Supply Chain and Logistics Updates – November 2023

EU Emission Trading System Expansion to Shipping Sector: Implications and Timeline

Starting from January 1, 2024, the European Union’s Emission Trading System (ETS) will be extended to the shipping sector, encompassing large vessels exceeding 5000 gross tonnages. This system places a limit on the total greenhouse gas (GHG) emissions allowed from installations, aircraft, and vessel operators within the European Union (EU) annually. Companies must acquire allowances corresponding to their GHG emissions, which can be purchased on the EU carbon market or traded with other firms. Failure to meet emission allowances will result in substantial fines.

The emission cap will progressively decrease each year in alignment with the EU’s climate goals. The shipping sector’s ETS will cover all GHG emissions for intra-European voyages and 50% of voyages starting or ending in Europe, with a phased implementation reaching 100% coverage by 2026. This change will lead to a gradual increase in surcharges, with estimated industry-wide cost implications in the range of USD 9-10 billion.

Ocean Freight Highlights – November 2023

|

Key |

|

|

++ |

Strong Increase |

|

+ |

Moderate Increase |

|

= |

No Change |

|

– |

Moderate Decline |

|

— |

Strong Decline |

Outbound

Middle East – North America

The rates out of the Gulf are increasing; whereas the space is tight for the trade lane. Furthermore, the conflicts in Israel may disrupt services in the region.

Capacity — (+)

Rate — (+)

Middle East – Asia

The upcoming Golden Week has slowed the demand, which has led to a decrease in the rates and increase in space availability out of the Gulf. The ongoing conflict in Israel may disrupt the service flow in this region.

Capacity — (-)

Rate — (-)

Middle East – Europe

The rates are slowly decreasing or flat out of the Gulf, and the services might be disrupted by the Israel conflict. Furthermore, space is generally available on this trade lane, despite Europe being one of the main volume destinations from the Middle East.

Capacity — (=)

Rate — (=)

Middle East – Latin America

The space is fairly open out of the Gulf; however, the rates are still increasing. The services in this region may be disrupted by the Israel conflict.

Capacity — (+)

Rate — (+)

Inbound Updates

Asia – Middle East

The spot rates to remain low to the Gulf, while the Israel conflict may cause disruption in the services for this region.

Capacity — (=)

Rate — (=)

North America – Middle East

There are regular blank sailings out of the South Atlantic ports. The space is tight, however, there are more options available on the Northeast Coast. Furthermore, the capacity out of US West and Gulf Coasts is improving, and despite more options for carriers, the space still remains tight.

Capacity — (=)

Rate — (=)

Latin America – Middle East

The rates are generally stable on this trade lane; however, the space is volatile, and the Israel conflict may affect the services in the region.

Capacity — (=)

Rate — (=)

Europe – Middle East

The capacity and spot rates remain stable on this trade lane, but GRI has been announced from November 1 from WMED and Arabian Gulf.

Capacity — (=)

Rate — (=)

Air Freight Highlights – November 2023

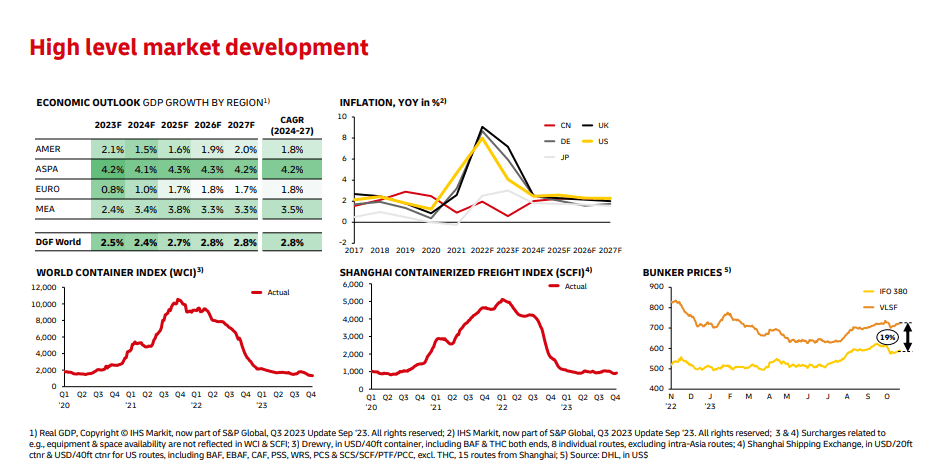

Demand: The volume remains stable with a slight increase month-over-month. Global inflation is expected to ease via strict monetary policy and lower commodity prices.

Capacity: The capacity has been consistently increasing since March 2023, which shows that the industry is following a stable and resilient trend. Furthermore, the air cargo capacity is 5% higher in comparison to October 2022, driven by the expansion of belly capacity.

Rates: Overall, the market remains competitive with a slight increase in some of the trade lanes. The improvement in the air cargo and stability in the rates is pushing the shippers to long-term contracts.

The Middle East and Air Carriers

In the Middle East, there is an expected 8% increase in cargo tonnages on routes from Asia Pacific. Additionally, pricing data indicates a modest 4% rate increase for cargo flows originating from the Middle East & South Asia and heading towards Asia Pacific. Furthermore, there is a significant capacity boost of 13% from the Middle East & South Asia region when compared to the previous year, highlighting notable developments in this specific market segment.

Asia

Amid the new product launches, there has been an increase in the demand for new technology products. Combined with the current e-commerce demand, this has led to tight capacity and increased rates on some trade lanes. This trend is expected to be continued in the year-end holiday and gifting season.

America

The flower season has started in Colombia from the end of September of end of October due to which the export will increase, and the space will be tight, mainly for dry cargo. The capacity is limited to Central America due to routing and aircraft changes. Furthermore, the import rates from Asia Pacific are increasing because of the economic recovery of China, the peak season, and mid-autumn holidays.

On the other hand, in North America, the IATA reports shows that the monthly air cargo demand has grown year-over-year for the first-time in 19 months. The global freight Ton Kilometers (CTKs) were below the pre-pandemic level but have recovered in comparison to previous years, mainly due to a 30% increase in the belly capacities. Furthermore, the transported tonnage between North America and Europe has seen an increase of approximately 6% in both directions.

Europe

There might be a slight increase in the rates as the carriers are implementing new winter schedules from October. Right now, there are no disruptions predicted for the 4th quarter as all the airports, ports, and terminals are running smoothly. Furthermore, the capacity is widely available.

Local Shipping News November 2023 - United Arab Emirates

Hapag Llyod has designed an ‘Online Business Suite’ that will allow customers to find all the online solutions in a single place. Learn more

DP World has introduced new THC and TLUC payment processes, which will be effective from November 1, 2023. Click to learn about the Terminal Handling Charges (THC) payment process for Importing Full Containers, the Terminal Handling Charges (THC) payment process for Exporting Full Containers, and the Truck Loading / Unloading Charges (TLUC) payment process for Exporting Full Containers

As per the directive by DMA, OOCL will not collect any Terminal Handling Charges for import or export at Jebel Ali, UAE. The terminal will directly collect TLUC, THC, and THD from customers. These changes will be applicable from November 1, 2023. Read More

A.P Moller – Maersk are making regular adjustments against the changes made to the list of restrictions for Russia. The recent one was made for iron and steel products. Read More

Maersk in partnership with Dubai Maritime Authority (DMA) will now be releasing Digital Delivery Order through Dubai Trade’s ‘Digital Delivery Order’ service for Jebel Ali Port of Discharge. The soft launch was on 20th October 2023, while the official go-live is 1st November 2023. Learn More

Maersk has updated the process of ICD nominations for import shipments to Dar es Salaam. Read More

The Ministry of Commerce, Government of Pakistan has released Statutory Regulatory Order (SRO) no. 1397 (I)/2023 that will be effective from 3rd October 2023. It highlights the measures need to be taken to stop the smuggling of items imported by Afghanistan in transit through Pakistan. Read More

In accordance with Article 15 of the Decision, Dubai Maritime Authority makes it compulsory for service providers to present all the invoices and collect the payments related to Digital Delivery Orders via Dubai Trade Platform. This is done to ensure transparency of Local Sea Container Charges in Dubai. Contact Maritime.Compliance@pcfc.ae for more information.

The Ocean Network Express has announced a new addition to their service network that connects Southeast Asia with India and the Middle East. Read More

DP World has implemented new anchorage services at Jebel Ali to enhance the offerings. Read More

Security Industry Regulatory Authority has released Circular No. (1) of 2023 regarding the Approved GPS Location Tracking System. Learn More

From November 1, 2023, all the shipments from Ghana, including the ones in transit must obtain Electronic Cargo Tracking Number/Smart Port Note (ECTN/SPN) from the ports of loading. Read More

CMA CGM has announced BAF updates for Algeria, Tunisia, and Morocco RoRo services. Read More

ESL has decided to introduce General Rate Increase (GRI), affecting the flow of goods from Jebel Ali to Far East, Southeast Asia, Middle East, Red Sea, and Indian Subcontinent. This will be effective from November 1, 2023. Read More

CMA CMA CGM has announced FAK updates for cargo from Asia to North Europe. Read More

Global Factory Output – November 2023

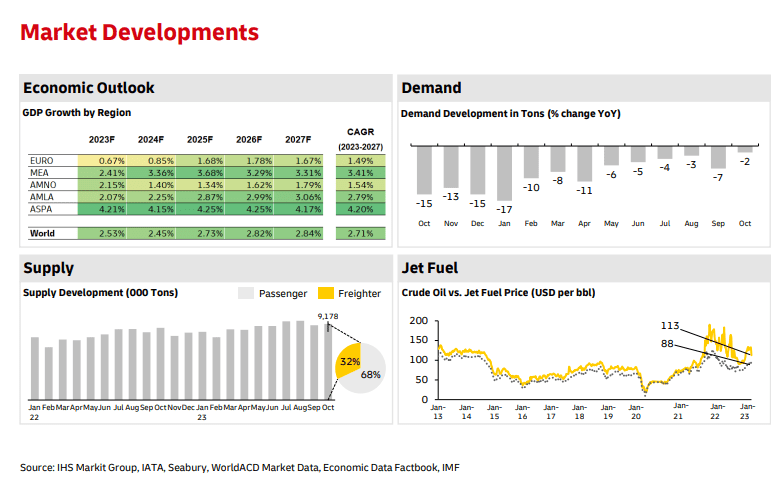

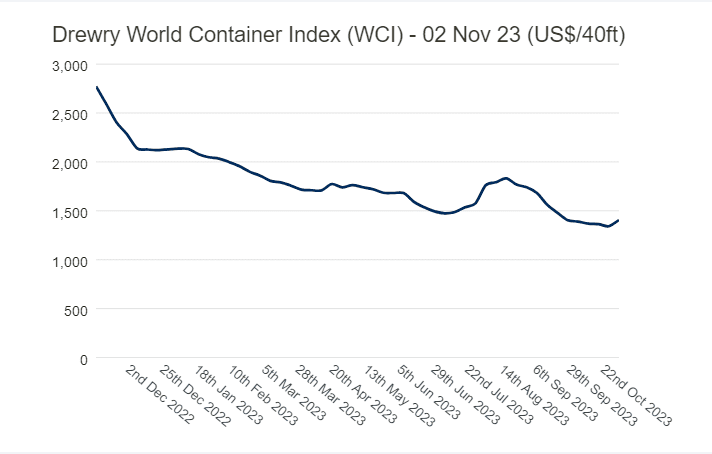

The World Container Index (WCI) has increased for 40ft containers by 5%, reaching USD 1406.

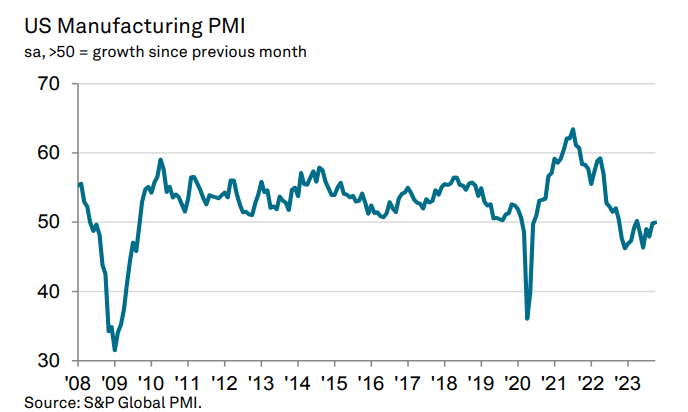

United States of America (USA)

In October, the Purchasing Managers’ Index (PMI) data for the US indicated a stabilization in the manufacturing sector, driven by an increase in new orders and stronger output growth. However, this improvement was primarily focused on the domestic market, as new export orders declined at a faster rate. On the price front, manufacturers faced higher costs and raised their output charges due to inflation gaining momentum in the sector, particularly driven by increased oil and oil-derived input prices, marking the third consecutive month of inflation acceleration.

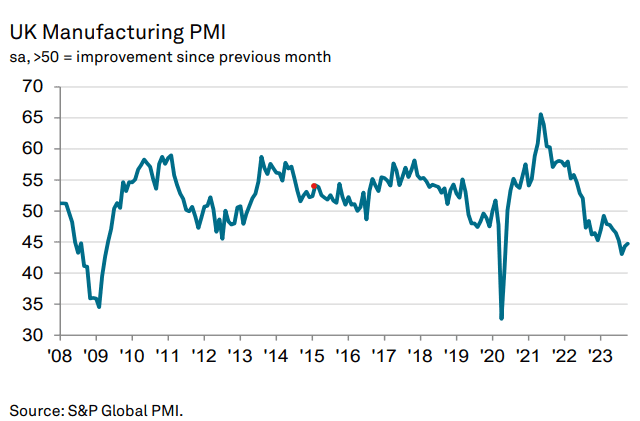

United Kingdom (UK)

In October, the seasonally adjusted S&P Global / CIPS UK Manufacturing Purchasing Managers’ Index (PMI) increased to 44.8 from 44.3 in September, although it remained below the earlier flash estimate of 45.2. All five sub-components used to calculate the PMI indicated a worsening of operating conditions for the manufacturing sector during the month. This deterioration was marked by lower new orders, reduced output, declining employment, a decrease in stocks of purchases, and improved supplier delivery times, which is typically indicative of weak demand in the sector.

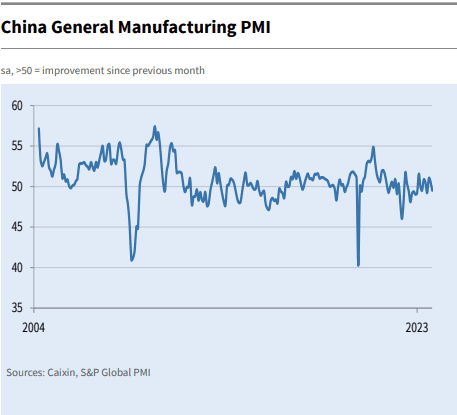

China

In October, the headline seasonally adjusted Purchasing Managers’ Index (PMI) for the manufacturing sector dropped to 49.5, falling below the neutral 50.0 threshold, which signifies a slight decline in manufacturing conditions. This marks the first time a deterioration has been observed since July, although it remains only marginal. The PMI is designed to offer a single-figure snapshot of the manufacturing economy’s operating conditions.

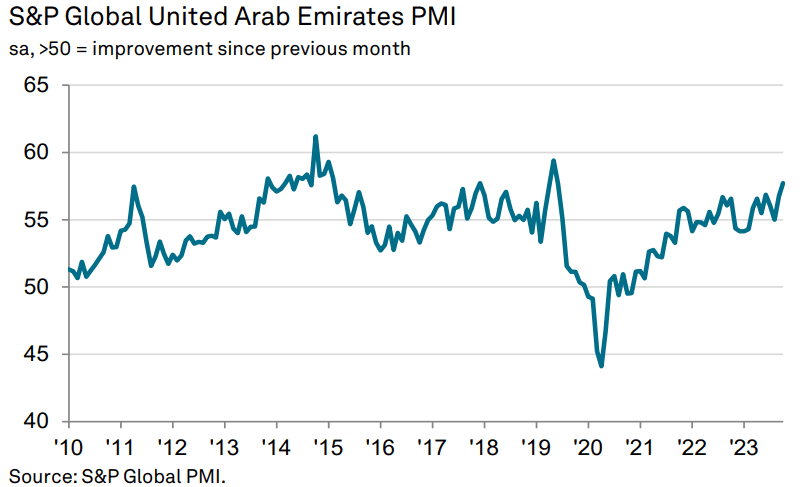

United Arab Emirates (UAE)

In the final quarter of the year, the non-oil sector continued to experience robust economic conditions, with October’s PMI results showing a recent record for new business growth. New orders grew at the fastest rate since June 2019, supporting a significant increase in output. High levels of business confidence suggest this momentum will persist, as predictions for the year ahead were among the strongest since March 2020. However, there were indications of rising inflationary pressures impacting pricing strategies, with overall cost burdens increasing at the quickest rate in five months, leading to higher output prices. This could result in an uptick in headline inflation, which would drop to a recent low of 1% in July, in future readings.

Related Articles

July 2025 Global Freight & Supply Chain

Middle East Ocean Freight and Port Operations Stable Operations with Ongoing Risk Monitoring Ocean f

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Global Logistics Market Update – May 2025

New Sulphur Emission Limits Enter into Effect in the Mediterranean The Mediterranean Sea officially

Post a comment

You must be logged in to post a comment.