Strategic Shifts in Maritime Trade: Responding to the Red Sea Shipping Crisis

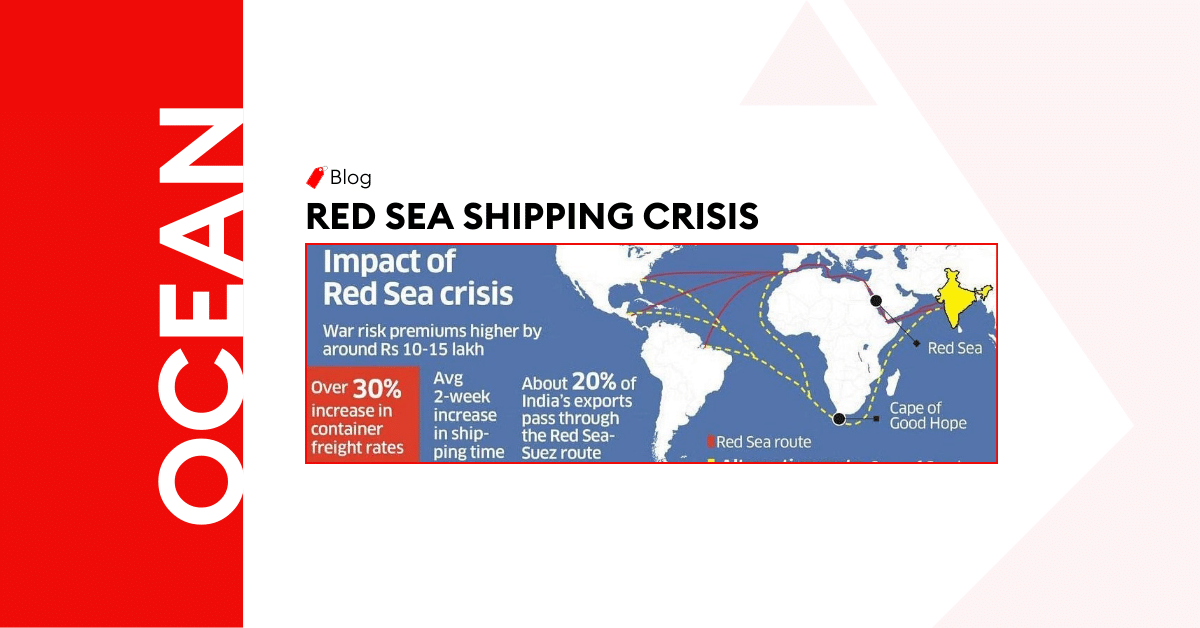

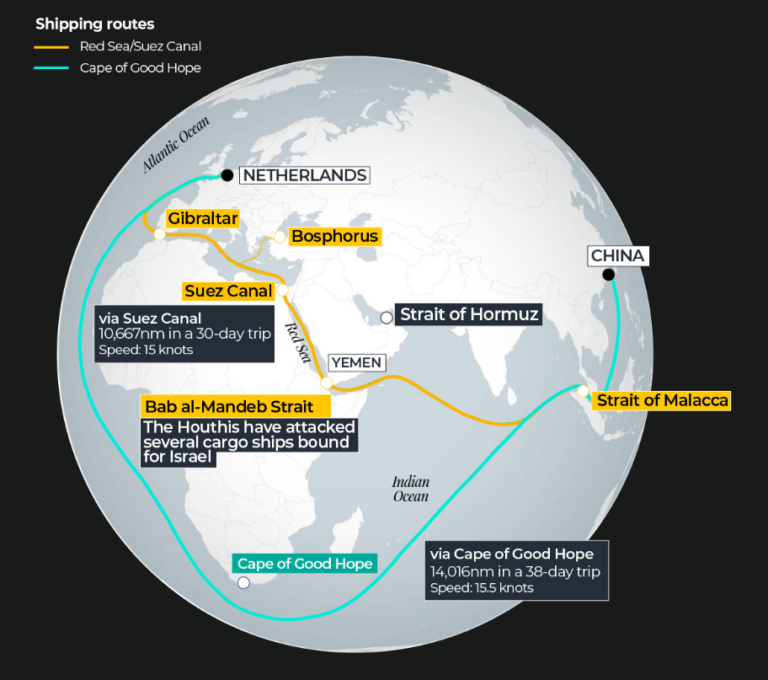

The Red Sea, a critical maritime artery connecting Europe, Asia and North America but recently it has thrust into the spotlight due to escalating tensions and shipping attacks by Houthi forces. This strategic waterway, essential for the global trade network, has witnessed significant disruptions, leading to a reevaluation of traditional shipping routes and practices. The crisis, catalyzed by geopolitical strife, particularly affects the Suez Canal, a pivotal route for international trade. As a result, shipping companies, industries, and global economies are grappling with the challenges and seeking alternative solutions to ensure the continuity of trade and minimize economic fallout.

Background of Red Sea Shipping Crisis

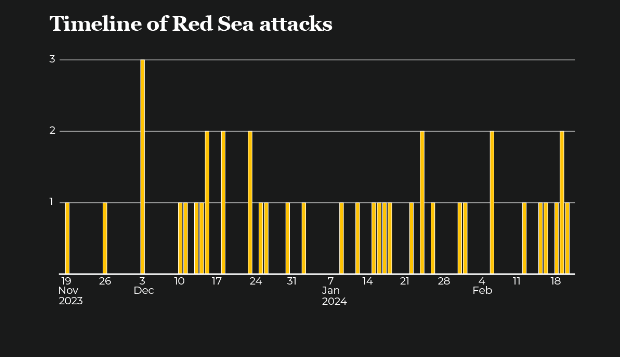

On 19th November 2023, Houthi forces started attacking the shipping vessels linked with Israel passing through the Red Sea. The attacks were launched in response of Israel and Gaza war and has disrupted the global trade by affecting the shortest trade route between North America, Europe and Asia. Since that period, around 40 vessels have been attacked, as highlighted by Ambrey Analytics (Global Maritime Risk Management Company).

Significance of Red Sea Shipping Routes

The Red Sea is considered a strategic artery of world trade that facilitates the movement of goods through the Suez Canal. The Red Sea and Suez Canal provide the shortest and fastest trade route between Europe, Asia & North America. In the last year, approximately 21,344 ships, making 59 vessels/day, travelled the Suez Canal in Egypt, which makes up to 12% of the total global trade.

Recent disruptions and political tensions are disrupting global trade. Multiple ships have been attacked near Bal al-Mandab Strait by Yemen’s Houthi militants, which is causing serious concerns for international shipping and global economies.

All the major carriers including Hapag Lloyd, Maersk, CMA CGM, and MSC have already started rerouting, especially the large container ships that carry between 15,000 to 20,000 TEUs of cargo. However, some carrier companies continue to use the same route despite all the risks.

The Effect of Red Sea Shipping Reroutes on International Trade

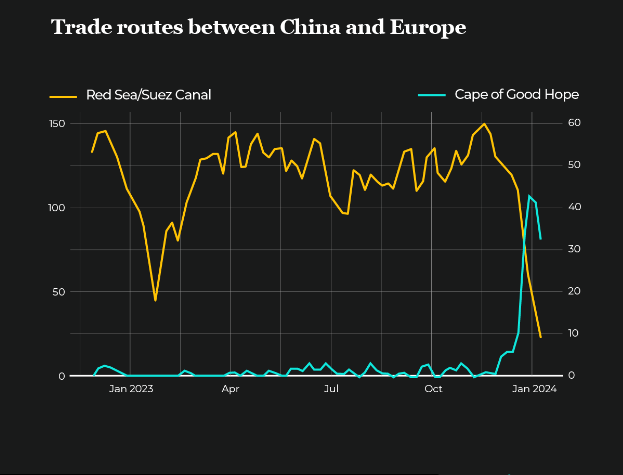

Based on the research done by Kiel Institute for the World Economy, the detour has caused a decrease of 78% freight container volumes through the Red Sea region. More companies are now traveling around Cope of Good Hope, which is causing congested ports and ship shortages.

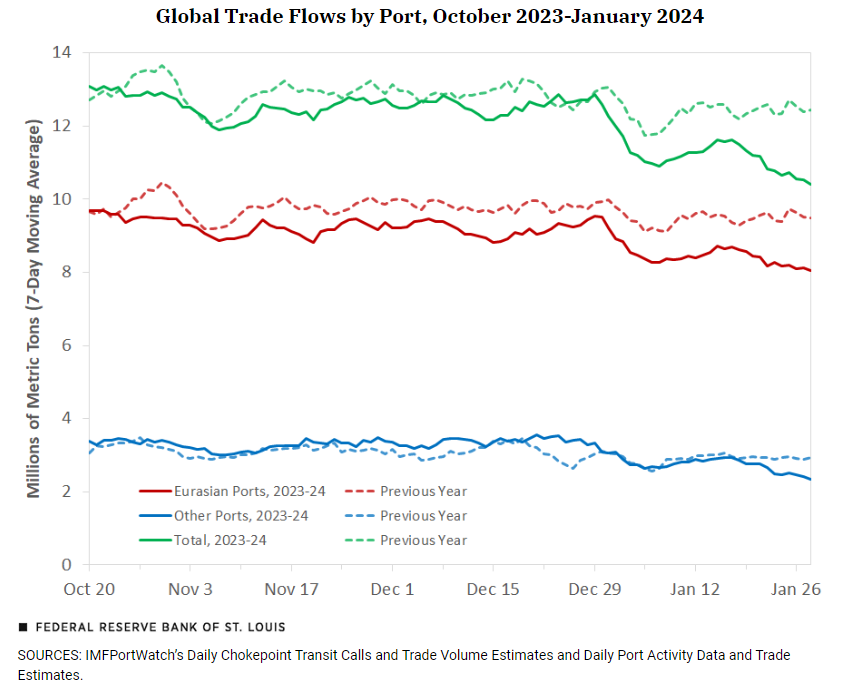

IMF PortWatch Data

The IMF PortWatch data assessed the global implications of red sea shipping by portioning 1378 ports into two groups:

- First Group: Eurasian Ports that depend on Suez Canal route to reach all the major destinations, including East Asia, Pacific, Europe, Central Asia, South Asia, Middle East, and North Africa.

- Second Group: The ports that do not rely on Suez Canal to reach all the major trade lanes, include Latin America, Carribean, North America, and Sub-Saharan Africa.

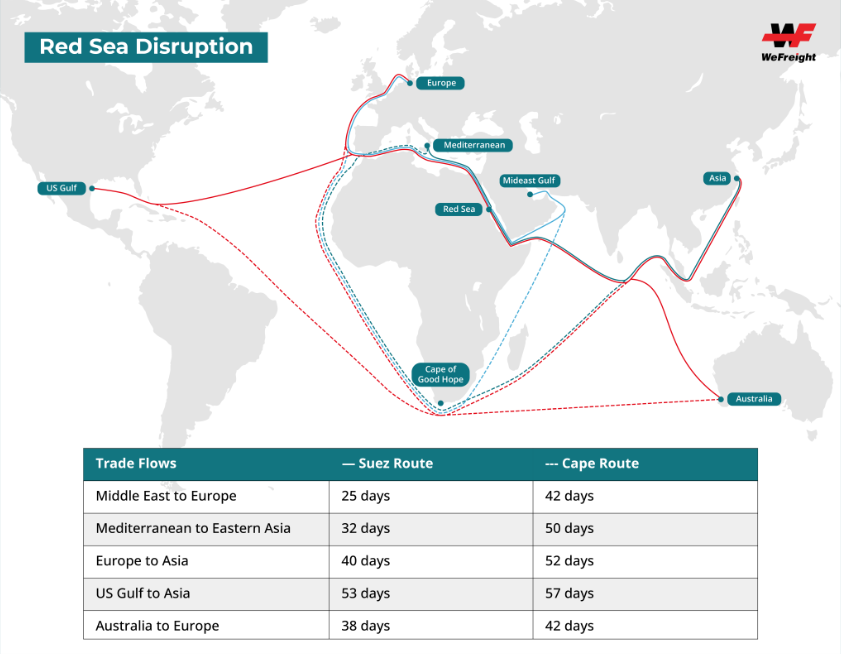

The Red Sea and Suez Canal routes are still facing disruptions amidst the ongoing crisis. The major carrier lines prefer to travel around and use the Africa and Cape of Good Hope route, which is adding to the transit time. The shippers are now facing the challenge of planning for long-term changes on the new alternative routes. The new shipping routes that are currently being used as alternative, includes:

Cape of Good Hope Route

This route is a longer, yet safer alternative to the Red Sea, which is open all year. This route adds around 2 weeks to the ship’s journey (i.e., between 3000 and 6000 extra nautical miles).

Northern Sea Route

This emerging route is less developed; however, it offers potential option for diversification in the future. The Northern Sea Route that passes over Russia and through the Arctic Circle is only useable for a few months during summer.

Land-Based Solutions

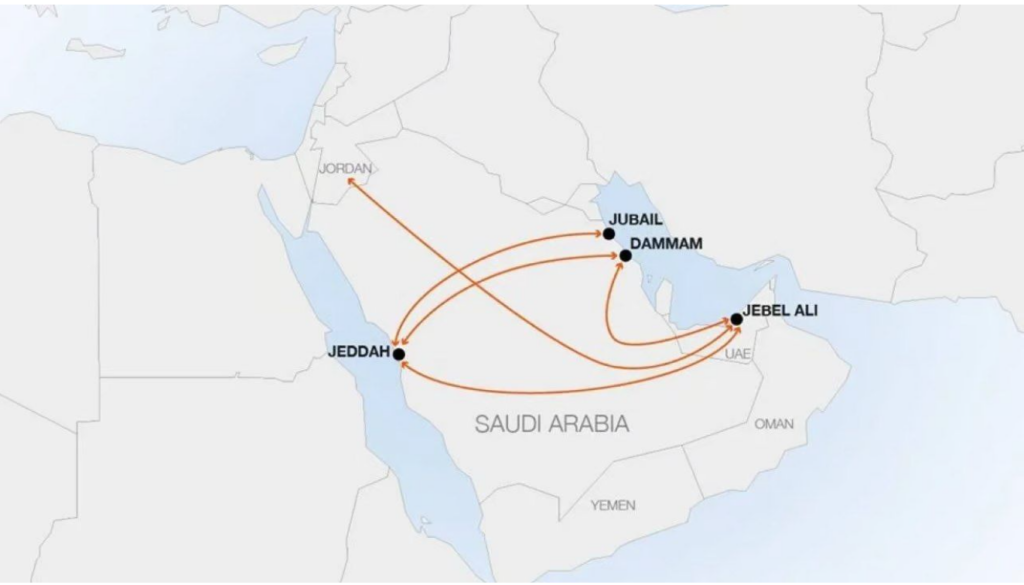

In light of the increasing risks in the Red Sea, Hapag-Lloyd and other major carrier lines have innovatively rerouted its shipping strategy. They now utilize a land-based transport system from Persian Gulf ports to Jeddah, circumventing the troubled maritime regions. This adjustment, while more costly and capacity-limited, provides a faster and safer alternative to the traditional sea routes, exemplifying the shipping industry’s agility in ensuring the flow of global trade amid geopolitical strife.

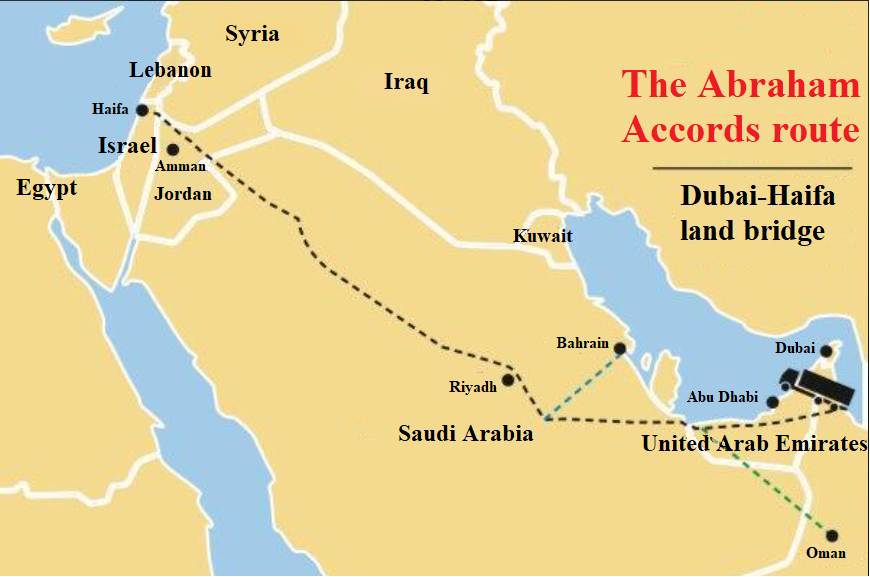

One other significant development is the establishment of a land corridor between the UAE and Israel, offering an alternative to the traditional Bab el-Mandeb and Red Sea routes. This land corridor connects Dubai’s Jebel Ali Port to Israel’s Haifa port via roads passing through Saudi Arabia and Jordan. It provides a faster and safer route for transporting goods, particularly perishable items and those requiring urgent delivery, as demonstrated by a recent trial phase where ten trucks successfully completed the journey.

Sea-Air Routes

Amidst ongoing disruptions in Red Sea shipping routes, alternative transportation methods are gaining traction. Sea-air routes are emerging as a viable solution to bypass delays caused by navigational hazards and geopolitical tensions in the region. By integrating sea and air transport, companies can mitigate delays and ensure the timely delivery of goods. This strategic approach underscores the resilience of the maritime sector and its commitment to maintaining efficient global trade networks despite unforeseen obstacles.

Rail Transport

In the wake of escalating tensions and attacks in the Red Sea, there has been a notable surge in demand for rail transportation as an alternative to traditional sea routes, particularly in European trade networks. This shift reflects the shipping industry’s response to mitigate risks and ensure the smooth flow of goods amidst geopolitical challenges. By leveraging rail transport, companies can bypass the affected maritime areas and maintain supply chain integrity.

Given the potential delays and high risk in the maritime shipping with the current Red Sea issue, shifting towards air freight might be a strategic option. This option may come with a higher price tag, on the plus side, it offers the following benefits:

- Quicker transit time

- Better security

- Less cargo insurance rates

- Lower risk of loss and damage

The air freight can be transferred via passenger craft where a certain space is available for cargo or on airlines that specialize in air freight. Furthermore, chartered flights are also an option for time-critical cargo.

Challenges and Opportunities for Shipping Amid Red Seas Crisis

Here’s a summary of the challenges and opportunities presented by the Red Sea crisis for shipping companies:

Challenges in the Red Sea Crisis

- Navigational and Security Disruptions: The crisis has led to interruptions in traditional Red Sea routes, causing heightened safety risks.

- Impact on Key Industries: Automotive, electronics, chemicals, and retail sectors face logistical delays, supply shortages, and rising costs.

- Company and Country-Specific Setbacks: Firms like Tesla, Maersk, and IKEA, as well as countries dependent on Red Sea trade routes, such as those in Europe and Asia and especially Egypt, are significantly affected, with economic ramifications due to the decline in Suez Canal usage.

Seizing Opportunities: Navigating the Red Sea Crisis for Freight Forwarders

- Business Boost for Alternative Routes: The Cape Route around Africa, involving ports in South Africa, Angola, and Namibia, sees increased activity and business opportunities.

- Surge in Air Cargo and Security Services: The need for faster shipping alternatives like air cargo has grown, along with increased demand for maritime security services, responding to the heightened regional risk. Furthermore, here’s how freight forwarders can capitalize on the evolving landscape:

- Adapting to Alternative Routes: As shipping companies seek alternative routes, forwarders can tailor logistic services to fit these new paths, offering innovative solutions to maintain efficiency.

- Adapting To Alternative and Multi-Modal Transportation: The Air or Sea-Land-Sea combinations, allows freight forwarders to navigate disruptions, offering flexible and efficient logistic solutions that meet the dynamic demands of global trade. This approach ensures continuity in supply chains, even during geopolitical or environmental crises impacting traditional routes.

- Negotiating Competitive Rates: With falling freight prices and increased capacity, forwarders can negotiate more favorable rates to provide attractive quotes to clients while maintaining profitability.

- Optimizing Capacity: With surplus space on ships, forwarders can secure discounted space and pass savings onto clients, enhancing their value proposition.

- Strategic Planning: By leveraging predictive analysis tools and market trends, forwarders can strategically adjust their space buying strategy to maximize efficiency and profitability.

- Diversifying Services: Offering a wider range of services, such as storage solutions or inventory management, helps mitigate the impact of market fluctuations.

- Proactive Communication: Clear and proactive communication with clients about route changes and cost impacts builds trust and strengthens relationships.

- Leveraging Technology: Implementing advanced technological solutions enables forwarders to optimize operations and decision-making in response to market volatility.

Conclusion

The UAE’s non-oil private sector showed strong performance in March, with a PMI of 56.9 indicating sharp growth in orders and activities. However, the Backlogs of Work Index reached a record high, highlighting capacity pressures and supply issues, partly due to the Red Sea shipping crisis, which could support longer-term activity growth once resolved.

FAQs

Our experience in the field and our global network

The Red Sea crisis typically refers to the ongoing maritime security concerns in the region, including piracy, armed robbery against ships, and geopolitical tensions affecting key maritime routes. This crisis impacts several countries bordering the Red Sea, a vital corridor for global trade connecting Europe, the Middle East, and Asia.

To address piracy in the Red Sea, multiple solutions can be implemented:

1. Enhanced Naval Patrols: Increasing naval patrols and the presence of international naval forces can deter pirate activities.

2. Cooperation Between Nations: Regional cooperation among bordering nations of the Red Sea, along with international support, to share intelligence and conduct joint operations.

3. Legal Reforms and Prosecution: Strengthening legal frameworks to prosecute pirates effectively and establishing jurisdictional clarity among nations.

4. Economic Development: Addressing underlying economic issues in pirate-prone areas to reduce the incentive for engaging in piracy.

The economic implications of the Red Sea crisis are significant:

1. Increased Shipping Costs: Due to the need for enhanced security measures and potential rerouting, shipping costs can increase, impacting the pricing of goods.

2. Insurance Premiums: Ships traveling through high-risk areas face higher insurance premiums, adding to operational costs.

3. Disruption in Trade: Any conflict or disruption in the Red Sea region can lead to delays in global trade, affecting markets and economic stability worldwide.

4. Impact on Oil Prices: Being a major route for oil transport, any disruption can affect oil prices globally due to concerns over supply stability.

The Red Sea is a critical chokepoint for global maritime trade. The crisis in this region can lead to:

1. Trade Delays: Disruptions can cause significant delays in shipping routes that pass through the Suez Canal, affecting global supply chains.

2. Increased Costs: Higher security and rerouting needs can increase transportation costs, influencing the overall costs of goods in global markets.

3. Supply Chain Vulnerabilities: Companies globally might experience uncertainties and vulnerabilities in their supply chains, prompting a reevaluation of trade routes and logistic strategies.

4. Market Instabilities: Fluctuations in trade dynamics due to the Red Sea crisis can lead to market instabilities, affecting industries dependent on timely supplies of raw materials and finished products.

Related Articles

Al Sharqi Shipping and Logistics Wins Maersk Most Valuable Partner 2023 Award

Dubai, UAE – May 24, 2024 – Al Sharqi Shipping is proud to announce that it has been awarded the

Sustainability Milestone: Al Sharqi Shipping Receives 2023 Maersk ECO Delivery Certificate158

Al Sharqi named as the Maersk Line UAE Most Valuable Partner 2022 Dubai, UAE – Al Sharqi Shipping

Strategic Shifts in Maritime Trade: Responding to the Red Sea Shipping Crisis

The Red Sea, a critical maritime artery connecting Europe, Asia and North America but recently it ha

Post a comment

You must be logged in to post a comment.