What are the Trade Benefits Provided by the UAE?

For companies and corporations interested in conducting business within the borders of the United Arab Emirates, there are vast options available. These are possible due to the UAE being a signatory to various profitable trade agreements.

Generally, the intention of trade agreements in worldwide trade has been and continually remains to aid business operations among countries, states, or customs territories. However, it is only the benefits you are aware of that you can take advantage of to stay ahead in the market.

That’s why we’ll be discussing all trade agreements, their invaluable effects in the global markets, and the positive impacts of these treaties on executing trade operations in the UAE.

What Is a Trade Agreement?

A trade agreement occurs when two or more countries agree on terms and circumstances that make sure they conduct trade with one another with less problems. Essentially, these agreements minimize or remove trade restrictions between the involved countries.

Trade agreements may be unilateral (involving just one country), bilateral (a signed treaty between 2 countries or customs territories), or multilateral (signed by more than two countries bordering one another or situated in the same region).

Importance of Trade Agreements to Global Trade

In addition to easing trade regulations that govern business engagements with one country, between two countries, or with several countries, trade agreements are beneficial to the international market for the following reasons.

- Enhancing joint cooperation among worldwide customs authorities,

- Reducing violations of customs legal guidelines that negate economic, financial, moral, social, religious, and cultural interests of signatory parties,

- Enforcing punishments of customs violations to enhance cooperation between countries,

- Safeguarding the health and economy of local societies from the negative impacts of using counterfeit goods,

- Monitoring the transport of dual-use materials,

- Protecting intellectual property rights via efficient means of stopping and punishing piracy, and

- They facilitate passenger and trade movements among partnering international locations around the world via effective legislation.

Existing Trade Agreements between the UAE and Other Countries

Outlined below are the trade agreements between the United Arab Emirates and various international states that are currently in effect.

Signed in 2001 and effected in 2003, the GCC agreement encompasses the UAE and other member states of the Gulf Cooperation Council (GCC) such as Saudi Arabia, Bahrain, Oman, and Kuwait.

The GCC Commercial Agreement strengthens the economic ties of the UAE with these countries by tackling areas such as; commercial exchange, economic and currency unification, human capital development, scientific and technological research and development, creating a common Gulf market.

Furthermore, this trade agreement serves to enhance the competitiveness of the signatories through; standardizing import and export procedures and systems. In addition, it provides national treatment for citizens of GCC countries covering resident, social, business, and insurance benefits, among others.

It also adopts a customs union of legislation and procedures, and adopt complementary policies among GCC states for economic growth and development.

Greater Arab Free Trade Area (GAFTA)

The Arab League Economic and Social Council resolved to facilitate free trade among the Arab States. This resulted in the GAFTA agreement of 1997.

These member states that are party to the agreement, including the UAE, are; Saudi Arabia, Kuwait, Qatar, Bahrain, Jordan, Oman, Lebanon, Iraq, Egypt, Morocco, Tunisia, Palestine, Libyan Arab Jamahiriya, Syria, and Yemen.

The GAFTA Agreement envisioned to create an commercial block to successfully compete with other countries of the world and nurture trade relations among member states. Notably, members enjoy complete duty exemption on goods produced by member states and non-tariff restrictions on imports.

The GCC and European Free Trade Area (EFTA) countries signed a free trade agreement in 2009 to address issues such as trade-in; items and services, intellectual property rights, e-commerce, competition law, involvement in government procurement, and settlement of disputes.

As well as the UAE, the states involved in the agreement include Saudi Arabia, Switzerland, Kuwait, Norway, Qatar, Iceland, Oman, Liechtenstein, and Bahrain.

The GSFTA is an alliance uniting the GCC member states and the Republic of Singapore with the aim to develop free trade in goods and services and the procurement markets of each member state on a reciprocal basis.

Service sectors covered are; communication, distribution, environmental, contracting, and related engineering, financial, health, social, tourism, sports, cultural, and recreational services.

ITA

The United Arab Emirates is one of 78 countries (estimated to be 97% of the world’s IT market) that are parties to the Information Technology Agreement (ITA). The ITA was primarily established to reduce or eliminate, where possible, the customs duties and tariffs imposed on IT products.

The IT products covered by this trade agreement include; computers (including hardware and related accessories), communication equipment, semiconductors (including chips and hardware manufacturing software), and scientific equipment related to the products mentioned above.

Through the Federal Customs Authority (FCA), the UAE is actively involved in the international community and bodies such as the World Trade Organization, the World Customs Organization, as well as being a signatory in bilateral agreements with the following countries;

- The Islamic Republic of Pakistan

- Kingdom of the Netherlands

- The Republic of Algeria

- The Republic of Argentina

- The Republic of Armenia

- The Republic of India

- Republic of Maldives

- Republic of South Korea

- The Kingdom of Morocco

- The Republic of Azerbaijan

- The Republic of Kazakhstan

How Trade Agreements Enable Business Within the UAE

The participation of the United Arab Emirates in the various trade agreements anticipates better trade and industry cooperation with other countries, actively diversify the economy, and stimulate sustainable growth within its borders.

So, how do these bilateral and multilateral trade agreements contribute to a more efficient international trade market?

- The UAE does not impose tariffs, charges, and levies on any kind of exported items and products except when exporting steel scrap

- The Free Trade Zones (FTZ) program benefits companies located within the designated free trade zones in the UAE. Also, goods may be imported into a free trade zone without paying the applicable duty, and these special areas allow for the production of goods and provision of services

- Under the GAFTA, companies can import goods produced in the other Arab States into the UAE without paying customs duties

- Administrative procurement in the UAE is more inclined towards local companies and suppliers. However, key projects are executed using overseas expertise, particularly in the deficiency of skilled local service providers.

- In the United Arab Emirates, safeguarding intellectual property rights maintains high precedence. The goal is to prevent infringement/violation of intellectual property rights and promote an atmosphere of innovation and foreign investment in related areas.

- All materials intended to produce any licensed project in the UAE are permitted into the borders under a duty-free order.

- The GSFTA gives the GCC states, which include the UAE, the privileges of; exemption from customs duties when exporting to Singapore and 99% exemption from customs duties when importing from Singapore, and preferential treatment in the case of tariffs.

- Licensed businesses in the UAE enjoy the privilege of a flat and minimal-Value Added Tax (VAT) rate of 5%

- In the designated Free Trade Zones, foreign participation in companies may be up to 100% of the share capital. In addition, the tax rate on corporate (legal entities) and personal (owners and employees) incomes stands at 0%

Our customer service team is happy to assist you with planing your next booking.

Related Articles

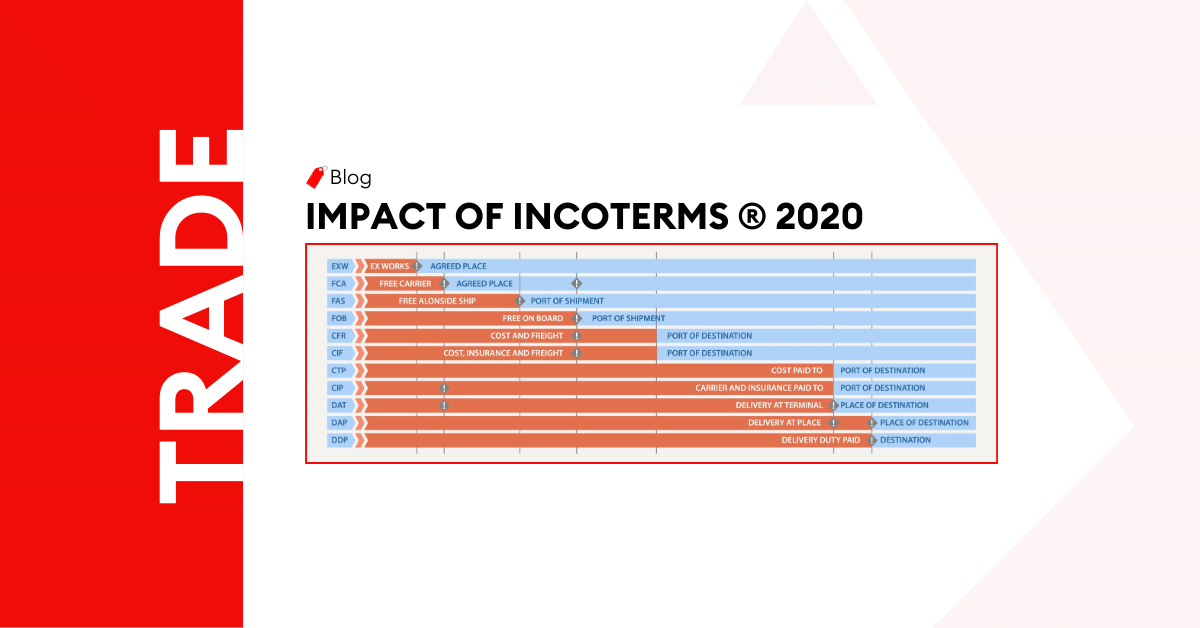

The Impact of Incoterms ® 2020 on Global Trade Explained

Understanding the incoterms is essential if you are shipping goods. These are the rules of commercia

Understanding the Different Types of Free Zones in the UAE

Introduction In the dynamic landscape of the United Arab Emirates (UAE), the concept of free zones h

UAE Free Zone vs. Mainland: Which One is Right for Your Business?

Introduction In the vibrant landscape of the United Arab Emirates, aspiring entrepreneurs often find

Post a comment

You must be logged in to post a comment.