Logistics Market Update: Trends and Insights – April 2024

Navigating Global Shipping Challenges in 2024

As the global supply chain faces simultaneous disruptions due to water level challenges in the Panama Canal and the Red Sea conflict, shippers around the world are encountering increased uncertainties. The ongoing situation has forced a reevaluation of shipping strategies, with significant implications for transit times, port operations, and overall logistics planning. In 2024, the industry must adapt to these changes, considering the intricate dynamics of rates, capacity, and terminal operations to maintain efficient and reliable supply chains.

Global Shipping Disruptions

Ongoing water level issues in the Panama Canal and disruptions in the Red Sea have led to global supply chain uncertainties. Despite some short-term mitigation through contingency plans, the long-term effects are still unknown.

Rate and Capacity Changes

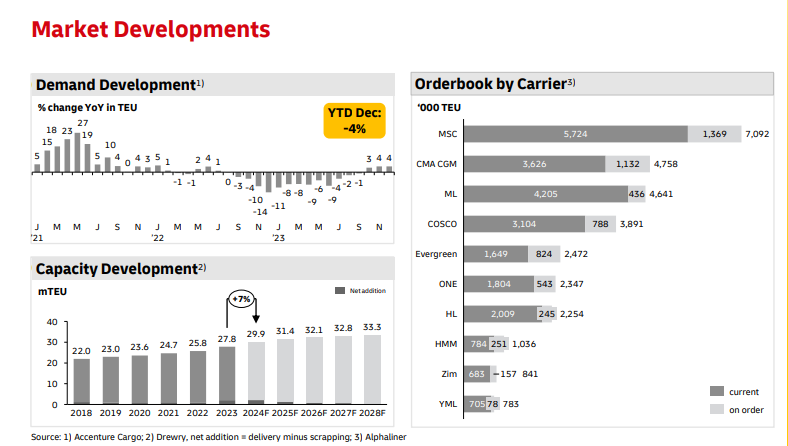

Transit times have increased due to rerouting around the Suez Canal and Panama Canal, affecting shipper demand and potentially leading to decreased ocean rates. The added vessel capacity in 2023 has been absorbed, showing limited impact on rate adjustments.

Port and Terminal Dynamics

Extended transit times cause vessel congestion and equipment shortages, particularly noted between the United States and Asia. Ports and rail terminals face delays and potential fee increases, with specific challenges at Los Angeles terminals and potential disruptions due to East Coast union negotiations.

Ocean Freight Highlights – April 2024

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound Updates

Middle East – North America

Capacity is stable with rising rates due to geopolitical tensions and operational changes.

Capacity — (=)

Rate — (+)

Middle East – Asia

Steady capacity with potential for increased rates driven by the Red Sea crisis and bunker fuel costs.

Capacity — (=)

Rate — (+)

Middle East – Europe

Capacity is under pressure with higher rates amid conflict-induced rerouting and the associated logistical challenges.

Capacity — (-)

Rate — (+)

Middle East – Latin America

Capacity remains constant but rates may increase due to extended transit times and supply chain disruptions.

Capacity — (=)

Rate — (+)

Inbound Updates

Asia – Middle East

Asia and Middle East trade lanes experience no change in capacity with an increasing trend, while spot rates continue to decrease.

Capacity — (=)

Rate — (-)

North America – Middle East

For North America to Middle East trade lanes, capacity is strained due to longer transit times and rerouting, while rates are increasing due to added surcharges and operational changes.

Capacity — (-)

Rate — (+)

Latin America – Middle East

For Latin America trade lanes, capacity is decreasing due to operational challenges and port inefficiencies, while rates remain stable despite high demand.

Capacity — (-)

Rate — (=)

Europe – Middle East

Europe to Middle East trade lane experiences tight space and potential disruptions due to strikes, with capacity decreasing and rates under pressure but high.

Capacity — (-)

Rate — (+)

Air Freight Highlights – April 2024

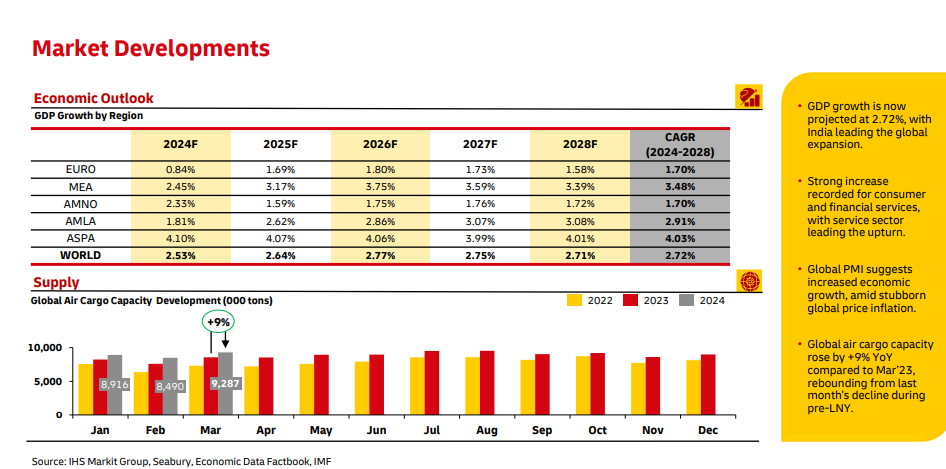

Demand: The global air cargo demand stayed solid in March 2024 and the volumes returned to their normal level amid the surge of pre-Chinese New Year in January 2024. Furthermore, due to the modal shifts caused by the Middle East crisis, the sea-air hubs in Asia-Europe recorded strong demand.

Capacity: There is a continuous growth in air belly cargo capacity of 12% YoY compared to the same time lasty year. There are some capacity constraints due to rise in the e-commerce volume outbound Asia, which is leading shippers to use alternative hubs.

Rates: The global rates are soft in certain regions as compared to last year, whereas there was a significant increase in the rates in the Middle East and South Asia. There might be unforeseen increases in some countries due to the rise in e-commerce demand and geopolitical events.

The Middle East and Air Carriers

The air freight is facing issues while sending cargo to Europe and US from Middle East, mainly due to Red Sea Shipping. These disruptions have also affected the ocean freight operations, increasing the cost and transit times. Similarly, there has been a visible shift to the air cargo as shippers strive to avoid delays in the shipment.

Asia

The workers are gradually resuming their work in factories after the Lunar New Year Holidays; however, the resumption of the productive activities is a bit slower with some beginning completely only in March.

The Suez Canal issue prevails, which means the rates are likely to be slightly elevated for Asia to European trade lanes and are expected to moderately rise at the end of 2024’s second quarter. The restrictions for the Panama Canal are not the strict; however, the pressure was built in the late March, affecting the Trans-Pacific routes.

The overall capacity is adequate; however, in the presence of the production momentum rising due to the first quarter’s rush, ecommerce cargo demand for Easter and Good Friday may put some pressure on capacity, causing the rates to peak in the first quarter.

America

The Latin American region is showing stability across all the trade lanes, and the demand for air transportation increased for perishable cargo from South America. This causes capacity pressure on the general cargo on some days. Furthermore, as far as the air imports are concerned, the space availability is high for the major destinations, especially from the US, as airlines are adjusting their rates that align with the market’s capacity offerings.

In North America, the US export market remains stable, and there is no indication of any change in the coming months. The capacity will rise for the Trans-Atlantic route as new summer schedule will come into effect in the second quarter.

Europe

There are capacity constraints from Europe to Shanghai route because of multiple flight cancellations. The summer schedules are expected to add to LD capacity and direct destinations. The ongoing labor strikes continue to affect the AFR operations. Furthermore, the Red Sea situation has contributed to an increase in the demand for air freight from Dubai to Europe.

UAE Shipping News - April 2024

DP World extends facial recognition registration for truck drivers to April 30, 2024. Unregistered drivers face access restrictions at specified gates from May 1. Registration via Dubai Trade portal is required. Learn More

Jebel Ali port is experiencing significant delays of 10-15 days due to Ramadan and bad weather, impacting voyage schedules. Read More

Maersk announces revision of Export Service (EXP), Documentation Fee – Origin (ODF), and Destination (DDF) rates effective from February 1, 2024, for shipments to and from Jebel Ali, AE. Rate adjustments will be communicated and are subject to regulatory compliance and additional surcharges. Read More

Maersk Gambia introduces a Peak Season Surcharge (PSS) effective April 4, 2024, for Non-Regulated countries and May 2, 2024, for Regulated countries, applicable to shipments from worldwide locations, excluding FEA, to Gambia. Read More

Global Factory Output – Overview

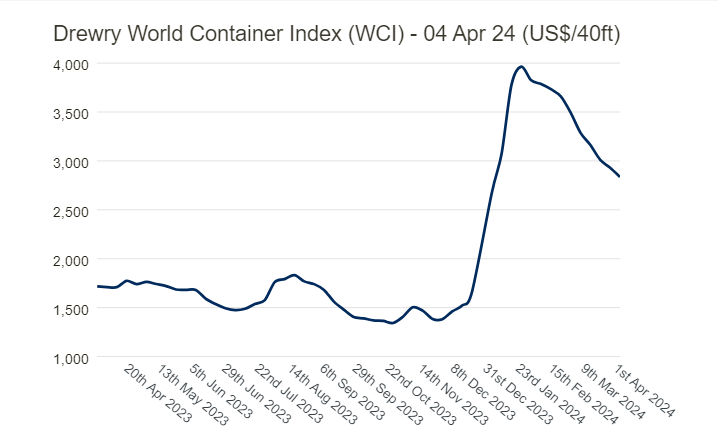

The World Container Index (WCI) has now reached the value of $2,836 per 40ft container after a 3% reduction.

United States of America (USA)

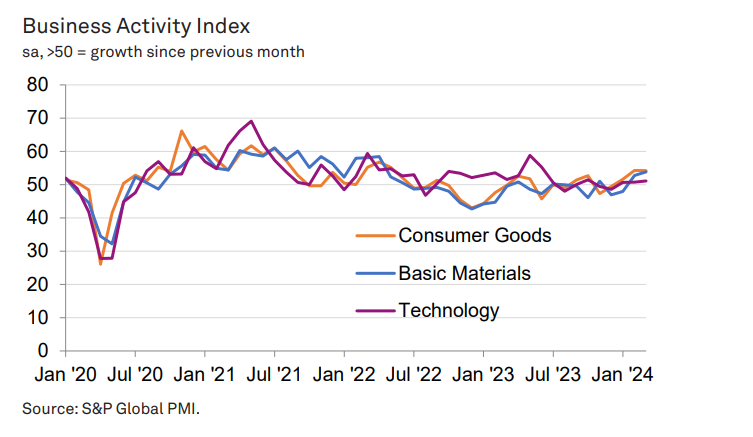

In March, all seven US sectors monitored in the S&P Global PMI survey showed business activity expansion, with Consumer Goods leading and Basic Materials experiencing significant growth acceleration. Financials and Industrials posted modest gains, while Consumer Services and Healthcare saw a slowdown in growth. Technology sector activity marginally increased but at the fastest rate since October.

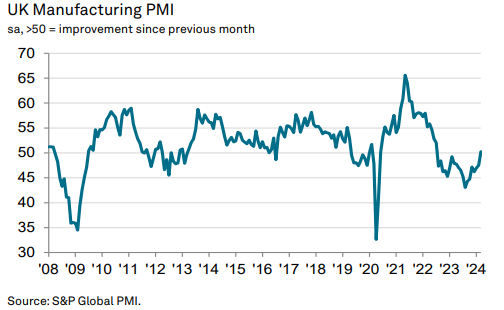

United Kingdom (UK)

UK manufacturing showed signs of recovery at the end of Q1, with production and new orders growing due to stronger domestic demand and improving manufacturer confidence. However, challenges like weak export performance and supply chain stresses, particularly from the EU market and the Red Sea crisis, persist, although their impacts are easing.

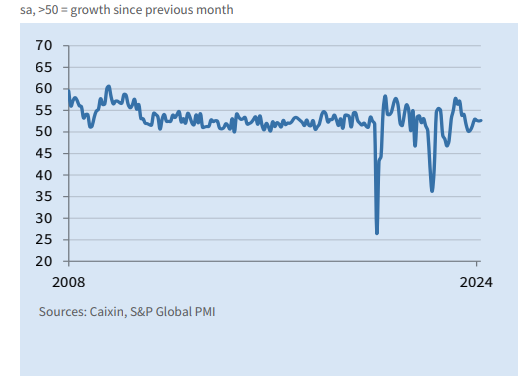

China

China’s service sector saw increased business activity in March 2024, with the Caixin Business Activity Index rising to 52.7, indicating the fastest new business growth rate since December and improved business confidence. However, employment levels declined slightly due to productivity measures, while input cost inflation eased, allowing for a slower increase in selling prices.

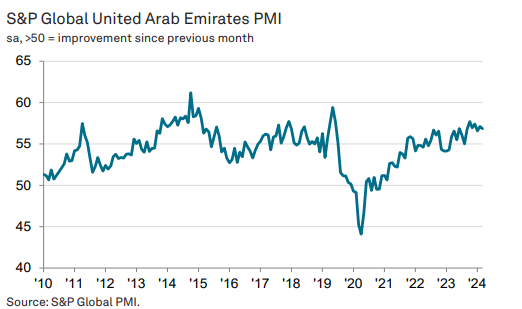

United Arab Emirates (UAE)

The UAE’s non-oil private sector showed strong performance in March, with a PMI of 56.9 indicating sharp growth in orders and activities. However, the Backlogs of Work Index reached a record high, highlighting capacity pressures and supply issues, partly due to the Red Sea shipping crisis, which could support longer-term activity growth once resolved.

Related Articles

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Global Logistics Market Update – May 2025

New Sulphur Emission Limits Enter into Effect in the Mediterranean The Mediterranean Sea officially

April 2025 Global Logistics & Supply Chain Market Update

U.S. Section 301 Proposals and Global Shipping Dynamics Global Trade Disruptions & Rising Costs

Post a comment

You must be logged in to post a comment.