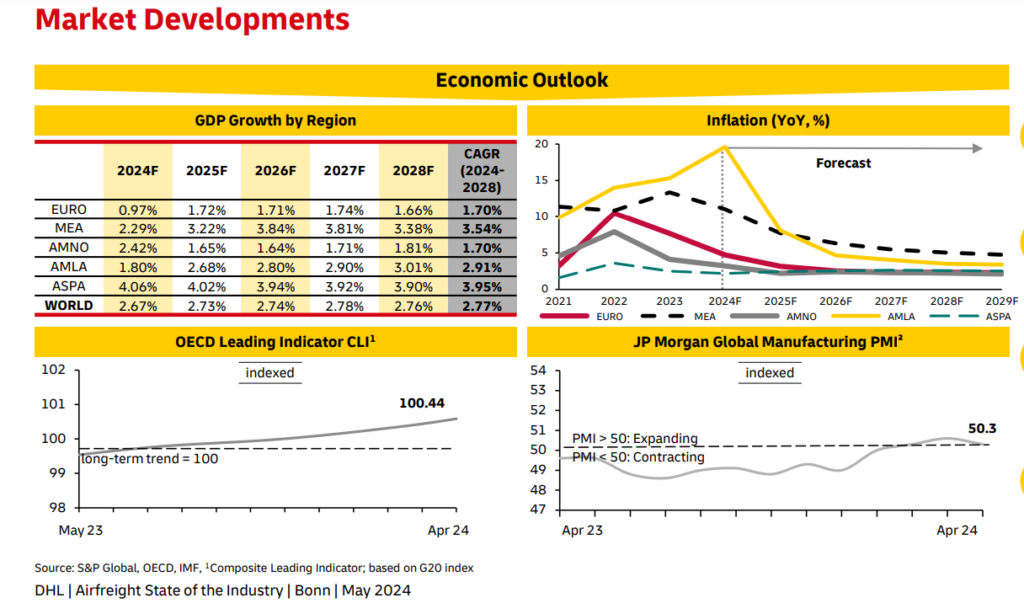

Global Market Overview: June 2024 Logistics Landscape

Navigating Change: Key Developments in Global Logistics

May 2024 has seen significant shifts and challenges in the global shipping industry, impacting air, ocean, and inland transport. These developments are poised to reshape the logistics landscape in the short term. Here’s a high-level summary of the major changes from Asia to the Americas.

Enhanced Efficiency at the Panama Canal

Efforts to boost efficiency at the Panama Canal are yielding positive results, with an increase in the number of daily transit slots facilitating smoother vessel passage. This improvement is expected to reduce transit times and alleviate congestion.

Rerouting Due to Middle East Instability

Ongoing instability in the Middle East has prompted many carriers to reroute freight away from the Red Sea and Suez Canal. This strategic shift aims to avoid potential disruptions and ensure the safe and timely delivery of goods.

E-commerce Demand Fluctuations

While e-commerce demand is generally lower compared to April, a notable exception occurred around Mother’s Day weekend, driving a temporary surge in charter air demand for fresh flowers. This seasonal spike highlights the unique pressures that holidays can exert on supply chains.

Improvements in India's Air Freight

The air freight backlog in India is improving, with capacity conditions becoming more favorable and rates trending slightly downward. However, ongoing challenges in the Red Sea region could reintroduce volatility to the market, necessitating careful planning to adapt to these changes.

Adapting to an Ever-Changing Landscape

The global logistics environment is continuously evolving, influenced by factors such as holidays, seasonal demand shifts, geopolitical tensions, and unpredictable weather. Success in this dynamic field requires adaptability, resilience, and strategic planning. Stakeholders across the supply chain must collaborate effectively to navigate these challenges and keep goods moving smoothly worldwide.

June 2024 Ocean Freight Analysis

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound

Middle East – Asia

The demand is less than the available capacity for this trade lane.

Capacity — (+)

Rate — (-)

Middle East – Europe

The Middle East to Europe trade lane is experiencing significant declines in capacity, reflecting a challenging market environment.

Capacity — (-)

Rate — (+)

Middle East – Latin America

The Middle East to Latin America trade lane is facing substantial declines in capacity and rates, indicating a downturn in market conditions.

Capacity — (-)

Rate — (-)

Inbound Updates

Asia – Middle East

The Asia-Middle East trade lane faces increasing freight rates and high-capacity utilization due to geopolitical tensions and strong demand.

Capacity — (-)

Rate — (+)

North America – Middle East

This trade lane experienced slower volume at the beginning of May but started the recovery in the latter half.

Capacity — (=)

Rate — (-)

Europe – Middle East

For this trade lane, the freight demand is greater than the available capacity.

Capacity — (-)

Rate — (+)

Air Freight Developments – June 2024

Demand: The global air cargo demand remains solid in May. The increase in air volume is due to the rise in e-commerce demand and a modal shift from ocean to air amid Middle East conflicts. The Asian Pacific-Europe and Middle East-Europe routes are boosting the demand growth.

Capacity: The global air cargo capacity is up +11% YoY in May, driven mostly by the passenger belly cargo increase. The capacity is stable in most of the regions, except for some trade lanes where high demand is causing constraints. Furthermore, the overall capacity from Asia to US, EU, and MEA remains tight.

Rates: The global air cargo experiences its first YoY increase since August 2022 after strong e-commerce demand and geopolitical disruptions. Shippers prefer long-term contracts stability, competitive rates, and reliable operational performance.

The Middle East and Air Carriers

The rates from Dubai are a bit higher in comparison to last year as the disruptions to container shipping continue to increase the air cargo demand. The volumes for Dubai-Europe remain twice their level this time last year, increased by sea-air tonnages.

Asia

The Middle East conflicts continue to drive the ocean-to-air freight shift, causing less carrier payloads and flight cancelation because of airspace closures and security concerns. The ecommerce demand strains airline capacity; however, India, China, and Southeast Asia cargo yields remain high.

Lastly, the airlines are re-positioning flights to take maximum benefit of the opportunity. The capacity is re-directed from Southeast Asia and now prioritizing express cargo uplift.

America

The export market of the US remains soft while the import volumes rose YoY in March and April, mainly by the inbound AP amid the Red Sea Crisis, impacting capacity and rates. The cargo capacity out of South America increased in April as the demand for flowers increased close to Mother’s Day celebration in North America.

Mexico continues to experience challenges due to impact of high temperature on aircraft payloads.

Europe

The economic growth in the Eurozone region remains relatively weak due to the contraction of European markets. The Red Sea conflicts continue to lead to the air freight demand from Dubai to Europe. Furthermore, the summer Olympics might cause import/export constraints in Paris metropolitan area due to imposed local security measures. Additional capacity is expected outbound Europe with the 2024 summer schedule.

News Update on UAE Shipping – June 2024

In an effort to offer a faster service, CMA CGM has now made it mandatory to submit the switch BL request online via MyCS using MY CMA CGM login credentials. This rule became effective from 20th of May. Read More

For reliable and efficient service, CMA CGM has announced new Peak Season Surcharges from Bangladesh to USA. Read More

CMA CGM revised their Terminal Handling Charges (THC) for all their Northern Emirates Ports (AEAJM, AERKT, AEQIW, AEFJR), effective from 1st July 2024. Read More

Peak Season Surcharges have been announced by CMA CGM from Asia to La Reunion, effective from June 1st, 2024. Read More

In response to the congestion in Paranaguá, Brazil, CMA CGM has announced new Port Congestion Surcharges, effective from 1st July 2024. Read More

New Peak Season Surcharge (PSS) has been updated by CMA CGM from Turkey, Egypt, and Lebanon to West Africa from 15th June 2024. Read More

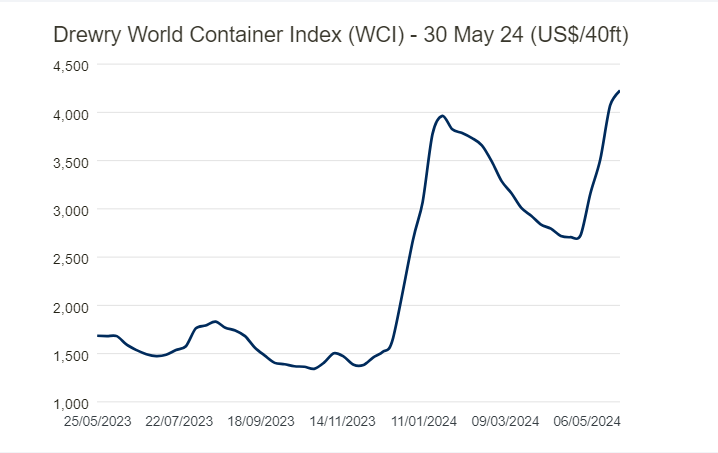

Global Factory Output – Overview

The World Container Index (WCI) has reached $4,226 per 40ft container after an increase by 4%.

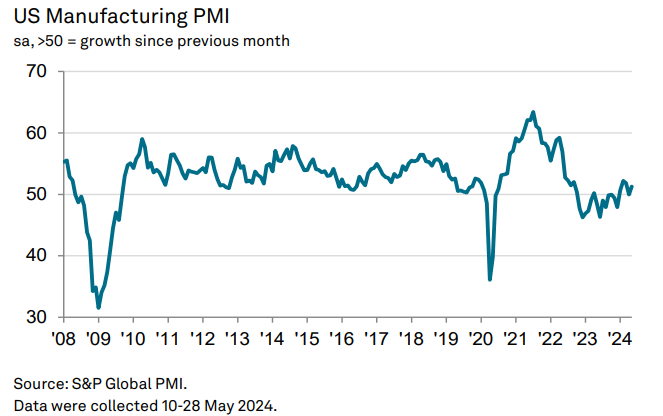

United States of America (USA)

After a blip in April, new orders started to grow in May again. Despite being modest, this increase will be beneficial for production in the coming months. Manufacturers are also expecting this spike to be a contributing factor to the increase in employment, finished good stocks, and purchasing activity.

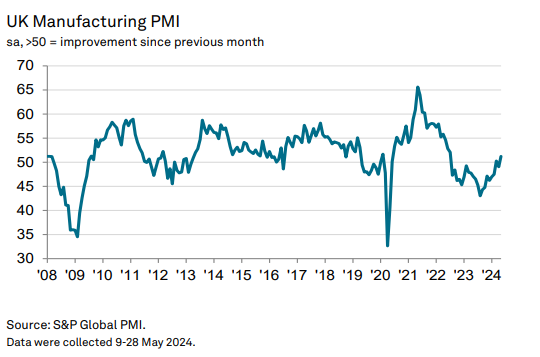

United Kingdom (UK)

In May, there was a revival activity in the UK manufacturing sector, with levels of production and new business rising at the quickest rate since early 2022. Furthermore, there was a growth in both output and new orders in all main sub-industries. The latest PMI indicates a mixed picture of price pressures at manufacturers. The output charge inflation at the factory gate strengthened for 5th successive month. However, ease in the rates of input costs should prevent price pressures from becoming embedded.

China

The service economy expansion in China expanded in May due to the increase in the business inflows, which also resulted in services activity growth. The new export business also grew in May. The pressure on price intensified; however, the firms are increasing their charges amid the higher cost burdens. As a result of this growth in business activity, the staffing levels rose for the first time after 4 months.

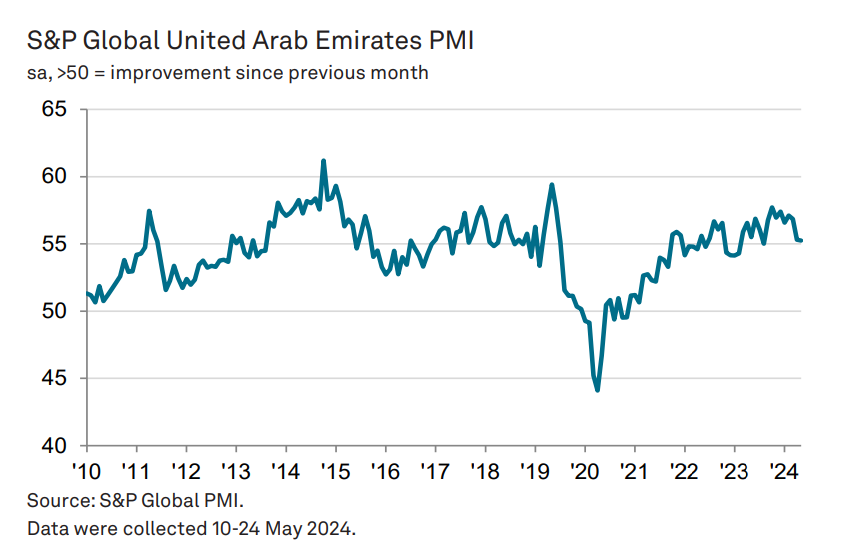

United Arab Emirates (UAE)

The non-oil companies in the UAE continued facing pressure on the business capacity in May; signaling the largest-ever increase in backlogs of work. However, the uplift can also be due to the record rainfall that the country experienced in April. The PMI indicates that the firms require a lot of effort to rebuild output levels, hire workers, and boost inventories. The May data also showcased a pickup in hiring and purchasing efforts, contributing to higher inflationary pressure.

Related Articles

July 2025 Global Freight & Supply Chain

Middle East Ocean Freight and Port Operations Stable Operations with Ongoing Risk Monitoring Ocean f

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Global Logistics Market Update – May 2025

New Sulphur Emission Limits Enter into Effect in the Mediterranean The Mediterranean Sea officially

Post a comment

You must be logged in to post a comment.