Logistics Outlook 2023 – Domestic and International Opportunities and Business Fundamentals

The year 2023 is expected to bring new opportunities and potential challenges for the logistics industry, particularly in the domestic and international market. The logistics industry is one of the most significant sectors, and it plays a vital role in global trade. In this article, we will explore the latest trends that the logistics industry is expected to face in 2023, such as freight rates and start-up ecosystems, domestic logistics opportunities in China, India, and Brazil, international logistics opportunities in China and UAE, and the Business Fundamentals Index. By the end of this article, readers will have a better understanding of what to expect in the logistics industry and how to prepare for the upcoming trends in 2023.

Domestics Logistics Opportunities

Domestic Logistics Opportunities | |||

1 | China | 8.47 | 0 |

2 | India | 8.04 | 0 |

3 | Indonesia | 6.34 | 0 |

4 | Qatar | 5.91 | 0 |

5 | UAE | 5.60 | 0 |

6 | Brazil | 5.42 | 1 |

7 | Saudi Arabia | 5.38 | 1 |

8 | Mexico | 5.37 | -2 |

9 | Malaysia | 5.29 | 0 |

10 | Pakistan | 5.16 | 6 |

Once again China, India, and Indonesia have maintained their position in the domestic logistics opportunities ranking.

Despite the recurring problems in China, the index shows the country’s importance in regard to size, economy, and growth perspective. The attributes for urbanization, income distribution, size of contract logistics, and parcel delivery sector have made the market next to impossible to overlook. All these factors indicate that the country will remain an investment priority for logistics and supply chain in the coming years, pending the removal of the zero tolerance Covid policy by the government. However, the intermittent lockdowns in different cities of China have caused an adverse impact on the economy, with many manufacturers reporting 40% decline in the output in the affected areas. Looking forward, there are many other issues that the country might have to face, including societal unrest in Taiwan and security concerns in the West. The condition has led to the adoption of ‘China Plus’ sourcing strategies to avoid US Tariffs and legislation on advanced technology export to China.

India - Retaining the Second Spot in the Ranking

The next country on the list is India, who retained the no.2 spot in the ranking. The initiation of ‘Make in India’ policy in 2014 by Modi has played an integral part in the promotion of advanced manufacturing capabilities. In the similar way as China, India has also been prioritizing higher level of supply chain value by encouraging the Indian-based suppliers, rather than depending on importing the intermediate goods from other Asian countries. However, as encouraging as Indian industry to become integrated with the Global Value Chains, the main focus of the Modi’s policy is to protect local manufacturers and retailers by increasing market barriers and tariffs. Due to this reason, Amazon is pulling out of the market partly.

Many of the emerging markets are taking this approach to globalization, where they are integrating with global markets, while protecting the local markets. China has been successful in doing so; however, it is unclear if the other markets will be able to.

Brazil - Falling Three Places Due to Disruptions

Brazil’s ranking fell three place due to disruptions in economic and political conditions. Based on the expert opinion, Brazil is experiencing an increase in poverty and food insecurity; where 33 million Brazilians are in famine conditions and about 63 million below World Bank poverty threshold. Inflation has increased a lot, while the GDP is forecasted to be weak in the coming few years. With the uncertainty in the fiscal condition of the country, it will be hard to maintain the infrastructure with domestic investment.

International Logistics Opportunities

International Logistics Opportunities | |||

1 | China | 9.75 | 0 |

2 | India | 7.45 | 0 |

3 | Mexico | 6.32 | 0 |

4 | Vietnam | 6.03 | 1 |

5 | Thailand | 5.98 | -1 |

6 | Indonesia | 5.89 | 0 |

7 | UAE | 5.89 | 2 |

8 | Malaysia | 5.88 | -1 |

9 | Saudi Arabia | 5.74 | 2 |

10 | Turkey | 5.70 | -2 |

It is not surprising that China is maintaining its dominant position in the world trade. It has an impenetrable position in terms of trade; including air and sea forwarding, international express markets, shipping connectedness, and air cargo level. However, the political policies like ‘Zero tolerance policy’ has caused a negative impact on China’s reputation of being a reliable choice for the global manufacturers and retailers.

Asian Countries Benefit from China Plus Initiative

Furthermore, the Asian countries are expected to benefit from the China Plus initiative, which means the use of suppliers that are from neighboring countries. For instance, the Vietnam’s furniture industry has benefited from this trend. Their industry’s share in global furniture exports have increased from 11% in 2019 to 17% in 2022; whereas China’s share has decreased from 61% to 53% (according to MDS Transmodal).

United Arab Emirates Climbs the Rankings

The United Arab Emirates (UAE) was the highest climber in the International Logistics Opportunity rankings last year. Despite many countries following the protectionist policies, the UAE continued their liberalization measures. For instance, the Comprehensive Economic Partnership Agreement (CEPA) between India and UAE in May 2022 has been playing a crucial role in boosting the trade between the two countries. The main commodities that were traded include perishable goods, retail goods (including textile and apparel), electronics, and chemicals. Furthermore, this has increased the shipping and air cargo services between the two countries, such as the ‘Shaheen Express’ by Maersk rotating throughout the India–UAE–Saudi Arabia corridor.

Promising Progress by Egypt

Apart from the top 10, Egypt has shown promising progress as it jumped four places and reached the number 22 spot. It is considered to be the biggest market in Africa; however, their trade focus was largely on Europe, Asia, and North America. Egypt is a part of African Continental Free Trade Area (AfCFTA), which will reinforce the connection with 32 new partners and could act like a change catalyst in the trade policy, offering more opportunities.

Business Fundamentals Index

International Logistics Opportunities | |||

1 | UAE | 9.10 | 0 |

2 | Qatar | 7.92 | 2 |

3 | Saudi Arabia | 7.86 | 0 |

4 | Malaysia | 7.85 | -2 |

5 | Oman | 7.24 | 1 |

6 | Bahrain | 7.15 | -1 |

7 | China | 7.11 | 1 |

8 | Chile | 7.01 | -1 |

9 | Jordan | 6.72 | 1 |

10 | Morocco | 6.45 | -1 |

The Business Fundamentals Index shows how easy it is to do business in the specific market based on the operational, regulatory, and commercial perspective. Different criteria are taken into account for this index, including the robustness of legislation pertaining to property rights and the government regulations.

Top Performers in Business Fundamentals Index - UAE, Qatar, and Saudi Arabia

While China and India were leading the Domestic and International Business Opportunity Index, UAE has been proven to offer the most robust framework for conducting business, followed by Qatar and Saudi Arabia. The other MENA region countries that made into the top 10 include Bahrain, Morocco, Jordan, and Oman.

Robust Legal Systems in the Middle East

One of the reasons why the Middle East countries have made it to the top of the list is the robust legal system they offer to the companies. It is a prerequisite for business confidence to follow international law; and UAE has received an uplift from European courts. The courts of Abu Dhabi and Dubai will be known by the English counterparts, supporting the principles of reciprocity. Though the agreement might have some legal implications, it increases the trust of businesses in UAE’s legal system. In addition, Saudi Arabia has also passed a Companies Law in line with their ‘Saudi Vision 2030’ to encourage more investment.

African Countries at the Bottom of the Business Fundamentals Index

6 out of 10 countries at the bottom are African countries, including Mozambique, Ethiopia, Uganda, Nigeria, Libya, and Angola. Their ranking shows lack of governance, crime rate, and weak security, and infrastructure environment.

Digital Readiness

International Logistics Opportunities | |||

1 | India | 7.61 | 4 |

2 | UAE | 7.37 | -1 |

3 | Malaysia | 6.72 | -1 |

4 | China | 6.63 | -1 |

5 | Qatar | 6.38 | 2 |

6 | Saudi Arabia | 6.30 | -2 |

7 | Indonesia | 6.21 | 1 |

8 | Thailand | 6.04 | -2 |

9 | Philippines | 5.99 | 1 |

10 | Oman | 5.81 | 5 |

This category is an important one as we move towards a more digitalized world. This ranks the countries in terms of ‘Industry 4.0’, which measures the readiness of a country to deal with the challenges of a digital and sustainable future. Some of the main insights measured for this category include how it caters to entrepreneurs and start-ups, access to banking among the population, the adoption level of renewable energies, digital skills, and the importance of e-commerce.

India leads the chart

For the year 2022, India is leading the chart, moving up to 4 places from the previous year. This jump is largely due to the shifting focus on e-commerce, especially at the time when adoption in the emerging markets has reduced.

Middle East countries in the ranking

Another important factor in this ranking is the digital skills of the workforce and how they use it to leverage future opportunities. Many of the richer Middle East countries have made it in the ranking by focusing on the factor; the list includes UAE (2nd position), Qatar (5th position), Saudi Arabia (6th position), Oman (10th position), and Kuwait (11th position).

In conclusion, the logistics industry is evolving continuously, and it’s crucial to stay up to date with the latest trends to remain competitive. The year 2023 is expected to bring new opportunities and challenges, particularly in the domestic and international market. China, India, and Indonesia are maintaining their top position in the domestic logistics opportunities, while China is maintaining its dominant position in the world trade. The UAE has been proven to offer the most robust framework for conducting business, followed by Qatar and Saudi Arabia, making the MENA region a strong contender in the Business Fundamentals Index. As the logistics industry continues to evolve, it’s crucial to keep a close eye on emerging trends and technologies to stay ahead of the competition.

Our customer service team is happy to assist you with planing your next booking.

Related Articles

Al Sharqi Shipping and Logistics Wins Maersk Most Valuable Partner 2023 Award

Dubai, UAE – May 24, 2024 – Al Sharqi Shipping is proud to announce that it has been awarded the

Sustainability Milestone: Al Sharqi Shipping Receives 2023 Maersk ECO Delivery Certificate158

Al Sharqi named as the Maersk Line UAE Most Valuable Partner 2022 Dubai, UAE – Al Sharqi Shipping

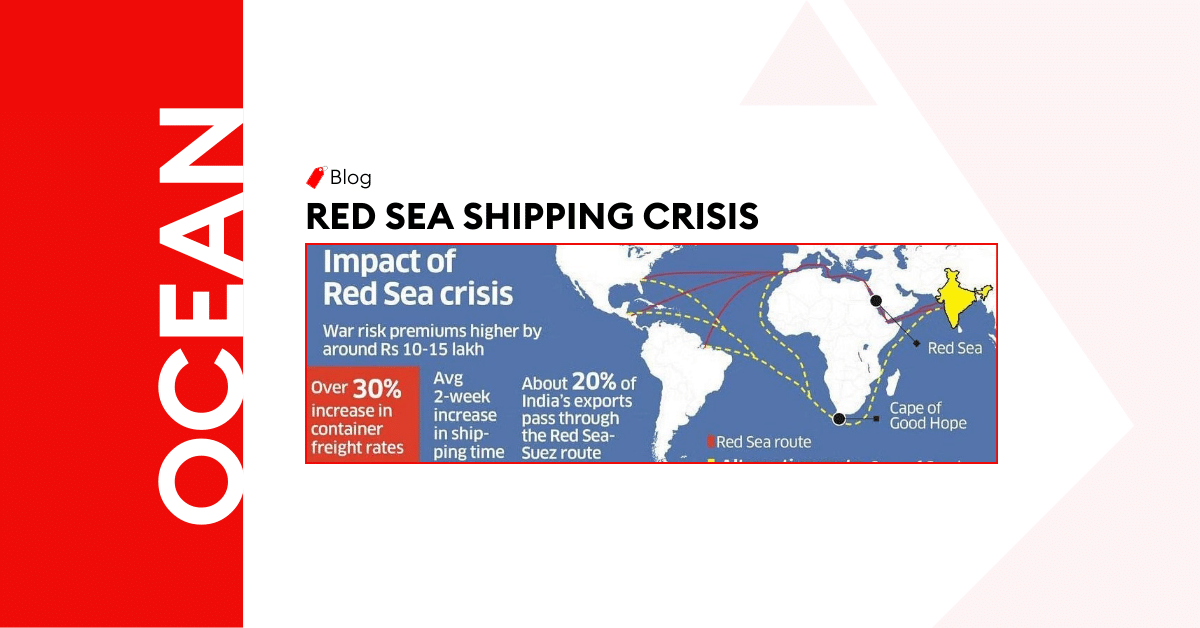

Strategic Shifts in Maritime Trade: Responding to the Red Sea Shipping Crisis

The Red Sea, a critical maritime artery connecting Europe, Asia and North America but recently it ha