Global Logistics and Shipping Update – August 2025

Logistics Outlook for IMEA in the Second Half of 2025

As we approach the second half of 2025, businesses in India, the Middle East, and Africa (IMEA) are navigating evolving market conditions, driven by peak season demand, tariff changes, and capacity constraints. Here’s a concise update on the latest trends and challenges affecting supply chains across the region.

Ocean Operations: Stability Amid Seasonal Challenges

- South Asia’s monsoon season has caused congestion at the Port of Colombo, leading to delays.

- Geopolitical tensions in the Middle East are being monitored, but logistics companies’ contingency plans are ensuring service continuity.

- In Africa, trade volumes are rising, particularly in East and West Africa, with strong imports from the Far East.

Customs Update: Tariff Shifts and Trade Realignments

The 90-day U.S.-China tariff pause expires in early July, potentially reinstating tariffs on key sectors like automotive and construction.

Warehousing: Adapting to Changing Demand

Businesses are shifting from just-in-time models to more flexible storage strategies due to tariff impacts.

As the region stabilizes, businesses are advised to stay informed and plan ahead to ensure smooth operations through peak season and beyond.

August 2025 Ocean Freight Update

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound

Middle East – Asia

The Middle East situation led to temporary suspension of vessel calls to Haifa, Israel, but service has resumed. Operations at the Port of Ashdod are stable, and the Strait of Hormuz remains navigable.

Capacity – (=)

Rate – (=)

Middle East – Europe

The situation in the Middle East caused temporary vessel call suspensions to the Port of Haifa, Israel, but normal service has resumed after a ceasefire agreement. Transit through the Strait of Hormuz remains feasible.

Capacity – (-)

Rate – (=)

Middle East – Latin America

Inbound operations in Latin America are facing moderate declines in both rate and capacity due to weather-related delays and terminal congestion.

Capacity – (-)

Rate – (-)

Middle East – North America

Inbound ocean demand to North America remains strong from Europe, Asia-Pacific, and the Indian Subcontinent, with limited space and tightening capacity as peak season approaches.

Capacity – (-)

Rate – (+)

Inbound

Asia – Middle East

Strong demand from Asia to North Europe and the Mediterranean is expected for the rest of July, in line with seasonality, with customers encouraged to book early to secure space.

Capacity: (+)

Rate: (+)

North America – Middle East

Outbound ocean demand from North America remains strong, with limited space to the U.S. and capacity constraints driven by peak season, while Asia-Pacific sees higher demand and faster transit via the new TP9 service.

Capacity – (+)

Rate – (+)

Europe – Middle East

Strong demand from Asia to North Europe and the Mediterranean in the month of July, and it’s expected to continue in the coming months, with customers encouraged to book space early.

Capacity – (+)

Rate – (+)

Latin America – Middle East

Outbound operations in Latin America show stable rates and capacity for the Tango service, while the new UCLA service sees moderate increases in both rate and capacity.

Capacity – (+)

Rate – (=)

Air Freight Trends & Projections – August 2025

Demand: Global air cargo growth for 2025 is revised to 0.6%, down from 5-6%, with strong gains in ex-Asia Pacific and Intra-AP lanes, while ex-EU and ex-MEA regions see declines. Resilient high-value and time-critical shipments are driving growth in emerging markets and tech-driven logistics.

Capacity: In July, air cargo capacity grew on AP-EU, EU-AP, and MEA-AP lanes but declined on Intra-AP and AP-North America lanes. Q3–Q4 2025 capacity is expected to grow modestly (~2–3% YoY), constrained by aircraft shortages and delays.

News: ICAO is updating Annexes 17 and 18 to enhance air cargo safety, especially for lithium batteries, with implementation by 2028. Swiss WorldCargo has joined Lufthansa and United Cargo’s transatlantic alliance for denser Europe-North America connections.

The Middle East and Air Carriers

Emirates SkyCargo, Etihad Cargo, and Qatar Airways Cargo are expanding their pharmaceutical, e-commerce, and temperature-controlled services, with Emirates extending freighter routes and Etihad doubling services to Africa. Q3 2025 is expected to see stable demand in the Middle East, with growth in e-commerce and pharma sectors, while Africa shows slow recovery and lower utilization.

Asia

The shift in supply chains to Southeast Asia has increased demand on Intra-Asia routes, reflecting a regional realignment. While Asia outbound flights to and via the Middle East have resumed, the avoidance of Israeli and Iranian airspace is causing longer flight times and reduced payload capacity.

America

In Mexico, high temperatures and severe rains in Mexico City are causing daily cargo offloads on PAX flights from MEX, with reduced freighter payloads at NLU, though the impact remains limited. In Canada, tariff-related disruptions are affecting AP-Canada traffic, with recent U.S.-Canada tariff changes causing some shippers, like those from Malaysia, to bypass Canada, leading to volatile demand and complicating flight planning.

Europe

Stabilized summer belly hold capacity helped ease Europe-bound rates, while transatlantic rates remained about 20% higher year-on-year. Europe-Asia rates saw a slight decline. Weak European industrial demand, as indicated by a Eurozone manufacturing PMI below 50 in June, suggests ongoing softness in air cargo demand for industrial goods like machinery and components.

UAE Shipping Sector Updates – June 2025

Maersk announced a fuel surcharge adjustment for Southern Africa and Islands, effective August 2025. Read More

Maersk is introducing an Operational Cost Imports (OCI) surcharge for all containers from the world (excluding China) to Jebel Ali, UAE, effective August 15, 2025. Read More

Maersk will introduce a EUR 0.04 per kg SAF surcharge on air freight shipments to/from the EU and UK, effective September 1, 2025, due to new EU regulations. Read More

CMA CGM urges all customers to submit Verified Gross Mass (VGM) for export shipments to avoid delays, penalties, and regulatory actions, as per SOLAS regulations. Read More

Ocean Network Express (ONE) has introduced a new AED 575 BL fee for all trade lanes and services from Jebel Ali, effective July 21, 2025. Read More

Documentation fees will be revised by CMA CGM, effective July 31, 2025, for non-U.S. shipments and August 5, 2025, for U.S. shipments. Read More

Ocean Network Express (ONE) has revised its documentation fee surcharge for all trade lanes and services from Jebel Ali, with the new tariff effective immediately. Read More

The UAE’s MPCI program, effective July 31, 2025, mandates electronic submission of Bills of Lading for inbound containerized cargo, with a grace period until March 31, 2026. Read More

Maersk is introducing OCI and OCE surcharges for Kenya, effective August 1, 2025, to cover new KEPHIS inspection charges. Read More

Evergreen Line has revised its local charges, including the Delivery Order Fee and Bill of Lading Fee, and seeks customer support and cooperation. Read More

Maersk now offers a Consignee Free Time Extension product, letting customers extend free time by up to 14 days at reduced rates via their website. Read More

CMA CGM will release Original Bills of Lading online from August 1, 2025, after vessel departure, with accurate documentation required to avoid amendment charges. Read More

A revision to Standard Detention in Transit (DIT) charges will take effect from September 1, 2025, to reflect current operating conditions. Read More

Global Factory Output – Overview

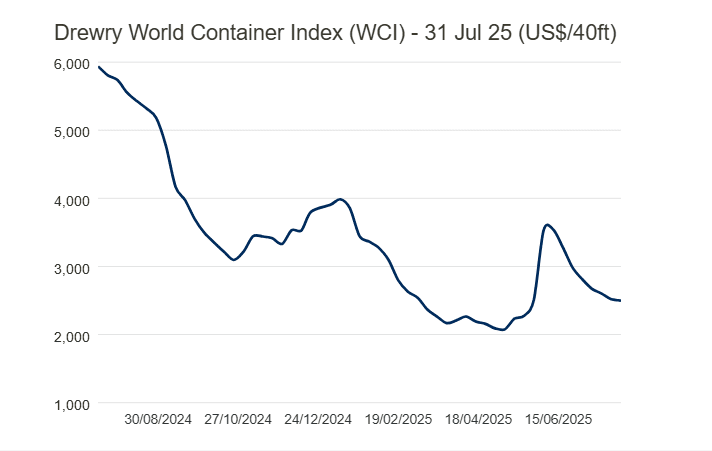

The World Container Index (WCI) has reduced by 1% and reached $2,499 per 40ft container.

United States of America (USA)

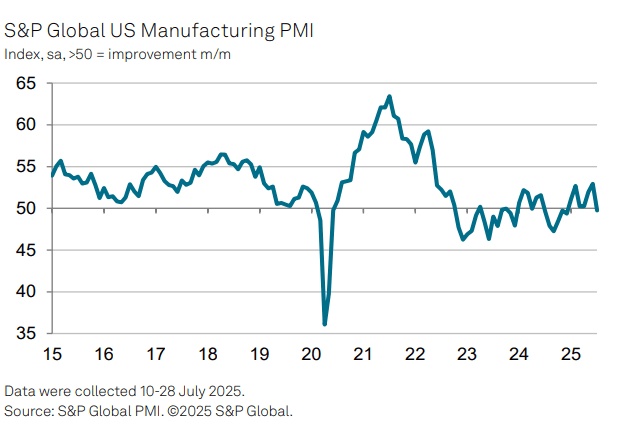

In July, manufacturing conditions worsened for the first time since December, driven by ongoing tariff concerns. After a period of inventory buildup, factories saw little change in new orders and reduced stock levels. Input prices remained high, though there are signs of peaking inflation. Optimism declined as factories worried about reduced demand, especially in exports, leading to job cuts due to rising costs and lower sales.

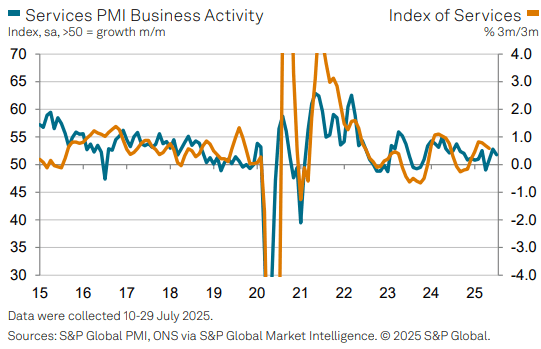

United Kingdom (UK)

UK service providers saw continued growth in July, but new business declined, driven by low client confidence and global economic challenges. Hiring slowed due to concerns over rising payroll costs, though the rate of price increases eased. Despite these issues, providers remain optimistic for the second half of 2025, hoping for a boost from interest rate cuts.

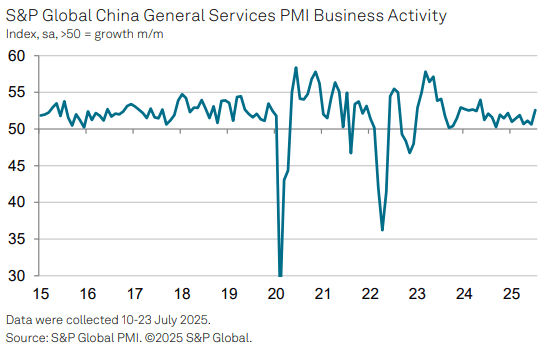

China

China’s service sector saw accelerated growth in July, boosted by stronger demand and a rise in export business. Business sentiment improved, with higher confidence and a return to part-time hiring. Service providers also increased output charges for the first time in six months, outpacing the manufacturing sector.

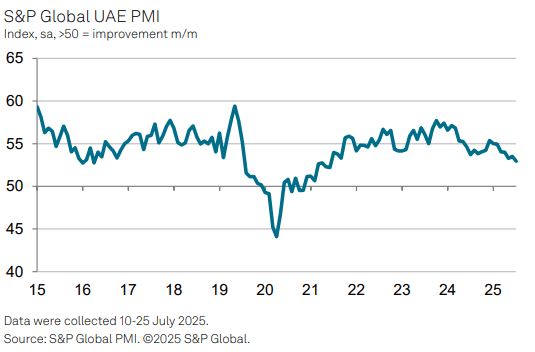

United Arab Emirates (UAE)

Business conditions improved in July, but growth was the weakest since mid-2021, with new orders rising at the slowest pace in almost four years. Factors like regional tensions and increased competition are causing hesitancy among clients and making it harder to secure new business. If tensions ease, sales growth may recover, aided by modest input cost increases. However, challenges such as limited inventory, slow hiring, and low confidence suggest continued risks.

Related Articles

Global Logistics and Shipping Update – August 2025

Logistics Outlook for IMEA in the Second Half of 2025 As we approach the second half of 2025, busine

July 2025 Global Freight & Supply Chain

Middle East Ocean Freight and Port Operations Stable Operations with Ongoing Risk Monitoring Ocean f

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Post a comment

You must be logged in to post a comment.