Monthly Roundup of Logistics Industry | December 2022

The World of Supply Chain is Disrupted with Strikes and Energy Crises

The global supply chain is heavily disturbed by the ongoing strikes and energy crises, which can cause hindrance in the normal operations of market.

In the United States, there is a risk of railroad strikes, starting from 9th of December 2022 due to disagreement of rail union leaders and the carriers. As a result of this issue, the inland commercial cargo transport will take a toll that will also affect the trade business.

Similar problems also prevail in the Chinese market. Due to protests against the strict Covid controls, the shipping industry has been facing constant issues.

The strikes and protests are not the only things causing trouble this month. The Russia-Ukraine war has created negative impact on many things and the European energy crisis is one of them. The cold season and the increase in energy rates due to the war has shifted production patterns as well. 25% of the chemical sector and 16% of the auto sector had to shift their production patterns because of this issue.

UAE’S Local Ocean Updates

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound Updates

Middle East – North America

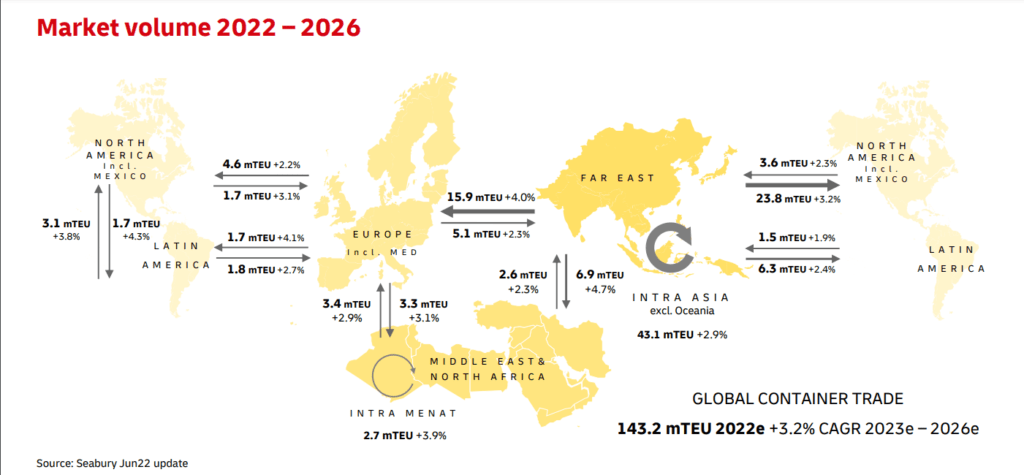

The space in the US East Coast and West Coast is opening; however, the rates have reduced and will stay low.

Capacity — (+)

Rate — (-)

Note: Some Asian Carriers have opened their bookings from Middle East to US West Coast.

Middle East – Asia

The carriers are offering special spot rates and open allocation. The rates are expected to be reduced.

Capacity — (+)

Rate — (-)

Note: Blank sails still continue to prevail in the market.

Middle East – Europe

For additional bookings, the carriers are aggressively charging; whereas to attract the spot cargo, the rates for online bookings are reduced.

Capacity — (=)

Rate — (=/-)

Note: Quarterly NAC offered by some carriers.

Middle East – North America

The space in the US East Coast and West Coast is opening; however, the rates have reduced and will stay low.

Capacity — (+)

Rate — (-)

Note: Some Asian Carriers have opened their bookings from Middle East to US West Coast.

Inbound Updates

Asia – Middle East

The carriers are expecting an increase in the GRI in December due to upcoming Chinese New Year. The market forecast also shows an increase in demand.

Capacity — (+)

Rate — (+)

Note: The GRI in Africa is expected to be the same due to low demand.

North America – Middle East

There are service improvements expected in the Middle East as a result of one port addition to EC5 and THEA’s direct service to Jebel Ali port, starting from the mid of December.

Capacity — (+)

Rate — (=)

Note: MEDGULF is offering transshipment to the Middle East region. Furthermore, CMA is also adding vessels to the EMA service.

Latin America – Middle East

In the area of Latin America, the shipments of MX EC to MED are still offered by MEDGULF.

Capacity — (=)

Rate — (=)

Europe – Middle East

The space and equipment are available to Middle East cargo along with a stable rate.

Capacity — (+)

Rate — (=)

Local Air Freight Market in December 2022

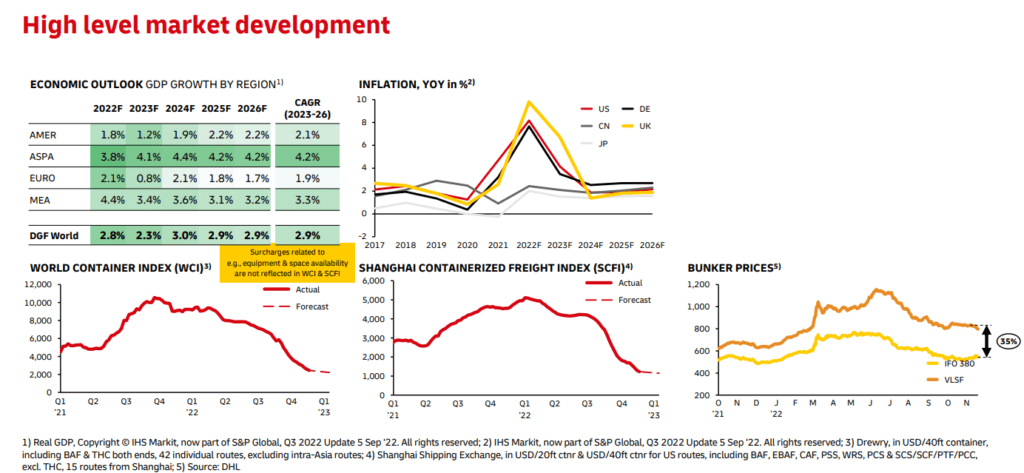

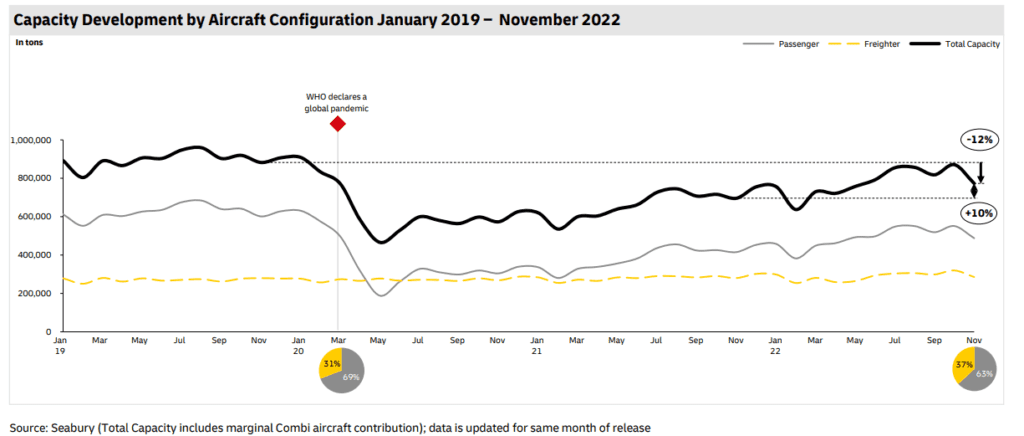

Demand: High inflation is expected to prevail worldwide in 2023, which is why demand will remain low. It is highly unlikely that the peak season will change the cargo volume; however, the ecommerce movements will increase at the end of 2022.

Capacity: The current capacity offered by airlines is sufficient to meet the current demand as the belly capacity has increased.

Rates: Across most of the trade lanes, there is an aggressive spot market.

The Middle East and Air Carriers

According to the IATA reports, the carriers in the Middle East have been facing a decrease of 15% on year-to-year basis in the cargo volumes, as recorded in October 2022. The capacity has also increased over time. Moreover, the cargo volumes to and from Europe will remain constant.

Asia

In Northern China, many commercial flights have been canceled to balance the supply due to lower demand. The rates have further reduced in the past week; however, the demand is expected to decrease.

In South China, the Covid outbreak in Guangzhou has adversely affected the manufacturing operations that is causing delays in the cargo output.

Taiwan has observed a slight peak in different destinations, including Los Angeles (LAX) and Far East Westbound (FEWB).

The overall condition of the Southeast Asian export market is that the rates are stagnant or dropping slowly.

The Korean market stays to be soft at the end of this month. The difference in the rates of Trans-Pacific East Bound (TPEB) and Far East West Bound (FEWB) continues to decrease.

America

The airports in the United States are operating at a normal condition and export demand remains steady throughout the market. Similarly, the capacity into Europe and other areas is opening up. As far as the rates are concerned, they are expected to remain stable in the coming months.

Europe

Apart from Amsterdam and John F. Kennedy airport, the demand out of Europe stays the same and is lower than expected for this time of the year. Though the demand expectations are being met with the current supply, the lead delays are expected to increase due to the demand spike in the US ports.

There could be some bottlenecks in the coming holiday season for air and land transport. Lastly, Amsterdam and London Heathrow airports might face delays due to terminal congestion.

Local News from the United Arab Emirates

Hapag Lloyd has recently updated their local rates and service charges to make the cargo planning easier for business. Read More

From effective 1st of December 2022, Air France KLM Martinair Cargo will increase their charges on cargo, except on the local import shipments, OCs that were increased in September, and DGR OC. Learn More

Dubai has been facing EDI mapping issues in Maersk’s trade services for Gate-In (Full) and Gate-Out (Empty). While their team has been trying to resolve the issues, it is recommended to follow these instructions for Gate-In and Gate-Out.

Gulftainer will now implement a terminal infrastructure fee on all the containers using their infrastructure. Read More

CMA CGM has updated the THC amount for the UAE ports that are effective from 1st of January 2023, with the exception of Abu Dhabi’s Khalifa port. Read More

From effective 1st of January 2023, Hapag Lloyd has announced that Marine Fuel Recovery (MFR) will be added as a surcharge separately in the Bill of Lading and Invoice. Read More

Overview of Factory Output December 2022

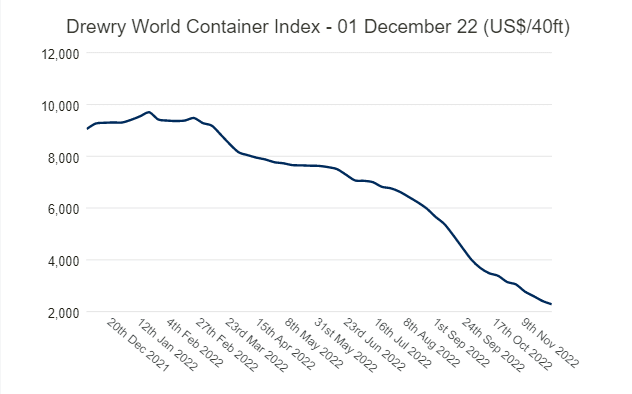

In the current week, the Drewry World Container Index (WCI) has reduced by 5% and has reached the new value of $2,284.10. This is the 40th week of continuous decrease in the composite index value.

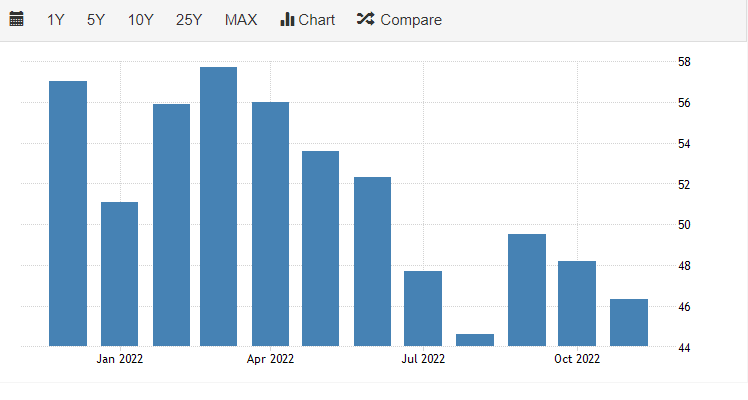

United States

The composite PMI for the USA further dropped to 46.3, which indicates that the private sector is further shrinking.

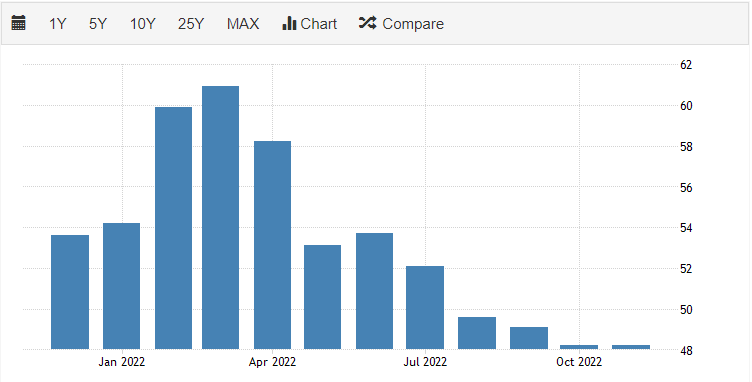

United Kingdom

The composite PMI for the United Kingdom remains same at 48.2 in November 2022, while the output for the private sector is decreasing.

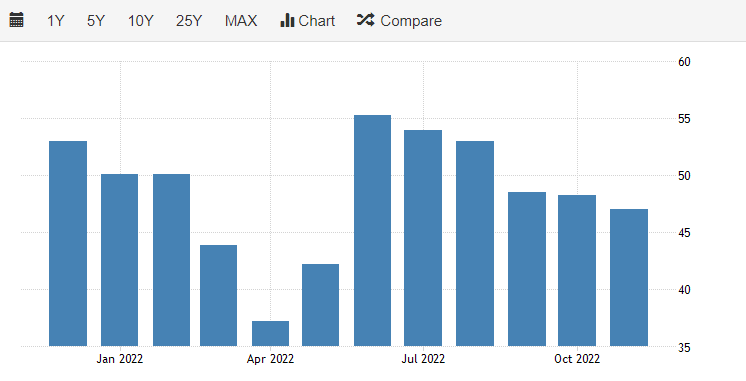

China

As the China is bracing 3rd wave of Covid, the composite PMI has dropped to 47 in November 2022. This has caused the service sector to contract even further.

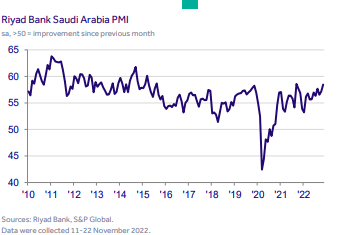

Saudi Arabia

The overall economy of Saudi Arabia in the non-oil sector has been improving and business conditions are now better.

Global Interesting News

Air Cargo

Saudi Arabia to invest in huge airport and logistics hub Read More

Cathay Pacific hungry for freighters Read More

MSC Air Cargo prepares for takeoff as first freighter arrives Read More

DHL: No increase for peak season volumes and flat growth into 2023 Read More

Etihad Cargo achieves IATA CEIV pharma recertification for pharmaceutical logistics Read More

DHL Global Forwarding and Air France KLM Martinair Cargo further expand Sustainability Cooperation Read More

ITA Launches on WebCargo Read More

BSL opens new logistics centre dedicated to pharmaceutical industry at Strasbourg airport Read More

Global air cargo traffic to increase twofold over next 20 years, says Boeing forecast Read More

Ocean Cargo

Ocean carriers struggle to match capacity with plummeting demand Read More

Ocean freight rate decline to accelerate through Q4: CMA CGM Read More

Maersk Tankers secures USD 150m credit facility Read More

Russian demand keeps freight prices high – particularly for one tanker type Read More

Forwarder frustration as ro-ro bookings look to be impossible until Q2 23 Read More

Svitzer’s Australian tug crew lockout will bring ports to a grinding halt Read More

Port of New York and New Jersey ends record-breaking run Read more

Nuclear power pursued by Canadian port Read More

China Merchants leasing unit makes boxship debut Read More

Baltic Hub kicks off construction of new box terminal Read More

Warehouse

Warehouse construction pipeline reaches record high as demand slows Read More

Our customer service team is happy to assist you with planing your next booking.

Related Articles

July 2025 Global Freight & Supply Chain

Middle East Ocean Freight and Port Operations Stable Operations with Ongoing Risk Monitoring Ocean f

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Global Logistics Market Update – May 2025

New Sulphur Emission Limits Enter into Effect in the Mediterranean The Mediterranean Sea officially

Post a comment

You must be logged in to post a comment.