General Import Guide for Importing Into UAE

Imports

The following sections contain the regulations governing the process of importing goods into the UAE.

General Import Guidelines

- Prospective importers must obtain code of approval from UAE Customs Authorities

- Goods to imported must be in accordance with the registered activities of the importer

- Imported goods must be accompanied with an International Waybill, a Commercial Invoice, and a Packing List

- A deposit fine of AED 1,000, for all documents, will be imposed after failure to present original documents of Commercial Invoice, Certificate of Origin, or International Waybill. When the documents are submitted within 60 days of customs clearance, the deposit will be refunded. After this period, the deposit is rendered forfeit.

- Goods imported into the UAE must have a Commercial Invoice with English stamp. Failure to do may result in delayed entry of goods.

- HS Codes must be clearly stated in the Commercial Invoice. If unable to do so, Customs Authorities will inspect goods to ascertain the appropriate HS Codes relevant to the description of the goods. Note that a payment of AED 25 will be made for each code.

Import Duties and Fees

- Valuation of goods by Customs is based on CIF (Cost, Insurance, and Freight), that is, the amount used to determine import duty is a sum of the cost of, insurance paid on, and expense of shipping goods to the UAE

- Customs duties at 5% is charged on CIF value

- All UAE-bound express goods without documents attract a VAT of 5% on the value of goods, regardless of value

- For information technology products and related goods, no customs duties are applied except for a 1% surcharge on CIF value

- 50% and 100% customs duties are imposed on intoxicating liquors and imported tobacco products respectively

- International express or courier imports having a declared value below AED 1,000 are exempt from duty

- Goods with declared value above AED 1,000 will be viewed as regular cargo, and hence require formal customs clearance

- For shipments intended for re-export, a deposit equivalent to 5% of CIF value is paid to Customs Authorities, and refunded upon exit of goods.

- Generally, declaring CIF amount on invoice is accepted, but Customs Authorities upon inspection of goods may provide a different valuation.

- Bill of Entry fee: is charged for processing the customs bill required for customs clearance. The value is AED 90 for each presented Bill of Entry

Certain trade agreements established within the UAE serve to reduce the rates of customs duties:

- Arab League

- Gulf Co-operation Council (GCC)

In order to qualify for customs reduction, shipment must be valued at or above 269 USD, and Certificate of Origin presented along with Commercial Invoice.

Duties Exemption

Certain commodities, as mentioned below, are exempted from customs duties.

- Raw materials for manufacturing in the UAE and imported by companies licensed for industrial activities

- Imports for authorities and organizations exempt from duty

- Diplomatic goods

- Used personal effects

Imports Required Documents

In the process of importing goods into the UAE, certain documents are need for obtaining Import Declaration from Customs Authorities.

General Imports

When goods enter the UAE from other countries, the documents required for Import Declaration are listed below.

- Bill of Entry

- Waybill (original document)

- Commercial Invoice (original document)

- Certificate of Origin approved at country of origin by Chamber of Commerce (original document or copy)

- Detailed list of packed shipments

- Form of exemption from customs duties if requirements for exemption are met

Re-Export

In the event of importing goods with the intent to re-export, the documents needed are listed below.

- Bill of Entry

- Waybill (original document)

- Commercial Invoice (original document or copy)

- Certificate of Origin approved at country of origin by Chamber of Commerce (original document or copy)

- Detailed list of packed shipments

- Trade license issued in the UAE (copy)

- Letter from licensed company/exhibition authorities stating purpose of entry, duration of stay, quantity, description, and estimated value of each item with indicated serial numbers.

Temporary Import – Exhibition / Repair and Return

When goods are imported into the UAE temporarily for use in an exhibition/event/festival or for the purpose of maintenance/processing/repair, a deposit of an amount equivalent to the expected custom duties is made available to the UAE Customs Authorities.

Upon re-export of the goods, the deposit is refunded. When goods are no longer exported, the deposit is forfeited. In the event of partial re-export, the amount refunded is estimated according to the value of exported portion of goods.

In obtaining Import Declaration, the following documents are needed:

- Bill of Entry

- Waybill (original document)

- Commercial Invoice (original document or copy)

- Certificate of Origin approved at country of origin by Chamber of Commerce (original document or copy)

- Detailed list of packed shipments

- Trade license issued in the UAE (copy)

- Letter from licensed company/exhibition authorities stating purpose of entry, duration of stay, quantity, description, and estimated value of each item with indicated serial numbers.

Exports

In the process of exporting goods from the UAE, presenting certain documents and complying with set regulations is necessary before goods are moved to their destination. Otherwise, the export of goods may undergo delays.

For exporters, the required documents are:

- Commercial Invoice (original copy)

- Possible approval from Security department when exporting to Syria, Sudan (Khartoum), and Iran

- Strategic export license for specific goods. Examples are goods in the military, electronic, agricultural, technological, and chemical industries as well as dual-use products.

Transiting Goods

In processing goods for transit, the documents needed are:

- Waybill (original document)

- Commercial Invoice (original document)

- Detailed list of packed shipments

- Certificate of entry/exit issued by Customs Authorities

Prohibited / Restricted Goods

According to Al Sharqi shipping policy, goods that are prohibited by the laws of UAE are not eligible for transport. Items classified as prohibited are:

- Items of monetary value such as currency, coins, and fake money

- Publications deemed offensive according to moral, religious, and human rights laws or intended to corrupt or cause chaos

- Drugs like heroin and opium, and raw material for such drugs including leaves, powder, and liquid substances

- Items utilized in gambling related activities

- All forms of counterfeit goods, such as clothing, machinery, electronics, etc.

- Waste from chemical and nuclear activities

- High value items like jewelry, precious stones, antiques, and similar articles

- Hazardous materials defined by the IATA

- Animals, plants, and perishable food items

- Pornographic related material

Some prohibited goods may be eligible for transport depending on compliance with special regulations, and approval by relevant authorities in the UAE. These authorities include:

- Ministry of Health

- Dubai Municipality

- Ministry of Environment and Water

- Telecommunications Regulatory Authority

- Ministry of Information and Culture

Al Sharqi Clearance Service

Al Sharqi offers clearance services to goods entering the following Customs Ports:

- The international airports of Abu Dhabi, Sharjah, Dubai, and Dubai World Central – Al Maktoum,

- Sea ports of Khalid, Khalifa, and Jebel Ali

For more information, contact us to learn more.

Our customer service team is happy to assist you with planing your next booking.

Related Articles

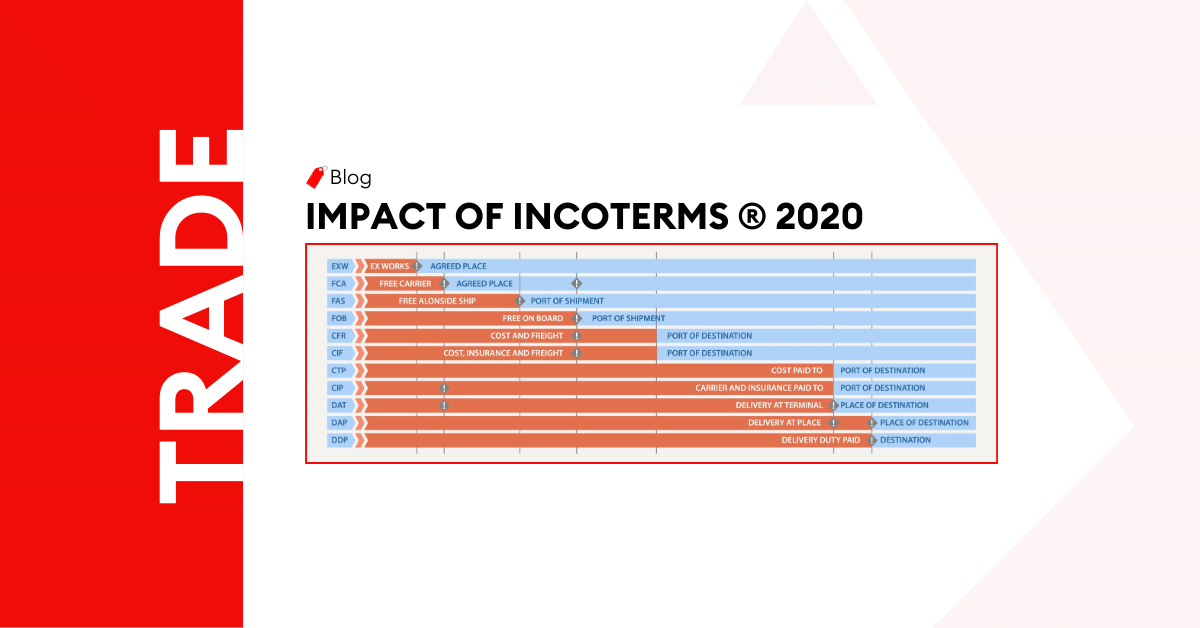

The Impact of Incoterms ® 2020 on Global Trade Explained

Understanding the incoterms is essential if you are shipping goods. These are the rules of commercia

Understanding the Different Types of Free Zones in the UAE

Introduction In the dynamic landscape of the United Arab Emirates (UAE), the concept of free zones h

UAE Free Zone vs. Mainland: Which One is Right for Your Business?

Introduction In the vibrant landscape of the United Arab Emirates, aspiring entrepreneurs often find

Post a comment

You must be logged in to post a comment.