Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors

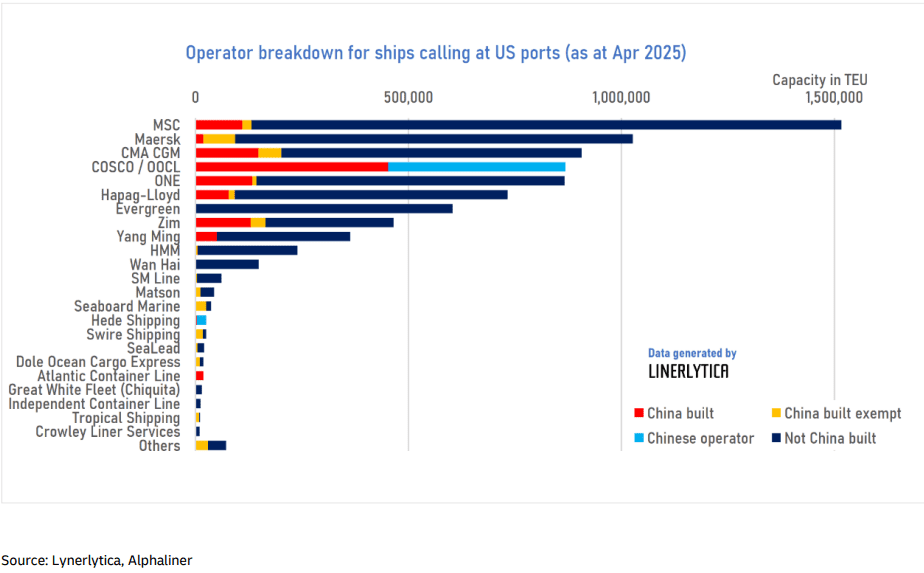

The U.S. Trade Representative (USTR) has revised its port fee regulations, targeting Chinese-operated and Chinese-built vessels starting October 14, 2025. The new fees are as follows:

- Chinese Operated Vessels: USD 50 per net ton, increasing to USD 140 by 2028.

- Chinese Built Vessels: USD 18 per net ton, rising to USD 33 by 2028, or USD 120 per container, increasing to USD 250 in 2028—whichever is higher.

- Non-U.S. Built Vessels Carrying Cars: USD 150 per vehicle.

- Fee Application: Fees apply only on the first U.S. port call, up to five times per year.

Exemptions

Certain vessels are exempt from these fees:

- Ships operating exclusively between U.S. ports, within the Great Lakes, or to/from Caribbean ports.

- Vessels smaller than 4,000 TEU or those on voyages shorter than 2,000 nautical miles.

Impact on Container Shipping

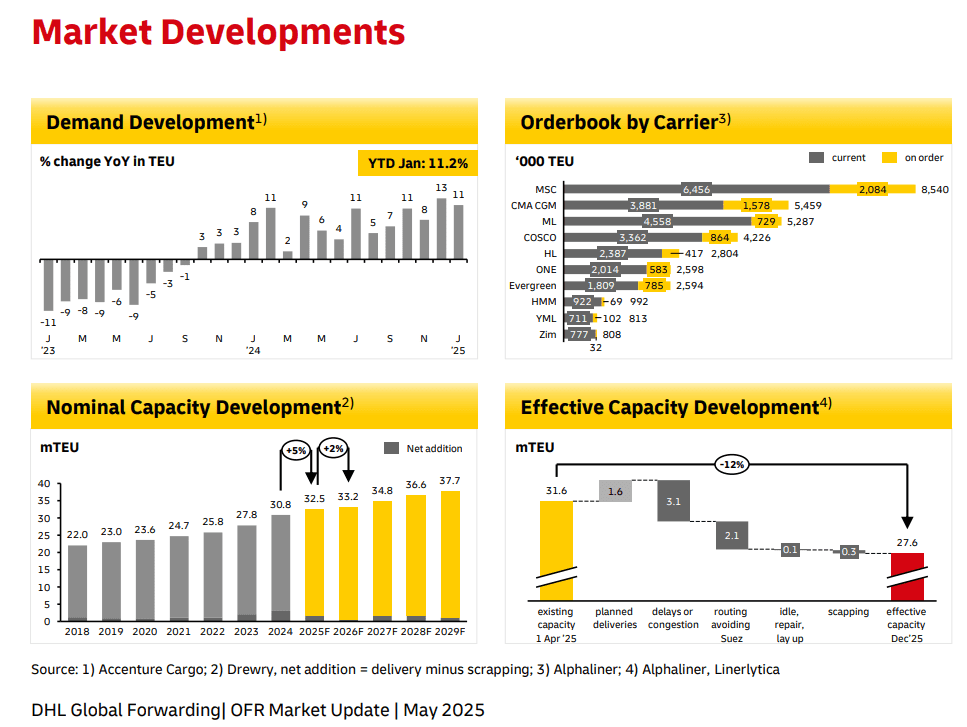

The revised fees will affect only 7% of the containerships calling at U.S. ports in 2024. Major Chinese carriers such as COSCO and OOCL will be significantly impacted, while operators with smaller vessels can avoid these fees. Despite the fee structure being softer than initially proposed, it will still disrupt the container shipping market.

Timeline

- April 17, 2025: Revised port fee regulations officially took effect.

- October 14, 2025: Enforcement begins.

- 2028: Final phased fee increases will be implemented.

Market Disruptions and Adjustments

To mitigate these fees, Chinese carriers like COSCO can use slots on exempt vessels from their alliances or deploy vessels under 4,000 TEU. Linerlytica reports that major carriers have enough exempt ships to avoid major disruptions. Currently, only 20% of the fleet calling at U.S. ports is affected, but the transition to these new regulations will still require close monitoring to avoid operational disruptions.

Ocean Freight Market Outlook – June 2025

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound

Middle East – Asia

Imports into Far East Asia declined due to post-Lunar New Year softness, while Intra-Asia trade showed resilience with strong demand.

Capacity – (-)

Rate – (=)

Middle East – Europe

Strong demand from various regions continues, with terminal congestion issues in key European ports. Customers are encouraged to pick up imports promptly to reduce pressure.

Capacity – (+)

Rate – (=)

Middle East – Latin America

Port congestion in Guatemala and ongoing adjustments in the Intra-Americas service are affecting schedules, leading to delays.

Capacity – (-)

Rate – (=)

Middle East – North America

Strong demand across various regions, leading to tightening capacity as peak season approaches, with limited space on many services.

Capacity – (+)

Rate – (=)

Inbound

Asia – Middle East

Exports from Far East Asia to global markets remain steady, despite market uncertainty, while Intra-Asia demand is driven by strong regional trade flows.

Capacity: (-)

Rate: (=)

North America – Middle East

High export demand from multiple regions, with services operating at full capacity and new options introduced to meet growing needs.

Capacity – (+)

Rate – (=)

Europe – Middle East

Exports remain strong with high demand from North Europe and the Mediterranean, while capacity is fully utilized in East-West services. Temperature-controlled goods continue to drive air freight volumes.

Capacity – (+)

Rate – (=)

Latin America – Middle East

Reefer services for citrus season are resuming, and bi-weekly calls to key ports are scheduled, but some delays are expected due to ongoing operational challenges.

Capacity – (-)

Rate – (=)

International Air Freight Overview - June 2025

Demand: E-commerce and tech demand, along with U.S. tariff news, increased airfreight. Key growth through April 2025 was seen in Intra-Asia-Pacific (13%), Europe-North America (8%), and Asia Pacific-North America (3%).

Capacity: In May 2025, growth occurred in key routes, while Intra-Asia Pacific and North America-Asia Pacific declined. Demand is set to grow 4-6% in 2025, outpacing limited capacity growth.

News: Lufthansa Cargo enhances temperature-controlled services for pharma, supported by the CEIV-certified Pharma Hub Frankfurt. UNCTAD predicts a 40% rise in global copper demand by 2040, driven by the green and digital economy.

The Middle East and Air Carriers

Security developments in Tripoli have caused several operational disruptions, while the demand for Kenyan flowers is expected to decline with the start of the low season through August, coinciding with the Eid Al Adha holidays starting June 6, 2025, which may impact regional cargo flows.

Asia

The tariff rollback has sparked a recovery in the spot market, leading carriers and logistics providers to reassess their capacity strategies to align with changing demand. While the short-term benefits of tariff reductions are evident, the long-term outlook remains uncertain due to ongoing geopolitical tensions and potential policy changes that could influence global trade.

America

The suspension is expected to prompt companies that were previously held back by tariffs to restart shipping and replenish their supply chains. Meanwhile, the US and UK have created a framework for a new trade agreement focused on lowering tariffs and improving market access, especially benefiting industries such as the UK automotive sector.

Europe

Despite weak export demand and cautious business sentiment, the Purchasing Managers’ Index nearly stabilized, while inflation in selling prices picked up. Freight rates have eased from their previous highs but remain stable, indicating a gradual return to normalcy in the air cargo market across Europe.

UAE Shipping Sector Updates – June 2025

Maersk is implementing an Emergency Operational Cost Recovery Surcharge for shipments to and from Pakistan due to trade restrictions, effective from May 21, 2025. Read More

Ocean Network Express (ONE) is making positive changes to how customers can reach them for export and import needs, effective immediately, with further details available in the attached advisory. Read More

CMA CGM has implemented an Emergency Operational Recovering Surcharge for all exports and imports to and from Pakistan due to recent geopolitical developments, effective from May 15th, 2025, with charges based on cargo origin and destination. Read More

CMA CGM announces changes to maritime services and introduces PIKEX service due to geopolitical tensions, with updated export/import connections and surcharges. Read More

A dedicated emergency phone line is now available for urgent UAE shipment matters outside regular hours, with specific operating times for support. Read More

Due to the closure of Hodeida port in Yemen, CMA CGM is holding cargo in Djibouti and requests instructions within 7 days for its fate, with additional costs on the customer. Read More

CMA CGM has resumed accepting bookings to Aden, Yemen, providing alternative solutions for cargo bound for Yemen. Contact CMA CGM Network for more details. Read More

Global Factory Output – Overview

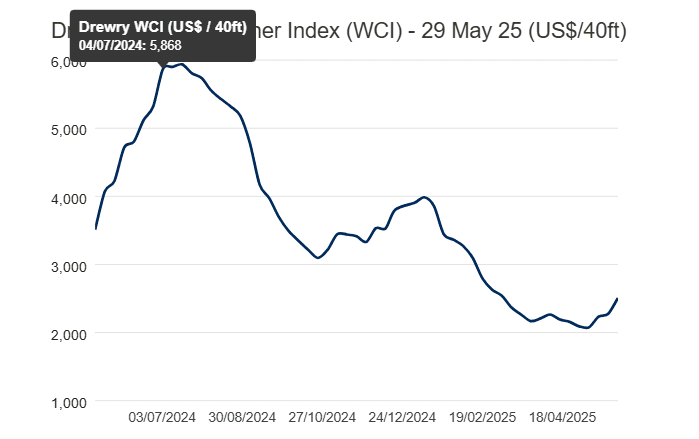

The Drewry’s World Container Index has increased by 10% and reached the value of $2,508 per 40ft container.

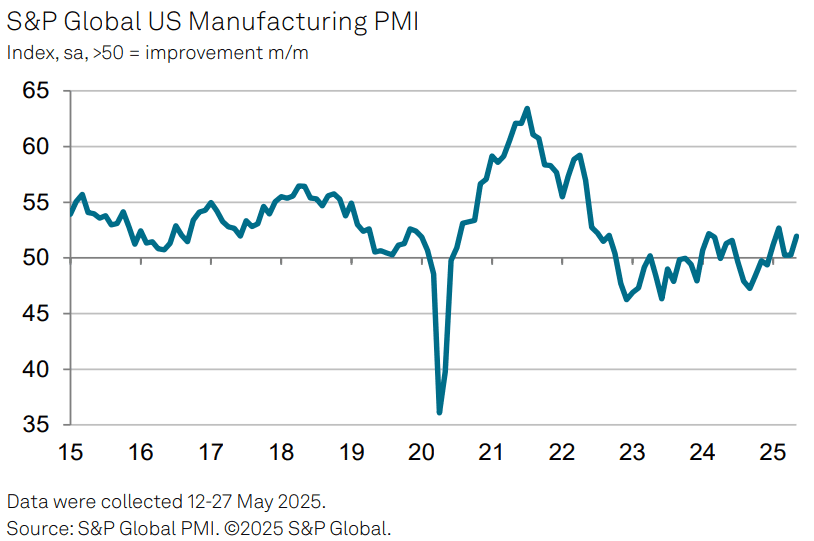

United States of America (USA)

The rise in May’s PMI for the US manufacturing sector masks underlying concerns. While new orders increased and inventories were built, this surge is driven by fears of supply shortages and rising prices, largely due to tariffs. Smaller firms and those in consumer markets are hit hardest. Despite regained optimism, uncertainty remains high, and factories are hesitant to expand their workforce amid tariff volatility.

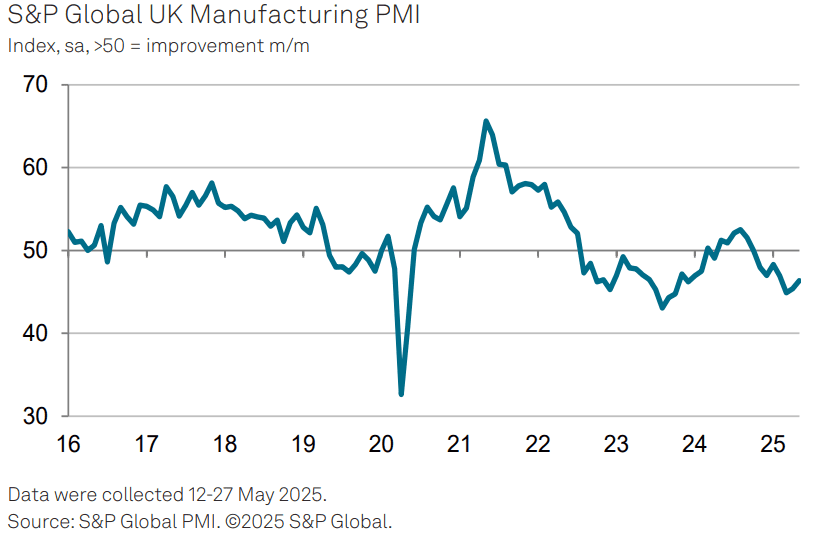

United Kingdom (UK)

May PMI data highlights significant challenges for UK manufacturing, including market turbulence, trade uncertainties, and rising wage costs. Smaller manufacturers are struggling the most, with declining output, demand, and job losses. While recent PMI indices suggest a slight improvement in output and new orders, trading conditions remain volatile, leaving the future uncertain.

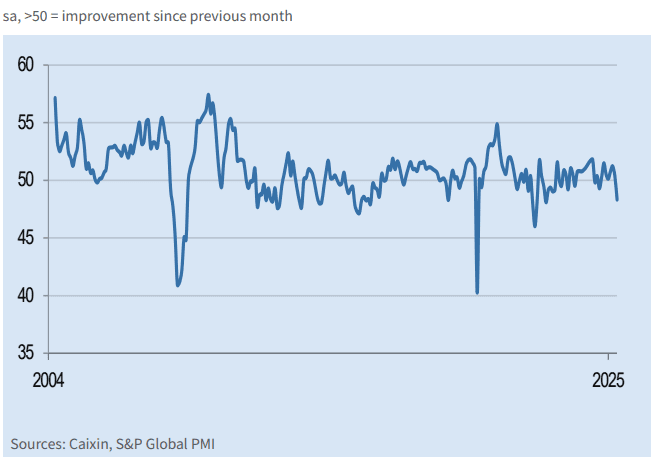

China

In May, China’s manufacturing sector saw a decline in operating conditions, with output, new orders, and export orders all falling. PMI dropped to 48.3, signaling the worst performance since September 2022. Firms reduced purchasing activity and staff levels. However, there was improved sentiment towards future output, with confidence rising for the first time in three months. Input costs and output charges continued to decrease, while optimism grew as firms hoped for better trade conditions and wider export markets.

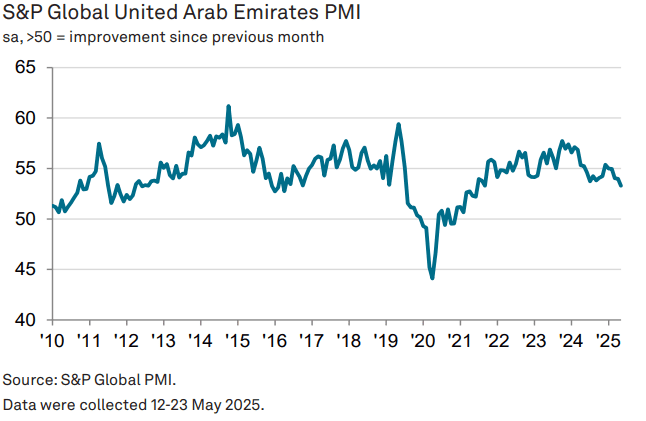

United Arab Emirates (UAE)

In May, UAE non-oil firms reported a slowdown in growth, with PMI dropping to its lowest level since September 2021. While strong demand continued, competitive pressures and weaker trade due to US tariffs affected growth. The sharp reduction in stock levels and a subdued outlook indicate softer growth ahead. On a positive note, inflationary pressures eased, with input costs rising at the slowest rate since late 2023.

Related Articles

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Global Logistics Market Update – May 2025

New Sulphur Emission Limits Enter into Effect in the Mediterranean The Mediterranean Sea officially

April 2025 Global Logistics & Supply Chain Market Update

U.S. Section 301 Proposals and Global Shipping Dynamics Global Trade Disruptions & Rising Costs

Post a comment

You must be logged in to post a comment.