The Impact of Incoterms ® 2020 on Global Trade Explained

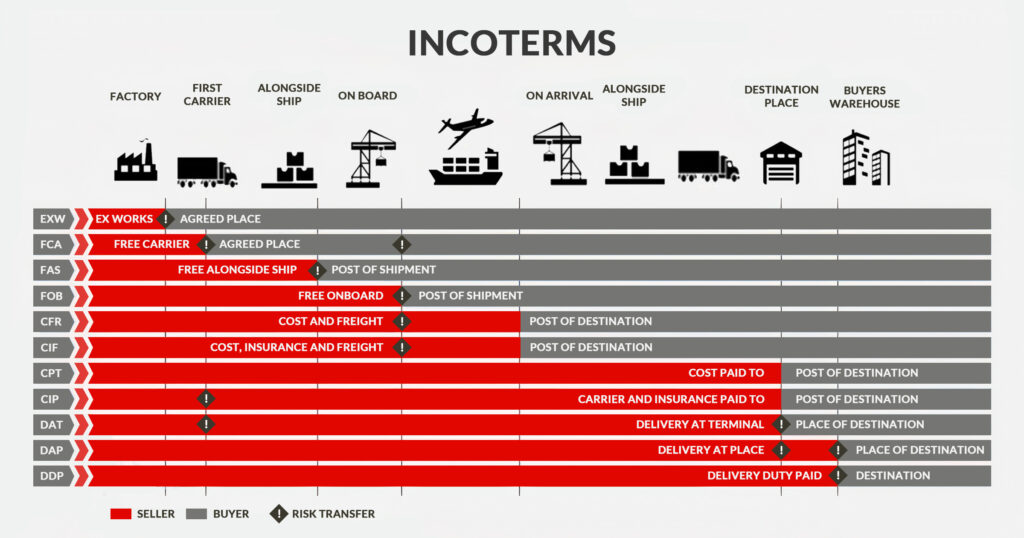

Understanding the incoterms is essential if you are shipping goods. These are the rules of commercial trade established by the International Chamber of Commerce (ICC) to be used in the sales contract. They are accepted by the governments and legal authorities around the globe. The latest version of the incoterms was published in 2020, coming in effect from January 1st, 2020. These terms play a vital role in global trade, which is why it is imperative for the buyers and sellers to understand how they work along the supply chain.

What are Incoterms?

Freight incoterms are standardized terms used in import and export sales contracts. They delineate the transfer of responsibility and liability for goods during transportation, indicating the point at which the ownership shifts from the seller to the buyer and outlining who bears the costs and logistical responsibilities.

Classification of Incoterms

The incoterms are classified in 4 main categories, which are as follows:

Category E (Departure)

Category E includes only one term, i.e.,

EXW (Ex Works or Ex Warehouse)

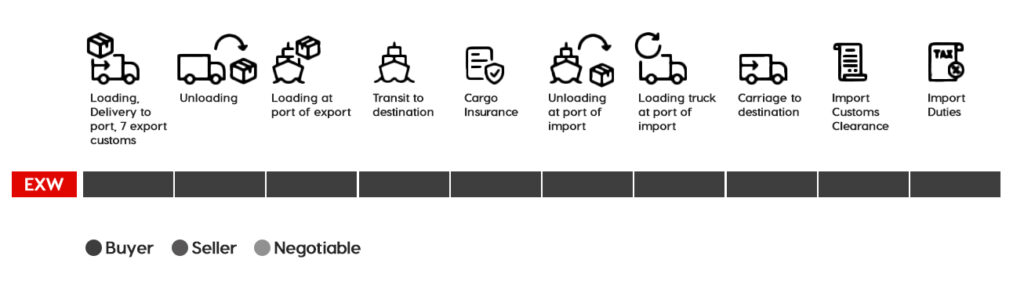

This term indicates a situation where the seller places a good at buyer’s disposal at the premises of the seller or other specified place. The seller is neither responsible for loading the goods on any vehicle nor clearing them for export, where applicable.

This term showcases that the seller has the minimum responsibility. Particularly, the seller is required to deliver the goods to the buyer at a named place on agreed time (it usually s seller’s place of business, or could be other particular location, such as a warehouse).

If the delivery place is not specified in the contract or several places of delivery can be envisaged, the seller has the right to choose a choose a point that best suits them. The products under this category can be transported using any mode of transportation.

Before the goods are delivered to the named place in the sales contract, the seller is responsible for bearing the risk of damage and loss. After the delivery, the responsibility automatically shifts to the buyer. For importers and exporters, this translates to working with a freight forwarder who arranges the whole shipment, from pickup to delivery.

Below are some of the most frequently asked questions about the EXW incoterm:

- What does EXW in shipping terms mean?

In shipping terms, EXW means that the seller will deliver the product to a named place; however, the buyer is responsible for all the transportation costs.

- What is the difference between FOB and EXW?

The EX-Work requires the seller to make the products available to the designated place where the buyer incurs transportation cost; whereas in FOB, the seller is responsible for the goods until they are loaded on the vessel, and then the buyer is liable for everything.

- What is the EXW rule?

The Ex Works-rule means a shipping arrangement where seller will make a product available at a specific location, while buyers pay for transportation costs.

- What are the risks of EXW?

The main risk of EXW is for the buyer, who bears all costs and risks involved in transporting goods from the seller’s premises. This includes responsibilities for loading goods, arranging transport, and handling customs procedures, which can be complex if the buyer is unfamiliar with local regulations.

- Who pays for shipping on EXW?

Under EXW terms, the buyer is responsible for all shipping costs from the seller’s premises to the final destination.

- What are the benefits of EXW?

EXW offers simplicity for the seller, minimizing their risk and responsibility as they only need to make the goods available at their premises. This can reduce the seller’s logistics and administrative costs.

- Does EXW include customs?

No, EXW does not include customs clearance; the buyer must handle all duties, taxes, and customs procedures required for exporting and importing the goods.

- Can you use EXW for export?

Yes, EXW can be used for export, but it places significant responsibility on the buyer for arranging all export formalities, making it less common in international trade compared to other Incoterms.

- How do you calculate Ex Works price?

The Ex Works-price is calculated by adding up all costs associated with producing and making the goods ready for collection at the seller’s premises, excluding any costs involved in loading onto vehicles and subsequent transportation.

Category F (Main Carriage Unpaid)

This category includes the following terms:

Free Carrier (FCA)

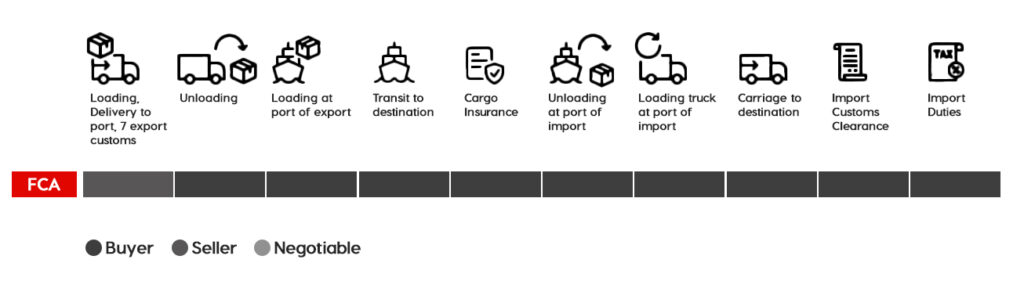

The FCA term indicates that the seller is responsible for delivering the goods at the named place to the carrier; the place could be a warehouse or terminal. The supplier is also responsible for the packaging and transport at the origin. Once the seller hands over the goods to the carrier, risks transfer to the buyers. This incoterm is applicable for all the shipping modes.

The FCA incoterm requires the sellers to clear the goods for exports where applicable. However, they are not obliged to clear goods for import. Furthermore, no insurance responsibility is placed on the buyer or the seller.

- Who pays for FCA shipping?

In FCA (Free Carrier) shipping, the buyer is responsible for arranging and paying for the transportation of goods from the seller’s premises to the final destination. The seller delivers the goods to a carrier appointed by the buyer.

- Is FCA the same as DAP?

FCA (Free Carrier) is not the same as DAP (Delivered at Place). In FCA, the seller is responsible only for delivery to the carrier, while in DAP, the seller is responsible for delivering goods to the named place of destination and assumes all risks until the goods are ready for unloading by the buyer.

- Is FCA and EXW the same?

FCA and EXW (Ex Works) are not the same. Under EXW, the buyer assumes full responsibility and risk for transporting goods from the seller’s premises, whereas in FCA, the seller delivers the goods to a carrier chosen by the buyer, reducing some of the buyer’s logistical burdens.

- What is a FCA carrier?

An FCA carrier is the transporter chosen by the buyer in a Free Carrier agreement to receive goods from the seller and transport them to their final destination. The carrier takes responsibility for the goods after the seller has delivered them to a specified location.

- What are the disadvantages of FCA?

The disadvantages of FCA include potential confusion about the exact point of delivery, which can lead to disputes over who was responsible for the goods at what time. Additionally, the buyer has to manage international transportation and customs clearance, which can be complex and costly if they lack experience.

- Is FCA better than FOB?

Whether FCA is better than FOB (Free on Board) depends on the specifics of the transaction. FCA is generally more flexible for buyers, allowing them to choose the carrier and potentially reducing costs associated with loading goods at the origin. FOB, however, is better for buyers who prefer the seller to handle all risks and costs until the goods are loaded on board a vessel.

- Why is the Free Carrier important?

Free Carrier (FCA) is important because it offers flexibility in international trade by allowing the buyer to have control over the main carriage and choose their preferred carrier. This can optimize logistics and cost management, particularly for air and rail transport, where FOB terms are not applicable.

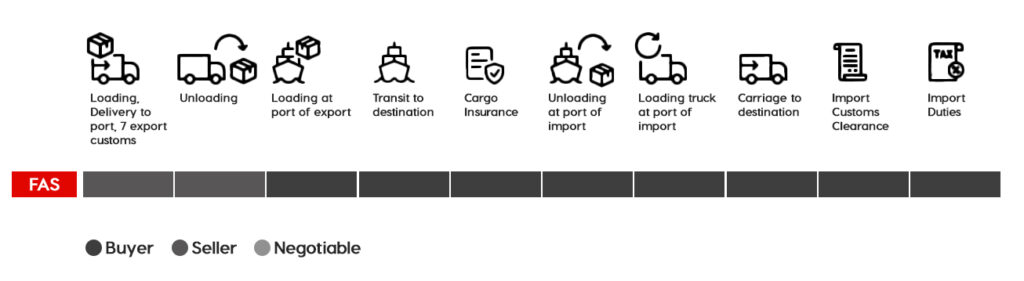

Free Alongside Ship (FAS)

The FAS incoterms means that the buyer is responsible for picking up the goods from the factory, clearing them for exports, and then delivering them to the departure location, which is usually the ship loading dock. Once the goods are placed alongside the ship, the risk transfers to the buyer, who is then responsible for the transit’s main leg and every other step in the delivery. The seller is responsible for the clearance of goods for export and not import.

Under the FAS Incoterm, the seller is not responsible for arranging or paying for the transportation of goods; these responsibilities fall on the buyer from the designated port of shipment. This term is not ideal for situations where goods are simply transferred to a carrier at a location like a container terminal. The seller is also required to clear the goods for export but does not need to handle import clearance or secure insurance.

- What does FAS stand for Free Alongside Ship?

FAS stands for “Free Alongside Ship,” an Incoterm where the seller delivers the goods to a designated port alongside a vessel chosen by the buyer. The seller is responsible for the cost and risk until the goods are placed alongside the ship.

- What is FAS in sea freight?

In sea freight, FAS requires the seller to deliver goods alongside the vessel at a specified port of shipment. The seller must clear the goods for export, meaning that all customs formalities and duties must be completed on the seller’s side before delivery.

- What does alongside mean in shipping terms?

“Alongside” in shipping terms means that the goods are placed within reach of the transport vessel’s loading equipment. This typically involves positioning the goods on the dock or within a designated area next to the vessel, ready for loading.

- Who pays freight on FAS?

Under FAS terms, the buyer pays for the cost of loading the goods onto the vessel and all subsequent transportation costs after the goods have been delivered alongside the ship.

- Why is FAS an incoterm?

FAS is an Incoterm to provide clarity and set standardized rules on the costs, risks, and responsibilities of buyers and sellers during the shipment of goods in maritime transport. It helps specifically in transactions where buyers prefer to control the shipping and insurance once goods reach the port.

- What is the difference between free on board and free alongside ship?

The primary difference between Free on Board (FOB) and Free Alongside Ship (FAS) concerns where responsibility and risk transfer from seller to buyer. In FOB, the risk transfers once the goods have been loaded onto the shipping vessel. In contrast, under FAS, the risk transfers when the goods are placed alongside the vessel at the port of shipment, before being loaded onto the vessel. This means in FAS, the buyer assumes risk and additional loading costs after the goods are alongside the ship, whereas in FOB, the seller bears all costs and risks until the goods are loaded onto the ship.

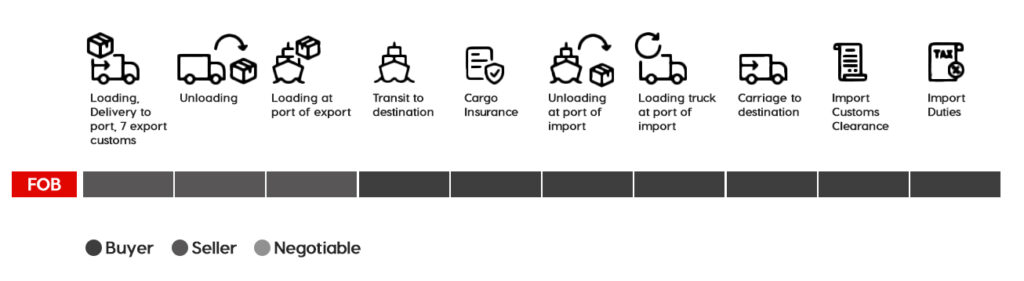

Free on Board (FOB)

FOB shows that the seller is responsible for packaging, pickup, and delivery of goods to the vessel at the shipment port. Once the goods are on-board on the vessel, the risk of every other step transfer to the buyers. The sellers have the responsibility of export clearance and not the import.

Under the FOB Incoterm, similar to the FSA Incoterm, the seller is not required to arrange or pay for the transportation of goods; these costs are the buyer’s responsibility from the specified port of shipment. Additionally, neither the seller nor the buyer is required to secure insurance.

- What does FOB stand for free on board?

FOB stands for “Free on Board,” an Incoterm where the seller delivers goods on board a ship chosen by the buyer. The risk and responsibility transfer from the seller to the buyer as soon as the goods pass the ship’s rail at the shipment port.

- What are the free on-board FOB prices?

Free On Board (FOB) prices refer to the cost of goods sold that includes all expenses up to the point where the goods are loaded onto the shipping vessel at the port of departure. This price excludes any further transportation or insurance costs beyond the initial loading.

- What do the terms FOB free on-board shipping point mean?

FOB shipping point, also known as FOB origin, means that the buyer takes responsibility for the goods once they are shipped, bearing all the transport costs and risks of loss from that point forward. The seller’s responsibility ends once the goods are transferred to the carrier.

- What does the term FOB free on board include?

The term FOB includes the seller’s responsibility to get the goods to the port of departure and load them onto the specified vessel. It covers all costs (including export fees and duties) and risks up to the point the goods are loaded on board the ship.

- Is CIF better than free on board FOB?

Whether CIF (Cost, Insurance, and Freight) is better than FOB depends on the needs of the buyer and seller. CIF can be more convenient for the buyer as it includes shipping costs, insurance, and freight to the destination port. However, FOB gives the buyer more control and possibly lower costs if they have better shipping arrangements or prefer to handle transit risks and insurance themselves.

- How do you calculate FOB value?

FOB value is calculated by adding up all costs associated with getting the goods ready for shipment and loading them onto the vessel at the port of departure. This includes manufacturing costs, packing, local transportation, and loading charges. It does not include international shipping costs, insurance, or any costs beyond the point of loading.

Category C (Main Carriage Paid)

The following terms comes under this category:

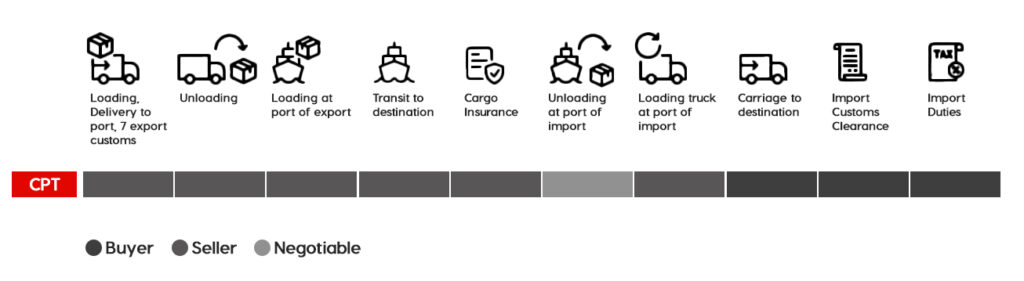

Carriage Paid to (CPT)

The Carriage Paid to (CPT) term indicates the responsibility of the seller to bear the cost of transporting goods to the destination. After the product’s delivery, the responsibility shifts to the buyer. This contract does not impact on the transfer of risk from the seller to the buyer at the point of delivery. However, if there is an obligation to bear costs relating to the unloading of goods at the point of delivery in the contract, the seller will be responsible for it, unless otherwise good.

This term also requires that the seller clear goods for export, where needed, and takes responsibility for all related risks. However, the seller is neither obliged for import clearance nor for concluding an insurance contract.

- What is CPT carriage paid to Incoterm?

CPT (Carriage Paid To) is an Incoterm where the seller pays for the transportation of goods to a specified destination, but the risk transfers to the buyer once the goods have been handed over to the first carrier.

- Who pays duty on CPT Incoterms?

Under CPT Incoterms, the buyer is responsible for paying any duties, taxes, and other charges when the goods arrive at the destination country.

- What are carriage charges in Incoterms?

Carriage charges in Incoterms refer to the costs associated with the transportation of goods from the seller to the agreed destination, which are borne by the seller in terms such as CPT and CIF.

- What is CPT Incoterms 2020 insurance?

Under CPT Incoterms 2020, insurance is not explicitly required for the seller to procure; the obligation to insure the goods falls on the buyer, unlike CIF where the seller must provide insurance up to the destination port.

- What is the CPT Incoterm rule?

The CPT Incoterm rule stipulates that the seller delivers the goods to a carrier or another person nominated by the seller at an agreed place. The seller must contract for and pay the costs of carriage necessary to bring the goods to the named destination.

- What is the difference between CIF and CPT?

The difference between CIF (Cost, Insurance, and Freight) and CPT is that in CIF, the seller also has to arrange and pay for insurance against the buyer’s risk of loss or damage to the goods during transit, which is not a requirement in CPT.

- What is an example of Carriage Paid To?

An example of Carriage Paid To (CPT) could be a scenario where a German machinery manufacturer agrees to sell and transport equipment to a buyer in Canada. The seller arranges and pays for shipping to Toronto, but the risk passes to the buyer when the goods are handed over to the first carrier in Germany.

- What is Carriage Paid To in terms of trade?

Carriage Paid To (CPT) in terms of trade means that the seller delivers the goods and pays the freight to bring the goods to a specified destination. Risk transfers to the buyer once the goods are handed over to the first carrier.

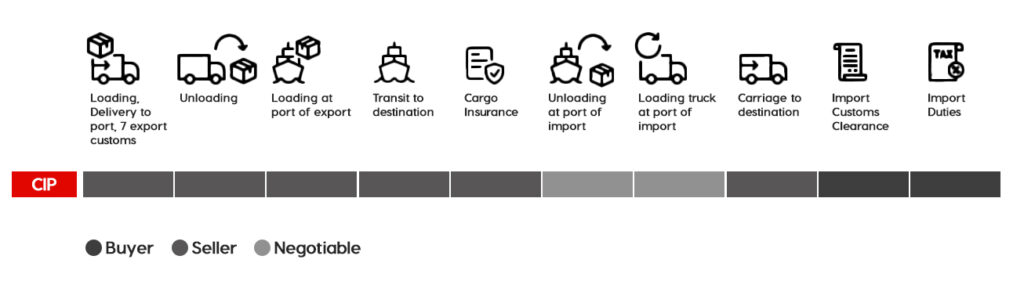

Carriage and Insurance Paid to (CIP)

This incoterm is similar to CPT with a slight difference that in CIP, the seller also arranges and pays for insurance coverage in case of any loss or damage to the goods during transit to the point of delivery.

The insurance details should be made with the compliance to Clause A of the Institue Cargo Clauses, or similar ones, and shall cover at least contractual price + 10%. Before the incoterms update in 2020, only minimum insurance coverage was applicable according to Clause C of the Institue Cargo Clauses. However, the parties can still agree on lower coverage, if needed. The seller has also an obligation to provide insurance policy or certificate to the buyer.

Clause A of the Institue Cargo Clauses

Clause (A) of the Institute Cargo Clauses offers comprehensive “All Risks” coverage for cargo, insuring against all loss or damage during transit, except for explicitly excluded risks.

Clause C of the Institue Cargo Clauses

Clause (C) of the Institute Cargo Clauses provides basic coverage for cargo against major perils like fire and collision, offering minimal protection compared to Clauses (A) and (B).

- Who claims insurance in CIP?

In CIP (Carriage and Insurance Paid to) Incoterms, the buyer is typically the party who claims insurance since the seller is required to obtain insurance only up to the named place of destination. After delivery, any insurance claims arising from transport risks during the remainder of the journey to the final destination are generally filed by the buyer.

- Who pays for insurance in Incoterms?

Who pays for insurance in Incoterms depends on the specific term agreed upon. For example, under CIF (Cost, Insurance, and Freight) and CIP terms, the seller pays for insurance covering transportation to the destination. In other terms like FOB or EXW, the buyer is typically responsible for arranging and paying for insurance.

- What is a CIP in insurance?

A CIP in insurance refers to the Incoterm “Carriage and Insurance Paid to” where the seller pays for both the transport and minimum insurance cover to the named place of destination, while the risk transfers to the buyer once the goods are handed over to the first carrier.

- What is the carriage paid to in Incoterms?

Carriage Paid To (CPT) in Incoterms means the seller pays for transporting goods to a specified destination. The seller is responsible for arranging and paying for carriage, but risk transfers to the buyer as soon as the goods are handed over to the first carrier.

- What insurance coverage is required under CIF or CIP Incoterms rules?

Under CIF or CIP Incoterms rules, the seller is required to provide insurance coverage against the buyer’s risk of loss or damage to the goods during the transportation. CIF requires a minimum of Clause C insurance, and CIP requires a minimum of Clause A (All Risks) insurance, according to Incoterms 2020.

- Which Transport Types Qualify for CIP?

All types of transport qualify for CIP Incoterms, making it versatile for various shipping methods including road, rail, sea, and air transport. This universality is part of what makes CIP a popular choice for international trade agreements where multiple modes of transport might be involved.

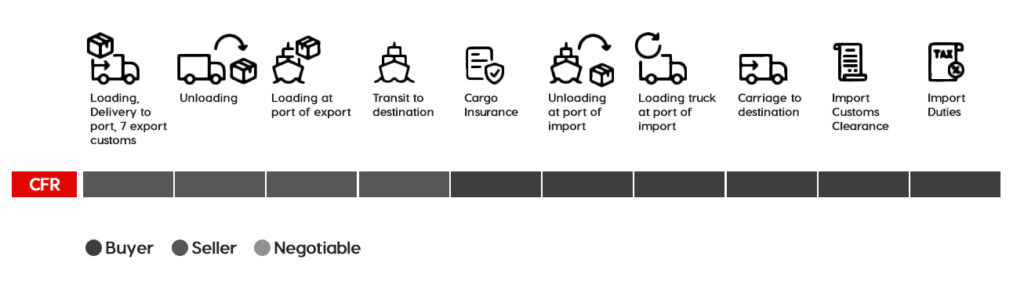

Cost and Freight (CFR)

This incoterm specifies the seller’s responsibility for transportation at the port of origin and for goods loading onto the vessel. It also puts responsibility for transportation to the destination port; however, they are not liable for this portion of the journey, as the risk transfers to the buyers when goods are loaded at the port of origin.

Despite the transfer of risk at the port of delivery, the seller must arrange and pay for transportation to the port of destination and cover any unloading costs at that port, unless otherwise agreed. The seller is also responsible for export clearance of the goods but not for import clearance. Neither the seller nor the buyer is required to obtain insurance.

- Who pays freight under CFR?

Under CFR (Cost and Freight), the seller is responsible for paying the costs and freight necessary to bring the goods to the named port of destination. However, the risk is transferred to the buyer once the goods are loaded onto the shipping vessel at the port of departure.

- What does the CFR Incoterms rule mean Cost and Freight?

CFR, or Cost and Freight, is an Incoterm where the seller must cover the costs, freight, and insurance necessary to ship the goods to a specified port of destination. However, the risk of loss or damage to the goods, as well as any additional costs due to events occurring after the goods have been delivered onboard the vessel, are transferred from the seller to the buyer.

- What does CFR mean in cargo?

In cargo shipping, CFR means that the seller pays the freight charges to transport goods to the destination port. The seller arranges and pays for transportation but does not cover the risk of loss or damage once the goods are onboard the ship.

- Is CFR cheaper than CIF?

Whether CFR is cheaper than CIF depends on the specific circumstances and the cost of insurance. CFR excludes insurance, which is a required component of CIF (Cost, Insurance, and Freight). Therefore, CFR can be cheaper since the buyer may opt to arrange their own insurance, potentially at a lower cost or with different coverage than what the seller would provide under CIF.

- What is the CFR price?

The CFR price includes the cost of the goods and the freight charges to transport the goods to a named overseas port. It does not include insurance costs, import duties, and other expenses at the destination port. This price typically reflects the total cost the seller must bear to ensure the goods are transported to the destination port.

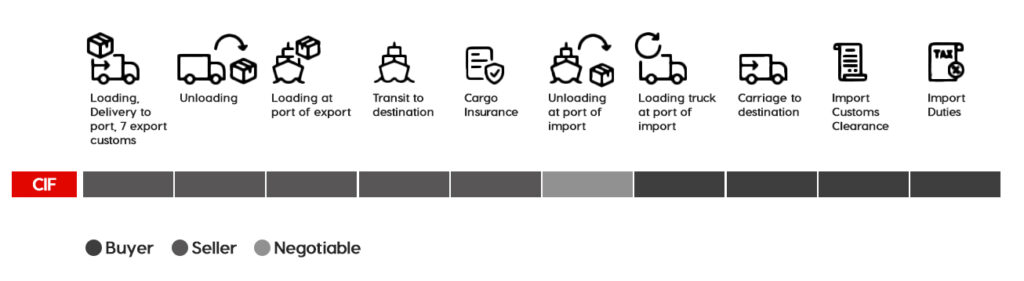

Cost, Insurance, and Freight (CIF)

This incoterm is similar to CFR; however, the seller is also responsible for arranging and paying for the insurance coverage of the goods during their transit to the port of destination.

The seller is responsible for all costs associated with unloading the goods at the destination port as stipulated by the carriage contract, unless otherwise agreed upon. Additionally, the seller must handle the export clearance of the goods, but not the import clearance.

- What is the meaning of CIF cost insurance and freight?

CIF stands for “Cost, Insurance, and Freight,” an Incoterm where the seller is responsible for covering the costs, insurance, and freight of shipping goods to a named port of destination. The seller’s responsibilities include not only transporting the goods but also insuring them until they are unloaded at the destination port.

- What is cost insurance and freight CIF value?

The CIF value includes the total price paid for the goods, the cost of transportation to the named destination port, and the cost of insurance during transportation. This value is crucial for determining duties and taxes at the destination, as it encompasses all costs up to the point of unloading at the destination port.

- What is the CIF value of insurance?

The CIF value of insurance typically involves a premium cost that is a percentage of the total value of the goods, often estimated at 110% of the CIF price to cover potential additional expenses in case of loss or damage. This insurance should be adequate to protect the value of the goods during their transit until they reach the destination port.

- What is the insurance coverage for CIF?

Insurance coverage under CIF terms generally needs to meet the minimum cover requirements set by the Institute Cargo Clauses (ICC). Typically, the seller provides coverage under the ICC (C) terms, which cover standard risks associated with sea freight. Buyers often opt for additional coverage to ensure more comprehensive protection against all risks, as ICC (C) covers only a limited range of potential damages.

Category D (Arrival)

The terms included in this category are:

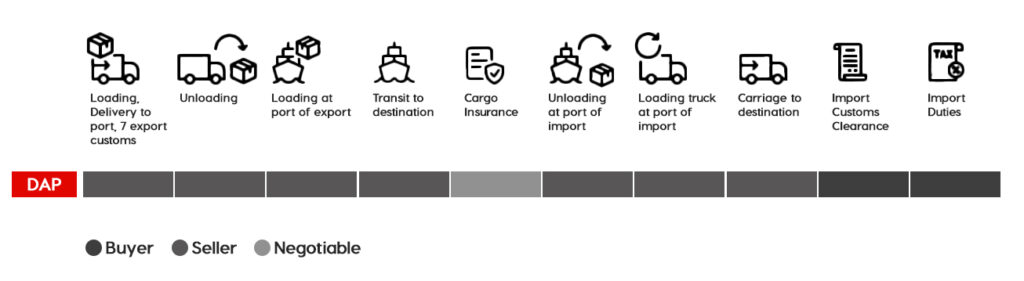

Delivered at Place (DAP)

DAP means the seller is responsible for arranging the entire shipment till delivering the goods at the decided place. After the delivery, the risk will transfer to the buyer. The seller will take responsibility for export clearance, but the buyer takes responsibility for import customs, fees, taxes, and duties. Contrary to CIP and CPT incoterms, the place of delivery and destination is the same under the CAP agreement.

Although the seller is required to finalize a contract of carriage or organize transportation and export clearance for the goods at their own expense, they are not obligated to unload the goods at the destination. Furthermore, neither the seller nor the buyer is required to take out an insurance policy.

- What is DAP Delivered at Place Incoterms 2010?

DAP (Delivered at Place) under Incoterms 2010 is an agreement where the seller delivers the goods when they are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination. The seller bears all risks and costs associated with delivering the goods to the specified location, excluding duties, taxes, and other official charges payable upon import.

- Is DAP Incoterm door to door?

DAP Incoterm can facilitate door-to-door delivery but does not necessarily imply it. The term specifies that the seller delivers the goods to a named destination, which can be any agreed point within the destination area, not strictly the buyer’s premises.

- Does DAP include customs clearance at destination?

DAP does not include customs clearance at the destination. The buyer is responsible for handling customs clearance, import duties, and other related administrative costs at the destination.

- What is the Incoterm basis of DAP?

The basis of DAP Incoterm is that the seller assumes all responsibilities, risks, and costs associated with transporting goods to a designated location near the destination. However, the risk transfers to the buyer once the goods are made available to the buyer on the arriving means of transport, ready for unloading at the named place.

Delivery at Terminal (DAT)

The seller resumes the responsibility for arranging the shipment and delivering the goods to the named place. They also take responsibility for unloading the goods. After the goods are unloaded, the risk transfers to the buyer. It is the only incoterm that requires the sellers to unload the goods at the destination.

The place of delivery and destination are also the same under a DAT incoterm; therefore, the sellers will bear the risk till the goods are delivered to the named place.

The seller commits to organizing and paying for the transportation and handles the export clearance of the goods, but not the import clearance. The buyer is required to assist the seller in obtaining any documents needed for export, with the seller covering these expenses.

Under the DAT Incoterm, unlike CIP, there is no requirement for either the seller or the buyer to purchase insurance.

- What is the meaning of Delivered at Place Unloaded?

Delivered at Place Unloaded (DPU) or Delivery at Terminal (DAT) is an Incoterm where the seller delivers the goods – and transfers risk to the buyer – not just to a named destination but unloaded from the arriving means of transport. It is one of the only Incoterms that requires the seller to unload the goods at the destination.

- What is an example of Delivered at Place Unloaded DPU?

Example of DPU or Delivery at Terminal (DAT): Imagine a Chinese manufacturer shipping furniture to a warehouse in Chicago, USA. Under DPU, the seller is responsible for all transport costs and risks, including the unloading of the furniture at the Chicago warehouse. Once the goods are unloaded at the designated warehouse, responsibility shifts to the buyer.

- What are DPU delivery terms?

Under DPU or DAT terms, the seller is responsible for arranging transport and all costs up to and including the unloading of goods at the named place of destination. The seller bears all risks until the goods are unloaded, at which point the buyer assumes risk.

- What is the difference between DPU and DAP?

The key difference lies in the unloading responsibility. In DAP, the goods are delivered to a named place, but the buyer is responsible for unloading. In DPU or DAT, the seller must also manage and pay for the unloading of the goods at the destination.

- Who pays duty at DPU?

Under DPU or DAT terms, the buyer is responsible for paying import duties, taxes, and handling all customs formalities at the destination.

- Is DPU and DDP the same?

No, they are not the same. DPU or DAT requires the buyer to handle duties and customs clearance. In contrast, DDP (Delivered Duty Paid) means the seller is responsible for delivering the goods and paying all costs, including import duty and performing all customs formalities.

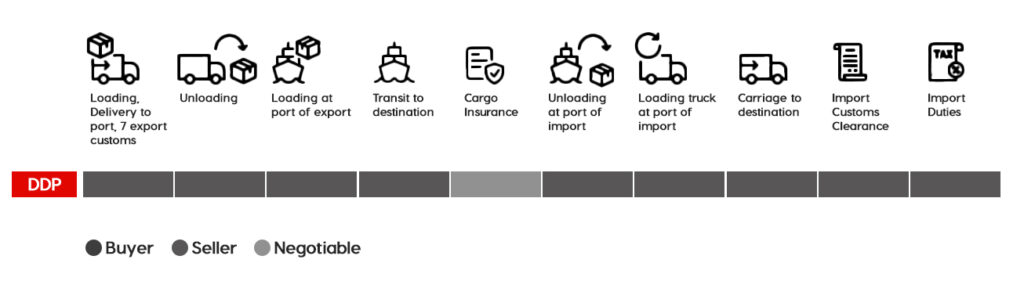

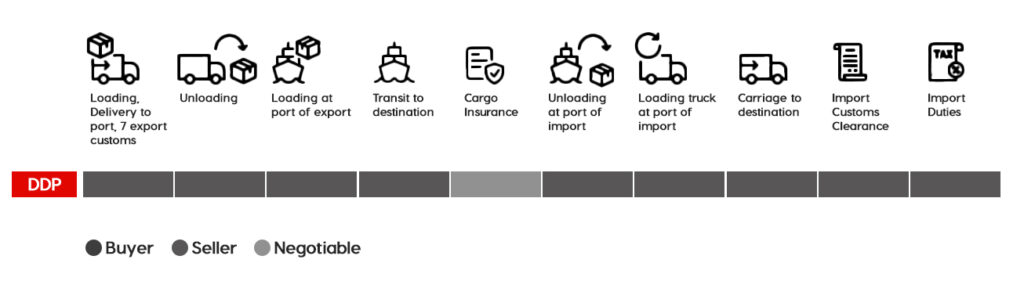

Delivered Duty Paid (DDP)

The seller assumes the responsibility for the entire shipment, including the customs fees and clearance, and delivering goods to the buyer’s premises. This incoterm requires the most responsibility from a seller, as it is the only term that includes import clearance by the seller.

Like other Incoterms, the DDP Incoterm mandates that the seller finalizes the transportation contract or organizes carriage at their own expense. However, neither the seller nor the buyer is required to secure an insurance contract.

- What does delivered duty paid DDP mean?

Delivered Duty Paid (DDP) means that the seller delivers the goods to a named place in the destination country and is responsible for all costs and risks involved in bringing the goods to the destination, including transport, export and import duties, insurance, and any other expenses incurred during shipping.

- What is a DDP delivery charge?

This encompasses all costs associated with transporting the goods from the seller’s location to the buyer’s designated place, including shipping costs, export and import duties, taxes, and insurance. These charges are typically prepaid by the seller.

- Who pays for DDP shipments?

The seller pays for all the expenses including transport, insurance, and customs duties to bring the goods to the buyer’s specified location under DDP terms.

- Is DDP refundable?

Generally, DDP terms involve non-refundable costs as they are prepaid expenses. However, specific refund conditions, if any, would depend on the contractual agreement between the buyer and seller.

- Is DDP free shipping?

DDP is not synonymous with free shipping. While it does mean that the seller bears all costs, the price paid by the buyer typically includes these costs. The term “free shipping” usually refers to promotional offers where the shipping charge is waived, but it does not cover duties or taxes.

- Who clears customs for DDP?

Under DDP terms, the seller is responsible for clearing the goods through customs in the buyer’s country, including handling all legal and administrative procedures related to importation.

Conclusion

Navigating the intricacies of international shipping agreements is crucial for ensuring compliance and avoiding unexpected costs. By clearly understanding the obligations laid out in these agreements, such as the seller’s responsibility for unloading costs and export clearance, businesses can better prepare for the logistical challenges of international trade. It’s essential for both buyers and sellers to review their contracts carefully to ensure that all terms are understood and agreed upon, preventing disputes and facilitating smoother operations.

Related Articles

The Impact of Incoterms ® 2020 on Global Trade Explained

Understanding the incoterms is essential if you are shipping goods. These are the rules of commercia

Understanding the Different Types of Free Zones in the UAE

Introduction In the dynamic landscape of the United Arab Emirates (UAE), the concept of free zones h

UAE Free Zone vs. Mainland: Which One is Right for Your Business?

Introduction In the vibrant landscape of the United Arab Emirates, aspiring entrepreneurs often find

Post a comment

You must be logged in to post a comment.