January 2025 Supply Chain and Logistics Industry Outlook

Supply Chain Trends to Watch in 2025

In 2025, the supply chain industry is set to undergo significant changes, driven by advancements in Artificial Intelligence (AI), an emphasis on cybersecurity, and a growing focus on sustainability and resilience. Industry experts anticipate that AI will be increasingly embedded across supply chain operations, enhancing visibility and speeding up decision-making processes. Companies are expected to leverage AI to analyze production errors more swiftly and monitor equipment deterioration, among other applications.

Artificial Intelligence in Supply Chains

AI’s integration into supply chain management will prioritize end-to-end visibility and faster decision-making. Technologies such as digital twins and advanced analytics will become commonplace, helping businesses predict lead times more accurately and manage assets more effectively.

Cybersecurity Enhancements

As supply chains digitize, the importance of cybersecurity measures will intensify. Companies will need to implement stronger security frameworks to protect against cyberattacks and ensure data governance. This shift will require a focus on securing all aspects of the supply chain as a competitive advantage.

Sustainability and Resilience

Sustainability and resilience will also be prominent, with supply chains prioritizing these aspects to adapt to global disruptions and evolving consumer demands. The shift toward circular supply chain models will focus on reducing waste and enhancing the reuse of resources. This approach is part of a broader movement towards sustainability that also includes strict compliance with green standards to prevent greenwashing.

Overall, the year 2025 will likely see supply chains becoming more agile, secure, and environmentally conscious as they adapt to new technologies and global economic pressures.

Ocean Freight Market Update January 2025

Review of 2024: Challenges and Adjustments

Geopolitical Impact and Rate Volatility

The year 2024 experienced significant rate fluctuations driven by geopolitical tensions and disruptions in key areas such as the Red Sea and Suez Canal. These events not only affected transit times but also kept ocean freight rates at elevated levels throughout the year.

Technological Advancements and Efficiency

2024 marked a year of considerable progress in digitalization within the ocean freight industry. Companies widely adopted new technologies such as AI, IoT, and automation, leading to enhanced operational efficiencies and reduced turnaround times.

Environmental Regulations

The push for sustainability was strongly influenced by tighter environmental regulations, accelerating the adoption of greener technologies and practices. The industry’s shift towards decarbonization became more pronounced, reflecting a significant commitment to environmental stewardship.

Economic Shifts and Trade Pattern Changes

Economic volatility prompted adaptive changes in trade patterns and logistics strategies. The industry’s flexibility in navigating these shifts was crucial in maintaining the flow of global trade amid changing economic landscapes.

Forward Outlook for 2025: Emerging Trends and Predictions

Supply Chain Resilience

Looking ahead to 2025, the focus on building more resilient supply chains is expected to intensify. Companies are likely to continue investing in technologies that enhance supply chain robustness, preparing for potential future disruptions.

Capacity and Demand Dynamics

The ocean freight market is anticipated to see a balance of supply and demand, although challenges remain due to potential geopolitical tensions and economic uncertainties. An increase in capacity is expected, which could help stabilize the rate volatility experienced in the previous year.

Sustainability and Regulatory Compliance

Sustainability will continue to be a dominant theme, with ongoing investments in green technologies and stricter compliance with international regulations shaping the industry’s operations.

New Alliances and Market Dynamics

The realignment of shipping alliances and the introduction of new partnerships are set to redefine operational and competitive dynamics within the industry. These changes are poised to influence market conditions and strategic decisions across global shipping routes.

Air Freight Market Update January 2025

2024 Air Freight Update

The air freight market in 2024 showcased remarkable growth, characterized by an 11.8% increase in cargo tonne-kilometers, marking a strong rebound following two years of decline. This resurgence was largely fueled by robust cross-border e-commerce, which continued to exceed expectations and capitalize on limited ocean shipping capacities.

Key Drivers of Growth

2024’s air cargo growth was driven by several key factors:

- E-commerce: Sustained growth in online shopping, particularly cross-border transactions, kept air freight volumes high.

- Supply Chain Adjustments: Businesses increasingly turned to air freight due to disruptions and capacity limitations in ocean freight.

Regional Performance Highlights

- Middle East and Asia Pacific: These regions saw the strongest growth, benefitting from e-commerce and unrestricted access to strategic airspaces like Russia’s.

- Europe and Americas: Faced capacity challenges but adapted with strategic rate adjustments and enhanced service offerings.

Rate and Capacity Challenges

Freight rates reached historical highs due to the imbalance between demand and available capacity. Airlines responded by strategically managing cargo space and leveraging rate adjustments to maintain service reliability and profitability.

Impact of Geopolitical and Economic Factors

Geopolitical tensions and economic policies significantly impacted air freight routes and logistics. Notably, the ongoing geopolitical issues in the Red Sea and the Suez Canal rerouted many shipments, adding complexity to global air freight dubai logistics.

2025 Air Freight Market Forecast

Air cargo volumes are projected to increase by 5.8% to 72.5 million tonnes. This growth, although slower than in 2024, remains robust, supported by continuous strong demand from e-commerce sectors and sustained disruptions in other freight modalities.

Economic and Regulatory Influences

- U.S. Trade Policies: Anticipated changes in U.S. tariffs and trade policies under the new administration could reshape trade routes and freight volumes.

- Global Economic Outlook: Predictions by the World Trade Organization suggest a stabilization of trade growth, aligning with general economic growth.

Challenges and Opportunities

- Capacity Constraints: Ongoing issues with available cargo space will likely continue to challenge the industry, necessitating innovative solutions from carriers.

- Geopolitical Uncertainties: Persistent uncertainties, especially in key areas like the Red Sea, will require flexible and adaptive logistics strategies.

Rate and Yield Projections

Despite a slight expected decrease in yields, air freight rates are likely to remain high relative to historical standards. This is due to continued high demand outstripping the slow growth in cargo capacity.

Strategic Responses by Airlines

Airlines are preparing for 2025 by adjusting rates and expanding dedicated freight services. For example, Air China‘s recent rate adjustments reflect a strategic response to anticipated market conditions, demonstrating confidence in continued market strength.

UAE Shipping Updates – January 2025

ONE Implements $500 Congestion Surcharge at Beira Port Effective December 22, 2024. Read More

East Med Express Service Launches January 2025 for Egypt-North Europe Shipping. Read More

Rate Increase for Shipping from Indian Subcontinent to Europe and North Africa Announced. Read More

New DG Storage Fees for IMO Cargo at Select Italian Ports. Read More

PIL Announces Terminal Handling Charge Revision for Sharjah, Ajman, and Ras Al Khaimah Effective January 1, 2025. Read More

Maersk Announces Fuel Surcharge Adjustment Effective February 1, 2025. Read More

Somalia Enforces CBCA Program with Higher Penalties Starting January 1, 2025. Read More

CMA CGM Advisory: Strict Adherence to IMDG Rules for Labelling Limited Quantity DG Shipments Required Read More

Cameroon PECAE Update: Import Declaration Form No Longer Required for Attestation of Conformity. Read More

New Dropbox System for Import OBL Submission Launched at Port Rashid, Effective Immediately Read More

New Documentation Fees for Madagascar Imports and Exports Announced. Read More

Bureau Veritas Dubai Appointed as Notified Body for Bahrain Energy Efficiency Regulations. Read More

CMA Terminals Khalifa Port Now Operational, Offering Efficient Services and Requiring Mandatory Truck Registration. Read More

Global Factory Output – Overview

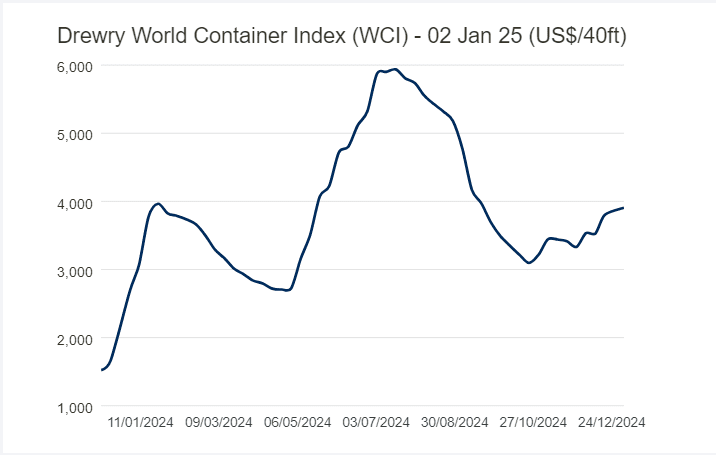

Drewry’ World Container Index for a 40ft container has reached to $3,905 after a 3% increase.

United Arab Emirates (UAE)

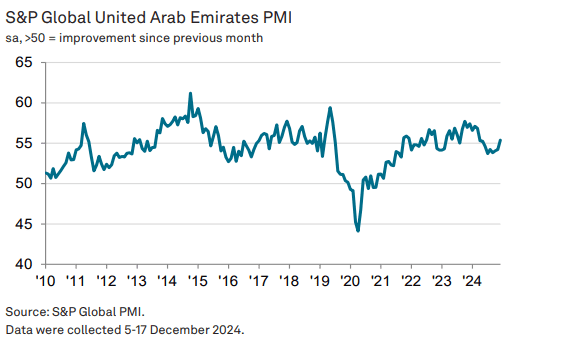

In December, the UAE’s non-oil business sector marked its strongest expansion in nine months, ending the year on a high note for 2025. Challenges persist with capacity constraints due to increasing backlogs and stagnant hiring near a 31-month low. However, slowing input costs and a peak in purchasing activity suggest potential improvements for the upcoming year.

United States of America (USA)

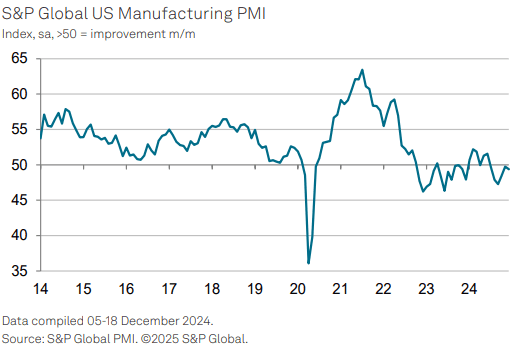

US factories experienced a difficult December 2024, with reduced production and disappointing new order inflows after a brief post-election recovery. Optimism for 2025 has waned due to rising input costs and inflation fears, tempering hopes that the new administration’s policies might boost demand and ease regulations. This shift in sentiment reflects concerns over less favorable interest rate adjustments than initially expected.

United Kingdom (UK)

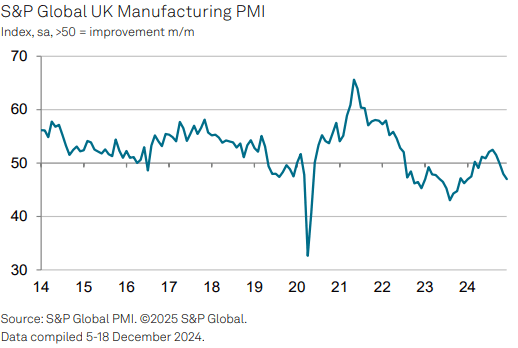

UK manufacturing experienced its most significant contraction in a year this December, driven by economic stagnation, weak exports, and new government policies raising costs. With business confidence at a two-year low and anticipated cost hikes in 2025, manufacturers are cutting jobs and restructuring. These factors are likely to keep the Bank of England cautious about reducing interest rates.

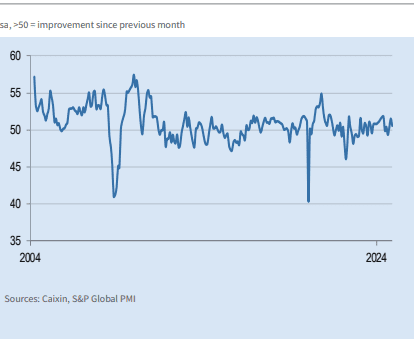

China

China’s manufacturing sector expanded in December 2024, with the PMI dropping to 50.5, indicating slower growth due to reduced new orders and production rates. Export orders fell, impacting sales and leading manufacturers to lower selling prices to maintain demand. Employment levels also decreased, and business confidence waned amid ongoing trade tensions and concerns over future growth.

Related Articles

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Global Logistics Market Update – May 2025

New Sulphur Emission Limits Enter into Effect in the Mediterranean The Mediterranean Sea officially

April 2025 Global Logistics & Supply Chain Market Update

U.S. Section 301 Proposals and Global Shipping Dynamics Global Trade Disruptions & Rising Costs

Post a comment

You must be logged in to post a comment.