Logistics Highlights from Across the Globe – March 2024

Global Supply Chain Turbulences Shaping 2024

In the global logistics landscape, certain issues continue to pose challenges for the shipping routes and supply chain operators.

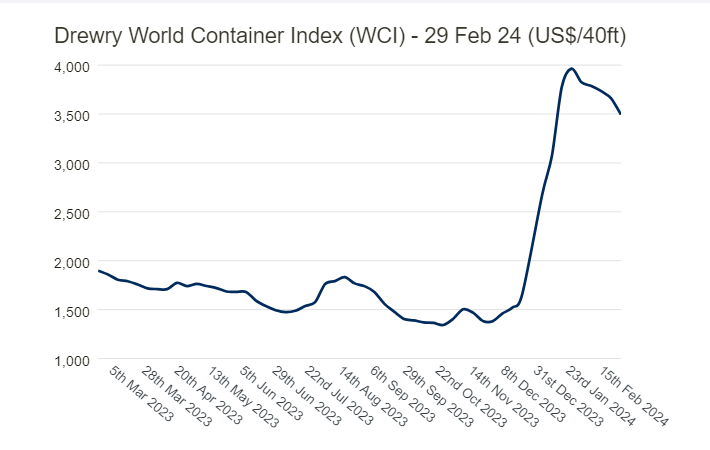

Price Surges Creating Shipping Tensions Globally

Global shipping companies are trying to find a way around the building tensions of Suez Canal issue, which has led to a significant rise in the shipping rates. Till now, more than USD 200 billion worth of goods have been diverted away from the Red Sea route to avoid any potential problems created by Houthi militants.

Farmer Protests Affecting Logistics in Several Parts of Europe

The planned farmer protests in Germany, Belgium, and France are continuously causing transit delays. As these protests unfold further, they are uncertain when normalcy will be restored in these trade corridors of Europe.

Impact of the Ukraine Conflict on International Freight Services

Due to the ongoing war in Ukraine, freight services have stopped accepting shipments destined for or originating from specific regions such as The Russian Federation, Belarus, Crimea, Sevastopol, the Donetsk Oblast, the Luhansk Oblast, or any Russian-controlled territories within Ukraine. This suspension affects customs brokerage and freight forwarding services across air and ocean transport sectors. Additionally, there is an increased focus on cybersecurity and assessing the financial impact of rising crude-oil prices stemming from the conflict.

Ocean Freight Insights – March 2024

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound Updates

Middle East – North America

The trade lane has tight space and higher rates. With the Suez Canal issues, the global space challenges, blank sailings, and capacity shifts are affecting this trade lane.

Capacity — (+)

Rate — (+)

Middle East – Asia

The rates are high, but the space is manageable. As the result of compromised Suez Canal route, this trade lane is expected to suffer from capacity shifts, global space challenges, and the blank sailings.

Capacity — (=)

Rate — (+)

Middle East – Europe

The route is struggling with blank sailings, global space concerns, and capacity shifts amid issues in Suez Canal route. Furthermore, there is a tighter space and higher rates out of the Gulf.

Capacity — (+)

Rate — (+)

Middle East – Latin America

The rates are high, and the space is tight out of the Gulf. Furthermore, the capacity shifts, blank sailings, and global space issues are affecting this trade lane due to the concerns at Suez Canal route.

Capacity — (+)

Rate — (+)

Inbound Updates

Asia – Middle East

There is a prediction of a potential equipment shortage in the coming days, while the rates are expected to increase. Moreso, due to the compromised Suez Canal route, the space shifts and challenges may have an impact on this trade lane.

Capacity — (=)

Rate — (+)

North America – Middle East

There is a limited service to the Red Sea ports because of the Houthi rebel attacks, which are causing longer transit routes and high-risk surcharges. However, better service is available for Persian Gulf ports, but with the contingency charges and extended transit time.

Capacity — (-)

Rate — (+)

Latin America – Middle East

The rates are generally stable on this trade lane, but the space is volatile because of the congestion in the destination ports. Moreso, the congestion in the Mediterranean ports is consistent due to Red Sea disruptions (congestion charges may apply).

Capacity — (=)

Rate — (+)

Europe – Middle East

The Suez Canal route is compromised, resulting in unreliable schedules, blank sailings, and causing tight space out of MED. There are challenges with equipment availability as well, specifically in the inland depots. Lastly, the port calls for Aqaba and Jeddah are suspended by many liners.

Capacity — (-)

Rate — (+)

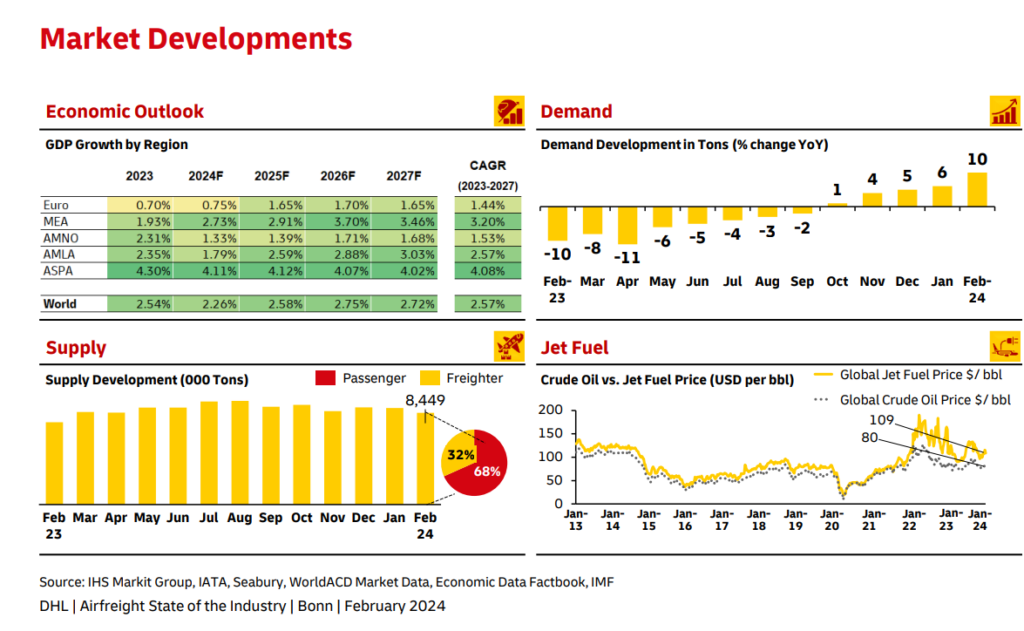

Air Freight Highlights – February 2024

Demand: The global air cargo volume is increasing 10% YoY in comparison to Feb 2023. The rise is mainly due to the pre-Lunar new year coupled up with Middle East disruptions. There is a strong air cargo traffic increase from China in the early 2024, whereas downward trend in air cargo demand persist in outbound US.

Capacity: The global air cargo capacity has now increased by 11% YoY in comparison to Feb ‘23. However, it has decreased by 5% from last month. The continuous rise in international travel has allowed the belly capacity to increase by 18% in comparison to the same period last year.

Rates: The hope of market normalization continues to increase the trend of long-term contracts. Lower jet fuel prices are expected in the second quarter as the global oil inventories are rising. However, potential geopolitical disruptions can impact these projections.

The Middle East and Air Carriers

The demand from Dubai to Europe and America has increased due to the modal shifts caused by the Red Sea Crisis. Furthermore, there is a limited capacity from Turkey to Saudi Arabia due to high e-commerce demand.

Asia

After the Lunar New Year holidays, the entire month of February had soft demand throughout, which is expected to slightly pick up in March. If the Suez Canal crisis continues after the Lunar new year holidays, there might be an increase in air cargo if ocean cargo is not able to handle the demand. This could in turn cause issues of container shortages, port congestion, vessel schedule reliability, and more.

The rates are expected to pick up in March in comparison to February. This will mainly happen due to an increase in the demand for air cargo, resulting in a rise in the fright rates.

The space is sufficient for most of the trade lanes; while the flight cancellation rate will become normal in March, after a slight rise in the pre-Lunar new year period.

America

The capacity will remain sufficient for the current trade volume. Whereas the US market will continue facing consistent weak demand and rising capacity, causing continued spot market pricing.

The disruptions in Mexico’s local trucking sector and the customs systems shutdown are affecting the export and import processes, causing 10-90% of no-show cargo for flights in the previous month.

Europe

Due to the Red Sea Shipping issue, there are some OFR-AFR conversions that are affecting the AFR capacity on certain trade lanes. Furthermore, the union calls for labor strikes in multiple European countries are creating problems in the warehouse and airside operations. Furthermore, there is a positive outlook for AFR demand, both inbound and outbound Europe, where the overall capacity will slightly be restrained in the transatlantic lanes.

UAE Shipping News - March 2024

To facilitate quicker and efficient response, CMA CGM has made changes to the MYCS C-to-A platform. Find more details here

The leading ocean carriers CMA CGM, Evergreen, Orient Overseas Container Line (OOCL), and COSCO Shipping are expected to extend their alliance till 2032. Read More

CMA CGM has revised and simplified their local UAE D&D tariff structure, which will be effective from 23rd March 2024. Read More

ONE has announced revisions in EU ETS Surcharge (ETS) that will be effective from April 1st, 2024, on all the existing and new contracts. Read More

Global Factory Output – Overview

The World Container Index has decreased to USD 3,493 per 40 ft container (a 5% decrease) in the last week.

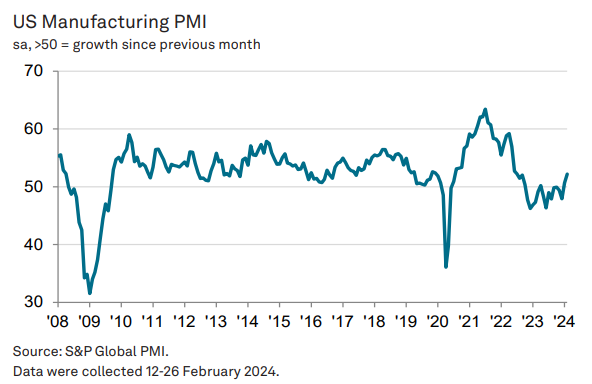

United States of America (USA)

Manufacturing is now displaying signs of easiness in the goods producing sector that has been in trouble for over 2 years. After the long run of reducing the inventory levels for reducing the cost, the factors are again rebuilding the warehouse stock levels, which is driving up the demand for inputs and pushing production at a higher pace, since 2022. Furthermore, now we are experiencing stronger demand for consumer goods.

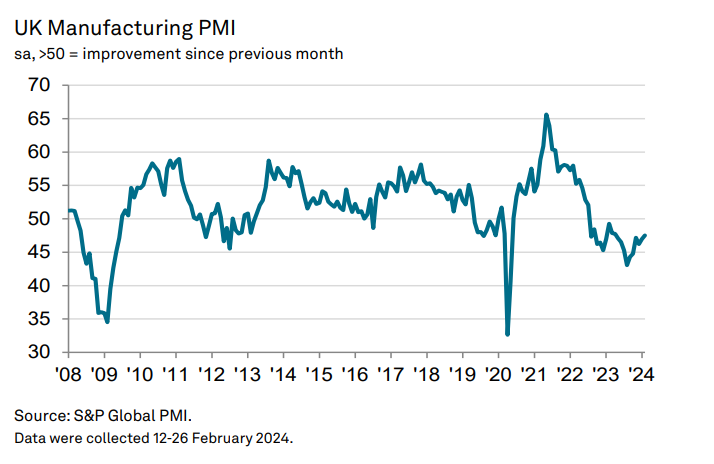

United Kingdom (UK)

As the impact of Red Sea Shipping, the UK manufacturers faced multiple challenges in February, including delayed raw material deliveries, increased purchasing prices, and affected production capabilities. The impact was also seen on the demand as the new export orders took a hit from both supply chain disruptions and higher shipping costs. Furthermore, the production volumes are still contracted for the 12th successive month; whereas the new orders fell at the sharpest rate since October.

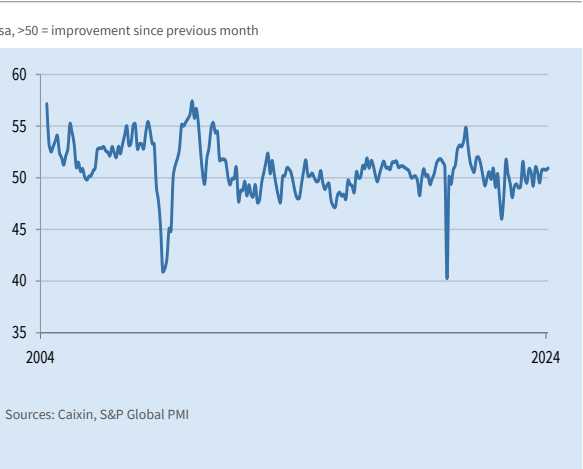

China

Chinese manufacturers are showcasing continuous improvement in the operating conditions midway through the 1st quarter of 2024. Many companies are experiencing an increase in both production and new work. The business environment has also brightened up as the output is predicted to reach a ten-month high.

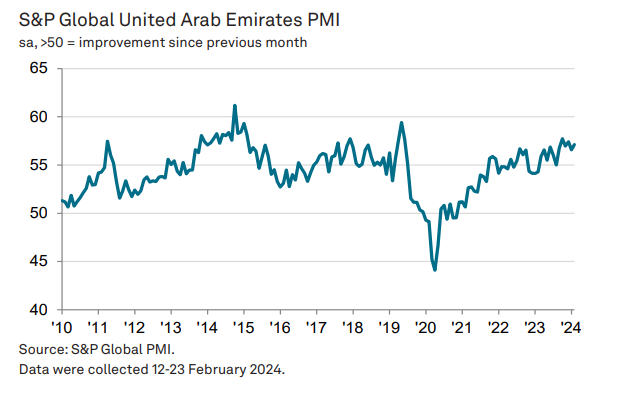

United Arab Emirates (UAE)

The UAE’s PMI indicated a growing momentum in the non-oil economy as 2024 started; the February reading was recorded at 57.1, which is an increase from January when it was 56.6. One of the main components in the measurement of PMI rose to the highest level since June 2019, which indicated rapid expansion in business activities.

The predictions suggest that the companies are expecting a positive year ahead. However, the issue is crowded market remains, dampening the sales growth further.

Related Articles

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Global Logistics Market Update – May 2025

New Sulphur Emission Limits Enter into Effect in the Mediterranean The Mediterranean Sea officially

April 2025 Global Logistics & Supply Chain Market Update

U.S. Section 301 Proposals and Global Shipping Dynamics Global Trade Disruptions & Rising Costs