Understanding the Different Types of Free Zones in the UAE

Introduction

In the dynamic landscape of the United Arab Emirates (UAE), the concept of free zones has emerged as a powerful engine of economic transformation. These specialized economic zones, scattered across the nation, play a pivotal role in the UAE’s grand strategy of economic diversification.

In a region historically reliant on oil revenues, these free zones are attracting businesses from every corner of the globe. Their allure lies in the unique benefits and incentives they offer – tax exemptions, streamlined regulations, and 100% foreign ownership. Let’s explore the different types of free zones in the UAE.

Free Trade Zones

Explanation of Free Trade Zones and Their Purpose

Free Trade Zones (FTZs) in the UAE are designated areas where businesses can operate with special regulatory and economic privileges. The primary purpose of establishing FTZs is to attract foreign direct investment, promote economic diversification, and boost trade by creating a business-friendly environment with simplified procedures and reduced barriers.

Benefits of Operating in a Free Trade Zone

Tax Incentives: Businesses operating within FTZs can enjoy tax exemptions for a specific period, contributing to increased profitability.

100% Foreign Ownership: In most FTZs, foreign investors can own their businesses entirely, without the need for a local partner or sponsor. This provides investors with control over their operations and decision-making processes.

Exemption from Customs Duties: Companies in FTZs benefit from reduced or zero customs duties on imports and exports, making it cost-effective to bring in raw materials and export finished goods. This enhances the competitiveness of products in international markets.

Repatriation of Profits: Companies operating in FTZs can repatriate all of their profits and capital without restrictions, allowing for efficient international fund management.

No Currency Restrictions: Businesses can transact in multiple currencies without any restrictions, facilitating international trade operations.

Definition and Characteristics of Export Processing Zones

Export Processing Zones (EPZs), also known as Free Export Zones, are specialized areas within a country where goods are produced, processed, and exported with specific incentives and benefits. In the UAE, EPZs are designed to promote export-oriented industries and attract foreign investment. These zones are strategically located near transportation hubs, such as ports and airports, to facilitate efficient logistics and distribution.

Characteristics of Export Processing Zones in the UAE:

- EPZs are specifically geared towards businesses engaged in manufacturing, processing, and producing goods for export markets. They provide an environment conducive to high-quality production and competitive pricing.

- Goods produced within EPZs are often granted exemptions from import duties, taxes, and other trade barriers. This makes the products more cost-effective for international buyers.

- EPZs typically have streamlined administrative processes for company registration, licensing, and permits. This reduces bureaucratic hurdles and accelerates business setup.

- EPZs may have more flexible labor regulations, allowing businesses to hire foreign workers and experts easily. This can contribute to a skilled and diverse workforce.

Advantages of Establishing a Business in Export Processing Zones

- EPZs offer a strategic location near transportation hubs, making it easier to access international markets and distribution services in Dubai.

- Businesses in EPZs benefit from exemptions on import and export duties, taxes, and other levies. This significantly lowers the overall cost of production and enhances competitiveness.

- The streamlined regulatory procedures and well-developed infrastructure within EPZs contribute to operational efficiency, allowing businesses to focus on production and growth.

- Export-oriented businesses can avoid many of the trade barriers that can hamper international trade, such as tariffs and quotas.

- EPZs attract foreign investors seeking a favorable environment for export-oriented manufacturing. This can lead to the transfer of technology, knowledge, and skills to the UAE. The establishment of export-focused industries leads to the creation of jobs, both directly within the EPZs and indirectly through the supply chain.

- EPZs contribute to economic diversification, reducing dependency on oil and fostering a more resilient economy.

- Businesses operating in EPZs can benefit from access to advanced infrastructure, skilled labor, and international business networks, enhancing their global competitiveness.

Overview of Special Economic Zones and Their Objectives

Special Economic Zones (SEZs) in the UAE are designated areas that offer unique incentives, regulations, and infrastructure to attract domestic and foreign investments. These zones are established to enhance economic diversification, promote innovation, and drive sustainable growth. SEZs are designed to create a conducive environment for various types of businesses, including manufacturing, technology, logistics, and more.

The objectives of SEZs include:

- Diversification: SEZs aim to diversify the UAE’s economy by attracting investments in non-oil sectors, and reducing reliance on oil revenue.

- Job Creation: SEZs generate employment opportunities, skill development, and training programs, contributing to workforce development and reducing unemployment.

- Export Promotion: SEZs often have a focus on export-oriented activities, driving the growth of industries that contribute to the country’s export revenue.

Benefits of Choosing a Special Economic Zone for Business Setup

- Many SEZs provide tax exemptions or reduced tax rates, enhancing cost efficiency and profitability for businesses.

- SEZs offer world-class infrastructure, including office spaces, manufacturing facilities, logistics centers, and utilities, enabling businesses to start operations quickly.

- The strategic location of SEZs near transportation hubs facilitates easy access to domestic and international markets, improving supply chain efficiency.

- SEZs attract multinational companies, fostering networking and collaboration opportunities, leading to partnerships and knowledge sharing.

- Similar to other UAE zones, SEZs allow 100% foreign ownership, providing investors with control over their businesses.

Case Studies of Businesses Flourishing in Special Economic Zones

- Jebel Ali Free Zone (JAFZA): One of the largest SEZs in the world, JAFZA has attracted a wide range of industries, including logistics, manufacturing, and trading. Major global companies such as Unilever and General Electric have established their presence in JAFZA.

- Dubai Internet City (DIC): DIC focuses on technology and innovation, attracting tech giants like Microsoft and Oracle. It has contributed to Dubai’s emergence as a technology hub in the Middle East.

- Khalifa Industrial Zone Abu Dhabi (KIZAD): KIZAD is a major industrial and logistics hub that hosts industries ranging from manufacturing to food processing. Major companies such as Emirates Steel and Abu Dhabi Ports operate here.

Explanation of Industrial Zones and Their Function

Industrial Zones in the UAE are specialized areas designated for manufacturing, processing, and other industrial activities. Industrial zones provide a supportive environment for businesses engaged in manufacturing, production, and related activities, offering various facilities, infrastructure, and incentives to facilitate their operations.

The functions of industrial zones include:

- Manufacturing and processing activities across a wide range of industries, including textiles, electronics, chemicals, and machinery.

- Necessary infrastructure such as factory spaces, warehouses, utilities (water, electricity, and gas), and transportation networks to support industrial operations.

- Logistics and distribution of raw materials and finished products.

- Research and development for innovation, technology transfer, and collaboration among businesses in the zone.

- Job creation, contributing to employment opportunities, and skill development.

- Value addition by promoting local manufacturing and processing of goods, reducing the country’s reliance on imports for finished products.

Advantages of Industrial Zones for Manufacturing and Production

- Industrial zones often offer cost-effective solutions for manufacturing due to shared infrastructure.

- Industrial zones foster the clustering of similar industries, facilitating better supply chain integration and collaboration among businesses.

- Simplified licensing and permitting procedures make it easier for businesses to set up.

- Businesses benefit from ready-to-use infrastructure, including utilities and transportation networks, allowing them to start operations quickly.

- Proximity to transportation hubs and export facilities enables easy access to domestic and international markets.

- Industrial zones often encourage technology adoption and innovation through collaboration, fostering growth and competitiveness.

Get In Touch

Benefits and Limitations of Different Free Zone Types

Detailing the Advantages of Each Free Zone Type

- Free Trade Zones (FTZs) cater to a wide range of industries, promoting economic diversification and attracting various types of businesses. Also, businesses in FTZs benefit from tax exemptions, 100% foreign ownership, import duty exemptions, and streamlined customs procedures to reduce import/export costs and delays.

- Export Processing Zones (EPZs) encourage export-oriented production, contributing to a country’s export revenue. For this reason, there are customs duty exemptions on raw materials to reduce production costs. Furthermore, EPZs provide industrial facilities and logistics support to optimize business operations and generate employment opportunities to improve local economies.

- Special Economic Zones (SEZs) promote economic diversification by attracting investments across various industries and attracting foreign direct investment through tax incentives and business-friendly policies. SEZs often encourage research and development to foster innovation.

- Industrial zones provide dedicated infrastructure for manufacturing and production activities, provide storage services in Dubai,, and encourage shared facilities to reduce operational costs and capital investment.

Discussing Any Potential Limitations or Considerations

- ree trade zones (FTZs) focus on international trade, which might limit access to the local market. Free zone businesses in certain sectors might find more specialized free zones better suited to their needs.

- EPZs’ focus on exports can make businesses vulnerable to fluctuations in international markets. Additionally, businesses solely focused on the domestic market stand to benefit from export processing zones. Yet, adhering to export regulations and standards in EPZs can be complex.

- Essentially, the diversity of industries within Special Economic Zones (SEZs) can lead to heightened competition. Changes in government policies can impact business operations. Also, balancing between attracting foreign investment and benefiting the local economy can be challenging.

- Industrial zones involve managing heavy industrial activities with potentially harmful environmental implications. As a result of these environmental or safety concerns, some activities might have zoning limitations.

Selecting the Right Free Zone for Your Business

6 Main Factors to Consider When Choosing a Free Zone

- Strategic location near your target markets, suppliers, and transportation hubs.

- Quality and availability of facilities, warehouses, utilities, and transportation networks.

- Regulatory framework and licensing requirements of the free zone.

- Available tax benefits.

- Setup and operational costs, including lease rates, licensing fees, and other expenses.

- Ease of doing business in terms of administrative processes, renewals, and amendments.

Aligning Business Goals with Free Zone Offerings

Aligning business goals with the unique elements of a particular free zone optimizes operations and guarantees results. Consider the following crucial factors:

- If your business primarily targets local markets, consider a free zone with access to the domestic market. For international reach, opt for zones near ports and airports.

- If your focus is on exports, opt for zones with export processing benefits. For local sales, consider zones with easy access to the domestic market.

- Choose a free zone that accommodates your expansion plans, both in terms of physical space and industry-related services.

- Evaluate your budget and consider setup costs, ongoing operational expenses, and potential return on investment.

- Ensure the free zone’s regulations align with your business activities.

How Al Sharqi Simplifies Free Zone Establishment

Al Sharqi is a Dubai based logistics firm that specializes in simplifying the process of establishing businesses in UAE Free Zones. With a comprehensive range of services, Al Sharqi assists companies in setting up and operating within these zones, enabling them to benefit from the UAE’s business-friendly environment and attractive incentives.

Expertise in Navigating Regulatory Procedures

Al Sharqi ensures that businesses adhere to the legal requirements and regulations of the chosen Free Zone, preventing any legal complications. We help in the process of obtaining the necessary licenses and permits required to operate in the Free Zones, preparing and submitting the required documentation accurately, saving time, and minimizing errors. Our expert team can navigate customs procedures and import/export regulations, ensuring businesses handle their logistics operations smoothly.

Ensuring Seamless Setup and Operational Processes

Al Sharqi services go beyond just setup; we provide ongoing support to ensure seamless operations. We assist in securing suitable office spaces, warehouses, and storage services in Dubai free zones, or elsewhere, based on specific business needs.

Also, our in-house professionals monitor regulatory changes and help businesses maintain compliance over time. Our industry experience allows us to provide valuable advice on business strategies, expansion plans, and market opportunities.

Conclusion

Various types of free zones serve different purposes–Free Trade Zones facilitate international trade, Export Processing Zones focus on boosting exports, Special Economic Zones promote innovation, and Industrial Zones apply to manufacturing processes.

United in diversity, these free zones epitomize the UAE’s commitment to nurturing innovation, embracing globalization, and making its mark on the world economy.

FAQs

Our experience in the field and our global network

Free Trade Zones focus on international trade and offer tax benefits, while Export Processing Zones encourage export-oriented production with customs benefits. Meanwhile, Special Economic Zones promote diversification, innovation, and foreign investment. Industrial Zones provide infrastructure for manufacturing and production activities.

Currently, there are at least 45 free zones all around the United Arab Emirates (UAE).

A free zone in the UAE is a specialized economic area offering distinct regulatory benefits to businesses. It encourages foreign investment, trade, and business growth, with advantages like 100% foreign ownership, tax exemptions, customs benefits, and streamlined administrative procedures.

Free zones in Dubai employ a low tax policy, meaning companies do not pay value-added tax (VAT), corporate tax, and customs duties. Also, there’s the possibility of 100% foreign ownership of the enterprise, access to world-class logistic facilities, and a readily available pool of multicultural, skilled professionals.

The cheapest free zone in the UAE is IFZA (International Free Zone Authority), offering low-cost company licenses without visas for AED 11,900.

In Dubai’s free zones, there are two main types of companies: Free Zone Limited Liability Companies (FZ-LLCs) and Branches of Foreign Companies. FZ-LLCs are standalone entities with limited liability, allowing individual or corporate ownership. Branches are extensions of foreign companies, enabling them to conduct business in the UAE while under the parent company’s regulations.

Related Articles

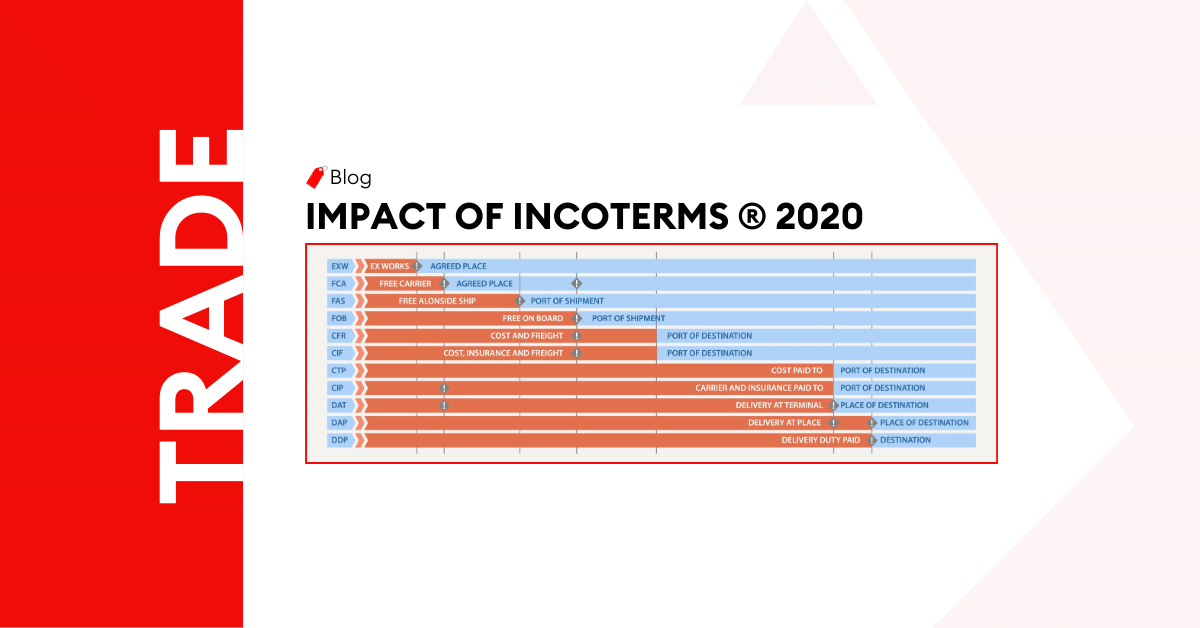

The Impact of Incoterms ® 2020 on Global Trade Explained

Understanding the incoterms is essential if you are shipping goods. These are the rules of commercia

Understanding the Different Types of Free Zones in the UAE

Introduction In the dynamic landscape of the United Arab Emirates (UAE), the concept of free zones h

UAE Free Zone vs. Mainland: Which One is Right for Your Business?

Introduction In the vibrant landscape of the United Arab Emirates, aspiring entrepreneurs often find

Post a comment

You must be logged in to post a comment.