July 2025 Global Freight & Supply Chain

Middle East Ocean Freight and Port Operations

Stable Operations with Ongoing Risk Monitoring

Ocean freight services across the Middle East remain operationally stable, despite underlying geopolitical tensions. Business continuity planning is in place to safeguard key trade flows and reduce the impact of disruptions on regional logistics.

Haifa Port Under Watch

While current operations at Haifa Port have resumed, the area remains under close observation. Any escalation in regional conflict could lead to renewed slowdowns, especially affecting exports such as garments. Alternate routing options through Egypt (Suez Canal), Saudi Arabia, or Jordan (Aqaba) are being considered as contingency routes.

Customs and Regulatory Developments in Saudi Arabia

Palletization Mandate

- Implementation: Phased from May 2025

- Requirement: All containerized goods must be palletized at Saudi ports.

- Exceptions: Apply to bulk cargo, heavy machinery, and oversized loads with formal exemption.

Mandatory Product & Shipment Certifications

- Effective: January 1, 2025

- Requirement: All imports must have both PCoC (Product Certificate of Conformity) and SCoC (Shipment Certificate of Conformity) issued through the SABER platform.

- Impact: Self-declaration is no longer valid; non-compliance may result in delays and penalties.

Prepare for Operational and Regulatory Shifts

The Middle East logistics landscape is evolving, shaped by geopolitical sensitivity and tightened customs regulations. Businesses importing into or operating within the region should monitor regulatory changes closely, ensure compliance readiness, and plan alternative routing strategies to maintain resilience in the face of uncertainty.

Ocean Freight Trends & Outlook – July 2025

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound

Middle East – Asia

Import flow stable; inland enhancements support smoother distribution.

Capacity – (=)

Rate – (=)

Middle East – Europe

Yard congestion in major ports; stable conditions in Algeciras post-Middle East disruptions.

Capacity – (-)

Rate – (=)

Middle East – Latin America

Imports stable via alternate routing; no major disruption despite infrastructure limits.

Capacity – (=)

Rate – (=)

Middle East – North America

Import demand remains strong; capacity tight from Europe and Asia, especially into the U.S.

Capacity – (-)

Rate – (+)

Inbound

Asia – Middle East

Export volumes steady; tariff uncertainty complicates Q3 shipment planning.

Capacity: (=)

Rate: (+)

North America – Middle East

Export flow steady but challenged by inland congestion and equipment imbalances.

Capacity – (-)

Rate – (=)

Europe – Middle East

Strong Asia-bound demand; early bookings advised as peak season drives volume.

Capacity – (=)

Rate – (+)

Latin America – Middle East

Export activity strong, especially agribusiness; new services and port delays observed.

Capacity – (=)

Rate – (+)

July 2025 Air Shipping Market Overview

Demand: E-commerce and consumer goods lead to air cargo growth, with strong YoY gains on Intra-Asia (+11%), Europe–North America (+8%), and North America–Latin America (+18%) lanes.

Capacity: In June 2025, Asia-Europe lanes saw growth, while Intra-Asia and Asia–North America capacity declined. Global air cargo capacity may rise by 3–4% YoY, but with 4–6% demand growth, tighter capacity and higher rates are expected.

News: Supply chain disruptions, from part shortages to aircraft delays, forced airlines to postpone fleet upgrades and reroute services amid geopolitical shifts. Meanwhile, the EU updated MRV rules to align with CORSIA, ensuring emission compliance from 2021 to 2026.

The Middle East and Air Carriers

Air cargo volumes in the Middle East declined sharply in Week 24 amid Eid Al-Adha and regional unrest, with Levant countries seeing a 21% drop due to flight cancellations. The UAE bucked the trend, posting a 15% rise driven by strong demand to Africa and South Asia, notably Kenya and West Africa.

Asia

Transpacific eCommerce demand stays weak amid customs clearance issues, though a quarter-end surge may boost June volume. Capacity to the U.S. and Europe is stable, while Intra-Asia—particularly to India—is tighter but still meets current demand.

America

Inbound cargo to the U.S. remains soft amid tariff uncertainty. Although tentative trade deals were struck with the UK and China, negotiations with Japan and Europe lag. The U.S.-China agreement set tariffs at 55% on Chinese goods and 10% on U.S. goods—lower than threatened but still elevated.

Europe

Escalating Israel-Iran conflict disrupted airfreight services, with Israeli airspace closures affecting 1,800 Europe-bound flights and 650 cancellations. Meanwhile, Europe saw modest growth in May 2025, with stable rates and Asia-Europe routes driving global capacity expansion.

July 2025 UAE Shipping Trends & Insights

Maersk announces fuel surcharge adjustment for Southern Africa and Islands, effective August 2025. Read More

Global Factory Output – Overview

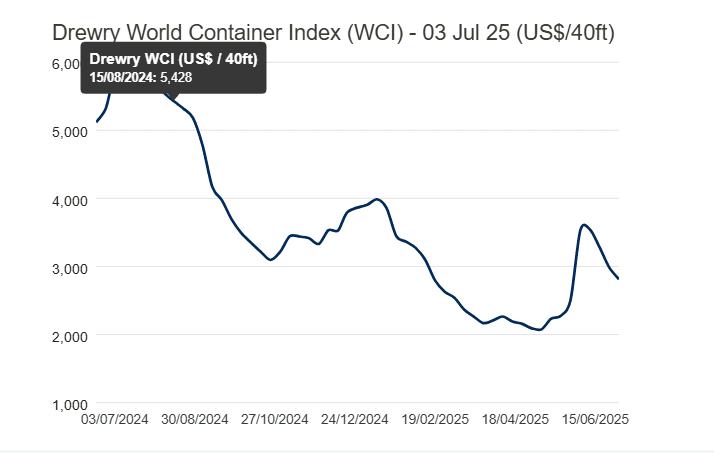

The World Container Index (WCI) has reached $2,812, after a reduction of 5.7%.

United States of America (USA)

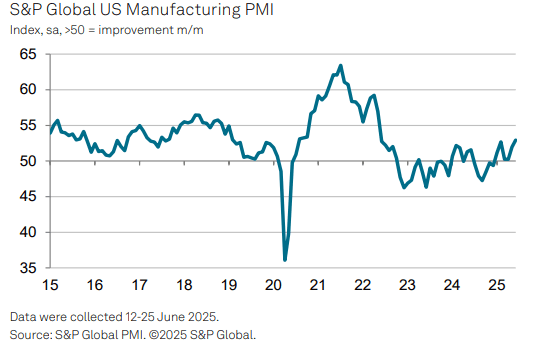

US manufacturing rebounded in June, driven by rising domestic and export orders, prompting strong hiring. However, growth was partly inventory-driven, raising concerns of slower momentum ahead. Tariff-linked cost pressures and uncertainty over trade deals remain key risks.

United Kingdom (UK)

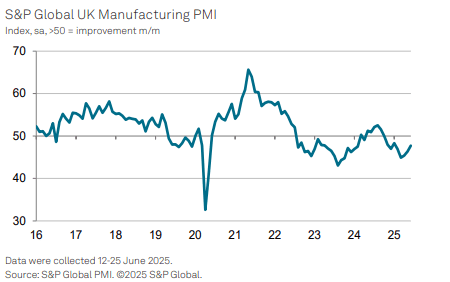

UK manufacturing showed signs of an easing decline in June, with slower drops in output, orders, and jobs, plus improved optimism. However, recovery remains fragile amid global market weakness, geopolitical risks, tariff issues, and policy uncertainty.

China

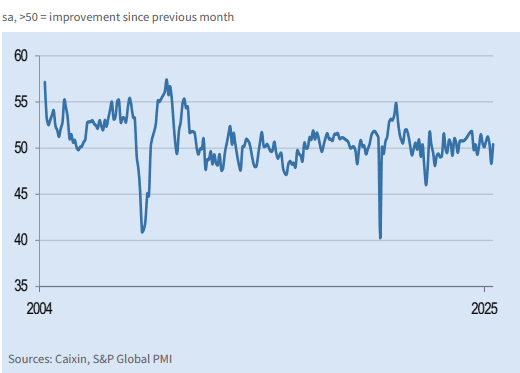

China’s manufacturing sector returned to modest growth in June, with a PMI of 50.4. Domestic demand lifted production, but export orders remained weak. Input and selling prices fell, while hiring slowed amid cautious business sentiment and ongoing supply delays.

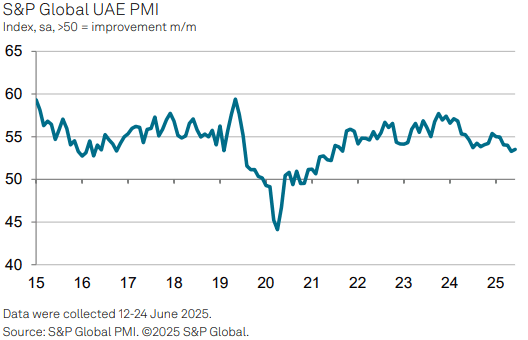

United Arab Emirates (UAE)

The UAE’s non-oil sector faced a mild setback in June due to Israel-Iran tensions, slowing new orders to a near four-year low. Yet, firms cleared backlogs, lifting output and the PMI slightly. Low inflation supported customer discounts and potential sales recovery.

Related Articles

Global Logistics and Shipping Update – August 2025

Logistics Outlook for IMEA in the Second Half of 2025 As we approach the second half of 2025, busine

July 2025 Global Freight & Supply Chain

Middle East Ocean Freight and Port Operations Stable Operations with Ongoing Risk Monitoring Ocean f

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Post a comment

You must be logged in to post a comment.