Trade Audit – Policy Import/Export Audits

In discussing international trade operations, importing and exporting is the driving force. Furthermore, the issue of businesses complying with laid-down rules of trade becomes a priority.

In order to efficiently move goods across global borders, it’s important to be aware of trade compliance and how it affects business operations. In this guide, we will discuss trade compliance, the various compliance audits carried out by customs authorities, and procedures for maintaining trade compliance.

Meaning and Purposes of Trade Compliance

Basically, trade compliance considers laws governing the importing and exporting of goods between countries to ensure that global trade operations are stable and ethical. It’s also essential to protect the national interests of varying countries.

For businesses seeking to move goods between countries or across international borders, the best possible practices must be put into place.

The audit processes of Custom Authorities can be arduous for businesses that do not have the appropriate trade compliance procedures in place. In a bid to avoid such a scenario, your business must develop a structured compliance program for self-auditing.

In creating an effective and long-term customs compliance program in your company, you need to understand and utilize the following.

Customs Compliance Assessments and Audits

Customs laws require that importers and exporters are accurate about declarations on customs documents. Therefore, the relevant authorities regularly perform audits to check whether the declarations, import procedures, and recordkeeping conform to applicable regulations.

The various types of audits performed by Customs Authorities are;

- Focused Assessment: this involves two stages; the Pre-Assessment Survey and the Assessment Compliance Testing. These processes test the internal operations of a company for sufficiency and emphasize probable areas at risk of non-compliance

- Quick Response Audits: involves interviews and walkthroughs of specific entries to understand a company’s importing /exporting process and estimate acceptable or unacceptable risks

- Audits Surveys: this is a rapid assessment of a company’s operations relative to particular areas of concern, with time and resources as needed in a full audit.

These customs audits generally involve a review of entry and financial documentation and examining systems of recordkeeping, internal control processes, and customs compliance procedures. And in any event of non-compliance, further assessments and penalties may be imposed.

Development of Internal Compliance Manuals

In global trade operations, laws and regulations are easily subject to reforms. As a result, businesses are expected to adjust or change completely to remain on the right side of the law in terms of operations.

Developing internal compliance manuals involves creating and implementing a written set of procedures that helps your company effectively meet up with trade compliance regulations. And these manuals take the unique operating environment of your company into consideration.

Internal compliance manuals also help communicate the company’s absolute adherence to compliance laws to the federal authorities and its employees. And talking about employees, the manuals can adequately serve for trade compliance training and evaluation processes.

Most importantly, internal compliance manuals create a framework for performing internal audits. These audits help a company review, evaluate, and correct its trade compliance procedures to reduce applicable rules and regulations violations.

Documentation and Recordkeeping Requirements

According to customs laws, any owner, importer, exporter, or applicable agent files and retains business records for five years from the initial date of activity. These records refer to declarations, documents, and data about customs activities in any form.

These requirements include: presenting the relevant documents when necessary and providing access to recordkeeping services when obligated.

Failure to comply with these requirements may result in payment of monetary penalties, prohibition, or withholding of all goods imported directly or indirectly by the company. In addition, goods may be disposed of or sold at public auctions in some cases.

Note that being selected for an audit does not indicate any form of wrong practice has been identified. All businesses performing transactions involving customs authorities are usually subject to audits. These are most commonly small and medium-sized importing businesses.

Being selected for an audit depends on your trade compliance history, the volume of import/export, your company’s involvement in specific duty programs, and moving high-risk commodities. Essentially, audits ensure businesses are not importing and exporting goods that may be unsafe or counterfeit.

Useful Procedures for Providing Customs Solutions to Ideal Supply Chain Customers

Activities involved in import/export processes and dealing with customs authorities are essential for the supply chain. This is true for businesses involved in international trade operations.

The maintenance of trade compliance while importing/exporting goods is usually a complex process. This brings about the use of third-party services that have the expertise and experience to guide your business. The main procedures of obtaining customs solutions can be in the form of the following.

Import Consulting

Import consulting involves hiring consulting services when carrying import activities. Import consultants may be individual agents, workers in import brokerage companies, or affiliates of shipping companies.

With this procedure, a business benefits from having outside expertise clearing trade obstacles and complying with specific import rules regarding peculiar products. Import consultants also prepare relevant import documents, pay applicable taxes and tariffs, and provide expansion opportunities.

Overall, import consulting helps reduce unnecessary costs, minimize errors in customs clearance procedures, accurately classify goods for quick customs clearance, and verify all declarations to customs authorities.

Export Consulting

Export consulting is similar to import consulting, except it deals with export processes. As such, this procedure involves getting expert advice on creating and implementing the appropriate export processes to comply with applicable trade laws.

Export consulting services involve evaluating the export potential to identify needed resources and possible pitfalls, researching export markets to identify target areas for your business, developing detailed market strategies, and analyzing possible export benefits.

In addition, export consultants process relevant export documents for compliance with legal and customs obligations and assist your company’s entrance into the foreign market.

Duty Mitigation

Duty mitigation puts into practice various legitimate ways of avoiding or reducing duties, taxes, tariffs, and additional expenses levied on imported/exported goods.

Basically, it involves taking advantage of provisions in federal laws and customs regulations to be fully or partially exempt from paying imposed tariffs by importing/exporting goods in particular conditions or for specific uses.

Supply Chain Security

Supply chain security is the procedure of managing possible risks that may result from your business operations with other organizations, such as suppliers, vendors, logistics providers. It involves both physical and cyber security measures.

These measures include automation of shipment information and relevant data, proper inspection of factories and warehouses, utilizing accredited suppliers and licensed third-party auditors, adequate employee training, simulating vulnerability tests, and developing a response playbook in the event of threats.

Benefits of investing in quality supply chain security include:

- Improved product handling and customer satisfaction

- Faster customs clearance process and delivery times

- Improved product safety, supply chain visibility, and inventory management

How Alsharqi Can Help You with Cross-Border Compliance Solutions

Even as a legitimate importer/exporter, your business can still be subject to annual audits by customs authorities. At Al Sharqi, we aim to help your business by ensuring your compliance program is well-equipped to comply with compliance laws across international borders, regions, and continents.

With our knowledgeable in-house personnel and a wide network of quality partners, we can provide customs solutions to your business by;

- Providing up-to-date information on import regulations around the world to prioritize speed and efficiency,

- Accurately classifying, securing licenses, and implementing procedures to maintain compliance of goods to global laws,

- Undertake measures, such as duty drawbacks, to reduce costs of applicable customs tariffs, as well as reviewing internal compliance procedures,

- Developing programs to enhance the secure movement of goods and counter threats to supply chain activities.

Our customer service team is happy to assist you with planing your next booking.

Related Articles

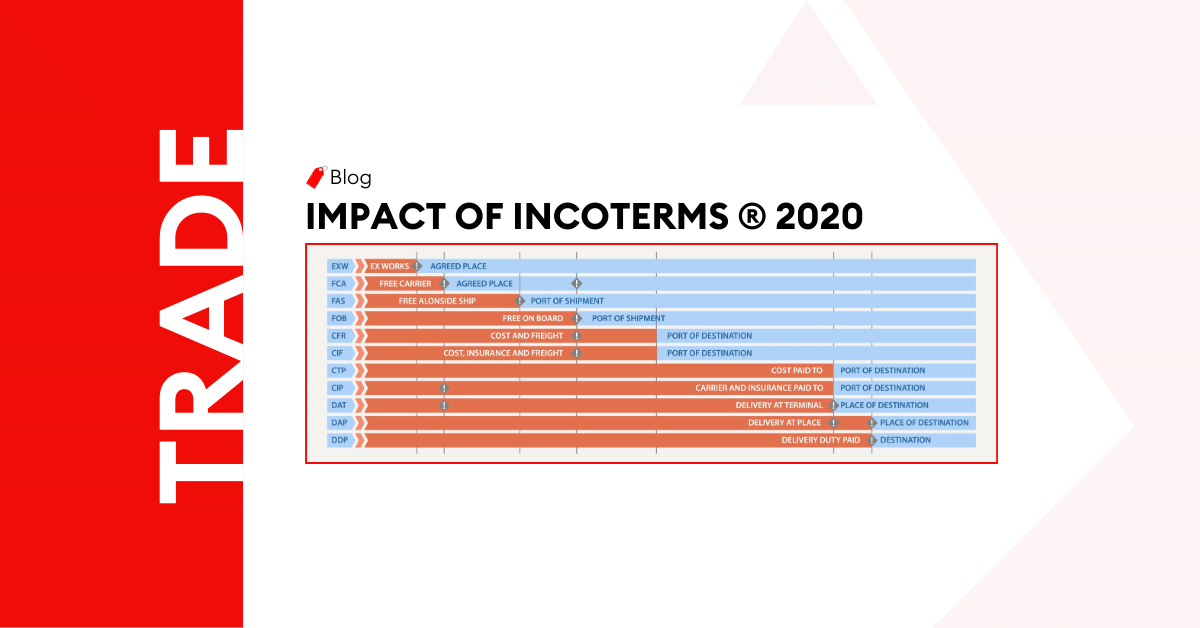

The Impact of Incoterms ® 2020 on Global Trade Explained

Understanding the incoterms is essential if you are shipping goods. These are the rules of commercia

Understanding the Different Types of Free Zones in the UAE

Introduction In the dynamic landscape of the United Arab Emirates (UAE), the concept of free zones h

UAE Free Zone vs. Mainland: Which One is Right for Your Business?

Introduction In the vibrant landscape of the United Arab Emirates, aspiring entrepreneurs often find

Post a comment

You must be logged in to post a comment.