Industry Spotlight February 2024 Logistics Market Trends and Updates

Resilient Shipping in Turbulent Times: Responding to the Red Sea Conflict

The ongoing Red Sea conflict is causing major disruptions in global supply chains, leading to several important shipping considerations:

Strained Global Ocean Capacity

Disruptions in the Suez Canal are stressing ocean capacity, especially on the Asia-Europe route, leading to container shortages in Asia. To adapt, businesses should book ocean freight well in advance, and consider less than container load (LCL) shipping.

Compounded Delays

The Suez Canal issue, combined with challenges in the Panama Canal, is causing additional shipping delays. The Cape of Good Hope, adding about 14 days to transit, is now a key alternative route, with upcoming Lunar New Year celebrations expected to further delay shipments.

Role of Air and LCL Freight

Shippers are focusing on contingency plans similar to those during the COVID-19 pandemic, involving a mix of air and sea solutions, expedited services, and LCL shipping. Keeping an eye on spot markets for shifts to alternative modes is crucial.

Increasing Ocean to Air Conversions

With the resumption of business post-holidays, swift implementation of contingency plans, including ocean to air conversions, is underway. Shippers should secure additional air capacity and collaborate with logistics providers for risk mitigation strategies.

Ocean Freight Highlights– February 2024

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound Updates

Middle East – North America

The space is tight for this trade lane, while the rates are increasing. There are several factors affecting this trade lane, including issues in Suez Canal route, global space challenges, and blank sailings.

Capacity — (-)

Rate — (+)

Middle East – Asia

The rates are high on this trade lane while the space remains tight. The Suez Canal route is compromised for the trade route of Middle East to Asia. Furthermore, the blank sailings and global space issues are adversely impacting this trade lane.

Capacity — (-)

Rate — (+)

Middle East – Europe

It is a main volume destination from the Middle East; however, the spot rates are increasing for this trade lane. The space is tighter out of the Gulf due to global space issues, blank sailing, capacity shifts, and problems on the Suez Canal routes.

Capacity — (-)

Rate — (+)

Middle East – Latin America

The rates are high, and the space is tight out of the Gulf. The Suez Canal route is compromised, and the trade lane is impacted by other issues as well; including global space issues, blank sailings, and capacity shifts.

Capacity — (=)

Rate — (+)

Inbound Updates

Asia – Middle East

The rates are expected to increase for this trade lane, while there’s potential for equipment shortage. Furthermore, the issues in Suez Canal route, global space issues, and shifts may create indirect domino effect.

Capacity — (=)

Rate — (+)

Latin America – Middle East

The rates on this trade lane are generally stable; but due to the congestion in some ports of destination, the space is volatile.

Capacity — (=)

Rate — (=)

Europe – Middle East

The Suez Canal route is compromised and due to the unreliable schedules and blank sailings out of MED, the space is tight on this trade lane. Furthermore, due to the availability challenges, especially at inland depots; Aqaba and Jeddah port calls were suspended by some liners.

Capacity — (-)

Rate — (+)

Air Freight Highlights – February 2024

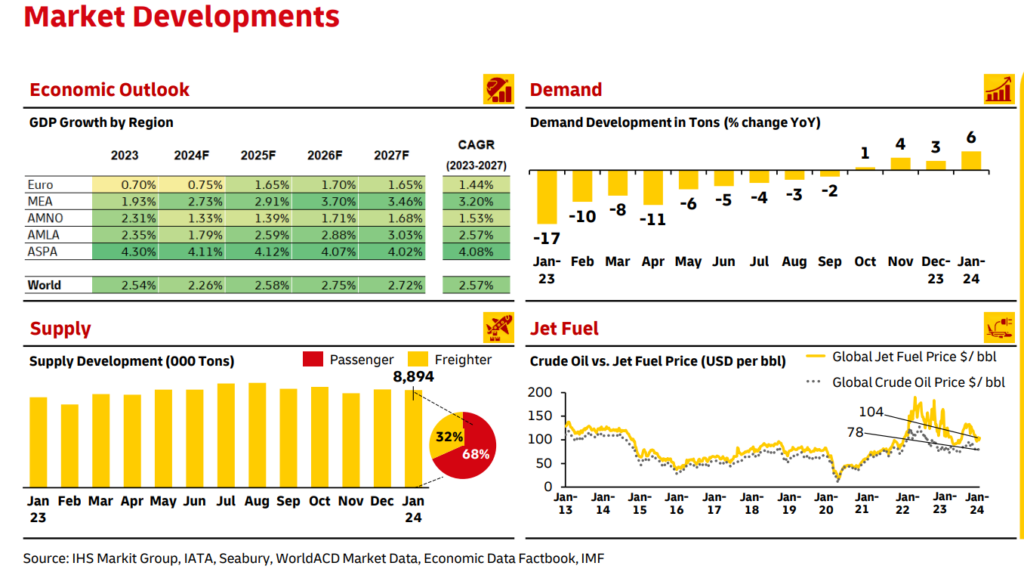

Demand: The air cargo demand globally increased by 6% YoY in comparison to January 2023, driven by the better manufacturing output and positive data from new export orders PMI. In the last quarter of 2023, there was a significant upward trend observed from Asia Pacific and Africa. The Red Sea demand is yet to materialize, in the meantime, the alternative inquiries are increasing.

Capacity: The global air capacity is now 8% higher in value than last year at the same time. This increase is boosted by the ongoing recovery of the passenger aircraft. Furthermore, the ongoing growth in international travel has caused an increase of 13% YoY. The capacity is sufficient for most regions, but there is a noticeable constraint observed in Asia Pacific and Israel.

Rates: The shipper’s preference for long-term contract grew in 2023. This potential rise in demand is due to the Red Sea crisis and the Lunar Year, that is expected to create a spike in spot rates.

The Middle East and Air Carriers

The 2024 forecast for Middle East air cargo, according to the International Air Transport Association (IATA), predicts a significant surge in demand with a 12.3% growth rate. This follows a recovery in the latter half of 2023, where carriers in the region began seeing an increase in cargo volumes. The global freighter fleet, as per Boeing’s outlook, is also set to expand, with the Middle East’s fleet projected to more than double by 2042. In preparation, regional maintenance and overhaul service providers are scaling up, including new freighter conversion lines and expanded facilities, to accommodate this anticipated growth.

Asia

For most of the Asian trade lane, there are no capacity issues; but some flight cancellations might happen as we move towards Lunar New Year Holidays in the early February.

The cargo demand increased in the second half of January before the manufacturing activities in most parts of the Asia, particularly in China were close prior to the full resumption after mid-February, while the demand to remain soft in February.

Furthermore, the rates are expected to hold up or turn volatile due to the Middle East conflict situation. This will also result in increased fuel prices and freight rates with a potential shift in the demand for more air services in comparison to ocean shipping.

America

The first month of the year is important for flower industry in Latin America as Colombia and Ecuador export large quantity of fresh flowers to the United States and Europe. This time also coincides with the high demand for flowers during Valentine’s Day and other celebrations. In the meantime, the rest of the Latin American market maintains a stable level of supply and demand, as they experience no major changes in the capacity or customer preferences. The air cargo rates are also fluctuating according to the supply and demand market. Furthermore, the airlines are optimizing their capacity utilization by adjusting their schedules and routes for maintaining profitability and competitiveness.

Meanwhile, in North America, the United States market is stable for most destinations. The capacity is sufficient to handle demand and there is not much change expected in the short term. Most of the US import lanes are in the same position as the first quarter is mostly considered as low demand period. With the Chinese New Year, there is prediction of potential increase in demand in late January and early February.

However, with the looming Panama and Suez Canal issues, the ocean market is expected to tighten dramatically, and there could be a significant volume shift from ocean to air.

Europe

In response to the increased transit times caused by rerouting cargo around the Cape of Good Hope, new Sea-Air transport solutions have been introduced via Dubai and Salalah to minimize delays in global supply chains. Furthermore, to tackle similar challenges in European supply chains, an Air-Sea service extending through Singapore to Asia and Australia has been implemented, providing an effective strategy to avoid potential delays.

Shipping Local News - United Arab Emirates February 2024

To ensure crew and cargo safety, Hapag Lloyd is avoiding the Red Sea route and introducing a shuttle service connecting Red Sea cargo via Jeddah, with altered transit times and a new 10-day frequency feeder service. Read More

Maersk has suspended voyages through the Red Sea/Gulf of Aden due to security risks, rerouting vessels around the Cape of Good Hope for safety, with support available for any logistical impact on customers. Read More

CMA CGM has announced a new feature on the Dubai Trade portal, started from January 15, 2024. Customers can now schedule a time slot to submit their Import Original Bill of Lading at the CMA CGM Dubai counter, facilitating the process for Delivery Order and split NOC release. Read More

Hapag Llyod has provided an overview of Operational Recovery Surcharges (OCR), Peak Season Surcharges (PSS), Contingency Surcharges (CSU), and Emergency Revenue Charges (ERC) per trade routes, allowing you to select the relevant updates based on your business’s geographical scope. Read More

In response to the ongoing situation in the Red Sea/Gulf of Aden, Maersk is focused on providing greater predictability and efficient supply chain management. This includes launching new services for the Middle East and Asia, particularly enhancing Intra-West Coast Asia coverage by introducing new weekly services connecting the Mediterranean and Red Sea. Read More

From January 25, 2024, CMA CGM will no longer request customer hauler code details during export bookings. Customers are encouraged to use the Hauler Nomination Service on the Dubai Trade portal to independently nominate hauliers, streamlining the process and offering flexibility in hauler selection and amendments.

To ensure supply chain reliability amidst the Red Sea/Gulf of Aden situation, Maersk is launching a new weekly Chennai service from February 5, 2024. It will connect Salalah, Oman, Colombo, Sri Lanka, and Ennore, India, providing connections to Europe and the Far East, with access to North Europe via West Mediterranean hubs. Read More

Starting from January 1, 2024, an Emergency Surcharge (EMS) will be implemented by Ocean Network Express L.L.C for all Dry, Special, and Reefer cargo on contracts originating from North Europe and Mediterranean to the ME, ISC, FE, Australia, and New Zealand region. Read More

CMA CGM is notifying its customers of the Import/Export Terminal Handling Charges (THC) amounts in Spain. Read More

In response to the changes in bunker prices since the last surcharge adjustment, CMA CGM SSL Intra Europe will update its Bunker Adjustment Factor (BAF) for its Roro South services, which connect France with Algeria, Tunisia, and Morocco for both import and export shipments. Read More

Global Factory Output – Overview

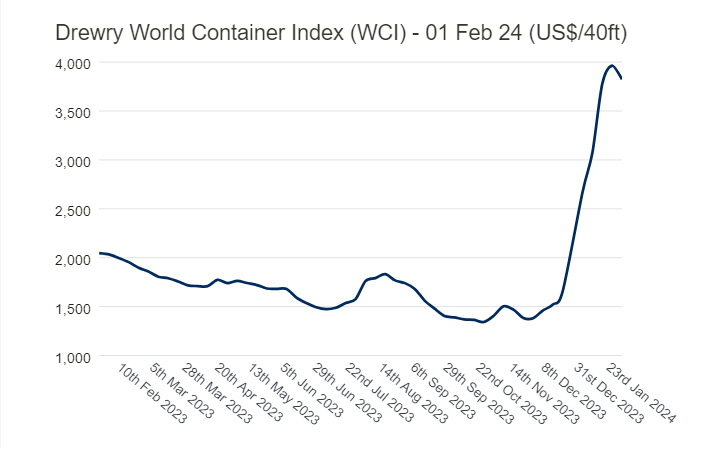

The Drewry’s World Container Index decreased by 4% in the first week of February to $3,824 per 40ft container.

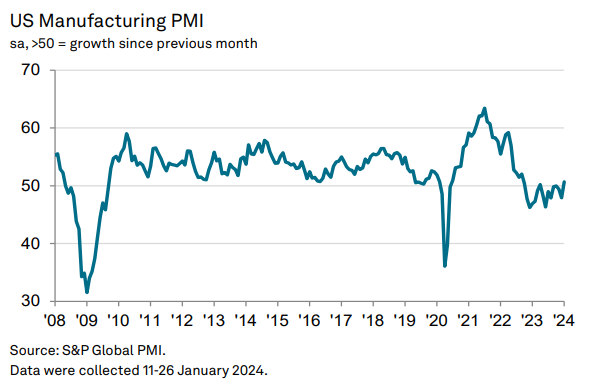

United States of America (USA)

The manufacturing sector has started the year with strong optimism and a surge in demand, experiencing the fastest growth in orders since early 2022, particularly in consumer goods. This is partly due to declining inflation and relaxed financial conditions. However, this positive trend is challenged by rising costs and supply delays, leading to higher factory prices and potential increases in consumer prices.

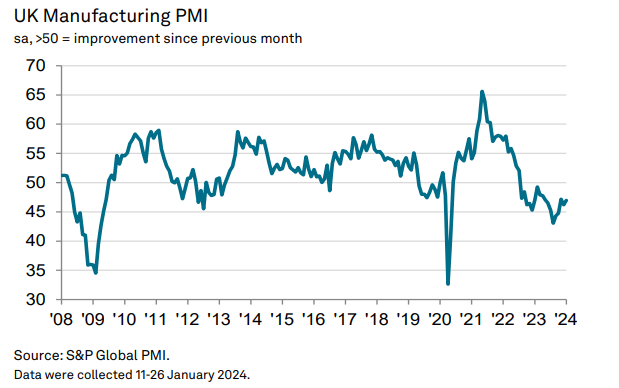

United Kingdom (UK)

In January 2024, the UK manufacturing sector experienced a downturn with decreases in output, orders, and employment across various sub-industries. Manufacturers are cutting back on purchases and stocks to manage costs and margins. The Red Sea crisis is exacerbating challenges, causing rerouting of supplies, higher prices, longer lead times, and added delivery delays of up to 18 days, further straining production and increasing inflationary pressures. Despite these issues, over 50% of manufacturers remain optimistic, expecting higher output within the next 12 months, indicating that some of these challenges might be short-lived.

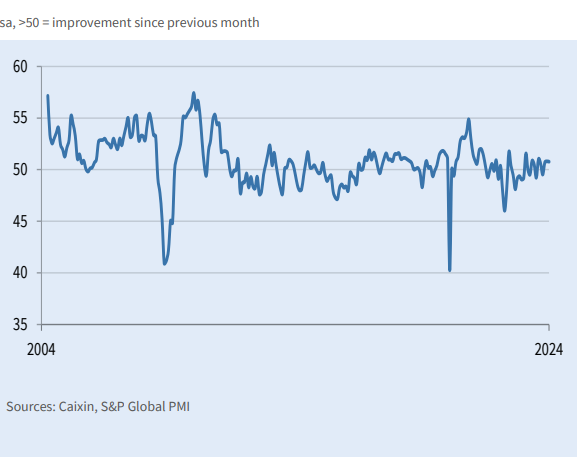

China

The PMI data for January revealed that China’s manufacturing sector is still experiencing growth, as evidenced by consistent rises in production and new orders. Although the overall growth in new business slowed down slightly from December, there was an increase in new export orders. Additionally, companies in the sector are showing a more optimistic outlook for the upcoming year. Notably, there has been a significant reduction in the rate of job losses across the industry compared to the previous month.

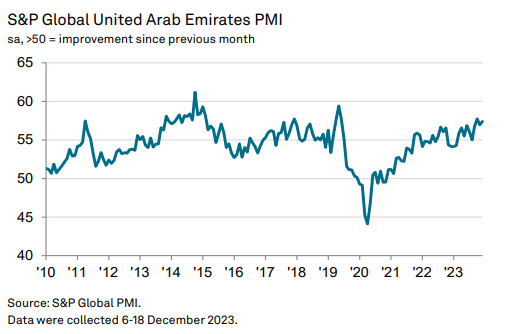

United Arab Emirates (UAE)

In 2023, the UAE’s non-oil economy witnessed significant expansion, the strongest since Q2 2019, positioning it well for 2024. Businesses not only saw a major rise in output but are also highly optimistic about future growth, with sentiments at pre-COVID-19 levels. This optimism is supported by reduced price pressures, as purchasing costs had the smallest increase in almost a year. Despite wage pressures remaining low and firms using promotions to stay competitive, this approach has led to the quickest drop in charges since July, suggesting that companies are keeping profit margins low in a competitive market.

Related Articles

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Global Logistics Market Update – May 2025

New Sulphur Emission Limits Enter into Effect in the Mediterranean The Mediterranean Sea officially

April 2025 Global Logistics & Supply Chain Market Update

U.S. Section 301 Proposals and Global Shipping Dynamics Global Trade Disruptions & Rising Costs