trends, Challenges, and Opportunities

Discover the latest insights and strategies driving the FMCG logistics market. This comprehensive wh

Post a comment

You must be logged in to post a comment.