Global Logistics Market Update – May 2025

New Sulphur Emission Limits Enter into Effect in the Mediterranean

The Mediterranean Sea officially became an Emission Control Area (Med SOx ECA) under MARPOL Annex VI on May 1, 2025. This regulatory change mandates that ships operating in the Mediterranean must limit the sulphur content in their fuel oil to 0.1%.

This is a significant step in the global effort to reduce air pollution from maritime activities, providing notable benefits to both human health and the environment.

Sulphur Content Limitations in Emission Control Areas

Ships operating within the Mediterranean are now required to comply with a stricter sulphur content limit of 0.1%, significantly lower than the global standard of 0.5%. These new regulations are part of the broader initiative to reduce emissions from vessels operating in Emission Control Areas (ECAs) designated for Sulphur Oxides (SOx) and Particulate Matter (PM).

Expansion of Emission Control Areas

With the Mediterranean now designated as an Emission Control Area, it joins several other regions under MARPOL Annex VI, including the Baltic Sea, North Sea, and North American areas.

The International Maritime Organization (IMO) has also set its sights on designating additional areas such as the Canadian Arctic and the North-East Atlantic in the near future. This expansion is part of the broader effort to tackle sulphur emissions globally and promote cleaner shipping practices.

Global Ocean Freight Overview – May 2025

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound

Middle East – Asia

Asia’s imports remain steady, supported by flexible networks, optimized capacity, and seamless operations at the Tanjung Pelepas hub, ensuring resilience in the face of evolving trade patterns.

Capacity – (+)

Rate – (=)

Middle East – Europe

Europe’s imports continue to be robust but manageable, with northern ports maintaining stability, rising yard density in Southern Europe, and ongoing congestion challenges at Antwerp.

Capacity – (+)

Rate – (=)

Middle East – Latin America

Inbound trade to Latin America is showing improvement with the resumption of services through Savannah, though Haiti’s instability presents potential risks to regional cargo flows.

Capacity – (+)

Rate – (=/-)

Middle East – North America

North America’s imports remain strong, driven by high demand, limited space, Peak Season Surcharges, and increasing LCL volumes, all amid ongoing inventory management challenges and tariff uncertainties.

Capacity – (+)

Rate – (+)

Inbound

Asia – Middle East

Asia’s exports are experiencing a surge, fueled by strong demand, an expanded fleet, high vessel utilization, and 94% schedule reliability. Maersk recommends early bookings to secure space.

Capacity: (++)

Rate: (+)

North America – Middle East

North America’s exports are experiencing strong demand, with full-capacity sailings and new services improving efficiency to Europe and Latin America, despite ongoing delays in the East Med and Canada.

Capacity – (+)

Rate – (+)

Europe – Middle East

Europe’s exports remain stable, supported by strong schedule reliability, steady ports, and proactive cargo management, despite congestion in Antwerp and recovery from weather disruptions in Tangier.

Capacity – (+)

Rate – (=)

Latin America – Middle East

Peru’s feeder service concludes after the reefer season, shifting its focus to Buenaventura, Colombia, to accommodate the growing export flows to South America’s west coast.

Capacity – (+)

Rate – (+)

May 2025 Air Freight Market Trends and Updates

Demand: Trade tensions, especially between the U.S. and China, caused a surge in air freight as companies sought to avoid tariffs. In Q1’25, major volumes came from Asia Pacific (China, Hong Kong, Indonesia, Japan). Key trade routes with notable year-on-year growth in Q1’25 included Europe-Americas (9%), Asia Pacific-Americas (3%), and Intra-Asia Pacific (11%).

Capacity: Forecasted capacity growth is slightly behind demand growth, with a 3-4% increase in capacity versus a 4-6% rise in demand. Capacity growth remains moderate due to uncertainty around tariffs and trade policies, e-commerce volatility, and ongoing supply chain constraints.

News: Starting April 1, 2025, Canada implemented the Pre-Load Air Cargo Targeting (PACT) program, requiring pre-loading risk assessments for shipments entering the country to improve air cargo security. Meanwhile, ongoing conflicts in the Red Sea and Ukraine continue to affect the airfreight market.

The Middle East and Air Carriers

In the Middle East, carriers have begun operating ad-hoc freighter flights to meet rising demand, increasing available capacity. Additionally, spot rates from the UAE to Europe are declining as carriers offer more space.

Asia

Airlines, forwarders, and shippers face challenges in planning due to shifting trade flows, with shippers rerouting goods to countries with lower tariffs and adjusting production and distribution hubs. Airlines are realigning their capacity to meet demand in key trade lanes. These shifts are expected to increase volumes from China to Europe/Latin America and from Southeast Asia/India to the USA.

America

Ongoing US trade talks make it uncertain how tariffs will evolve, complicating predictions about their impact on trade. In Mexico, the mango season is driving higher airfreight volumes and increasing demand for temperature-controlled shipping. However, rising temperatures in Mexico are causing flight delays and risks, particularly for perishable cargo that needs fast, stable transportation.

Europe

Major European cargo airports and airlines, including BRU, AMS, and LGG, expanded their handling capacities to accommodate rising cargo volumes and avoid congestion. However, labor strikes, particularly on March 31, disrupted European air freight, with a nationwide strike in Belgium halting flights at Brussels and Charleroi airports, along with similar disruptions in Germany.

UAE Shipping Sector Updates – May 2025

CMA Terminals Khalifa Port (CMATK) is now operational, with mandatory truck registration and RFID requirements for smooth operations. Read More

CMA CGM UAE offers email and phone support, with clear service timelines for export booking, invoices, and dispute resolution. Read More

CMA CGM requests customers to upload hazardous documents and lashing certificates via the online portal before the cutoff for efficient processing. Read More

Global Factory Output – Overview

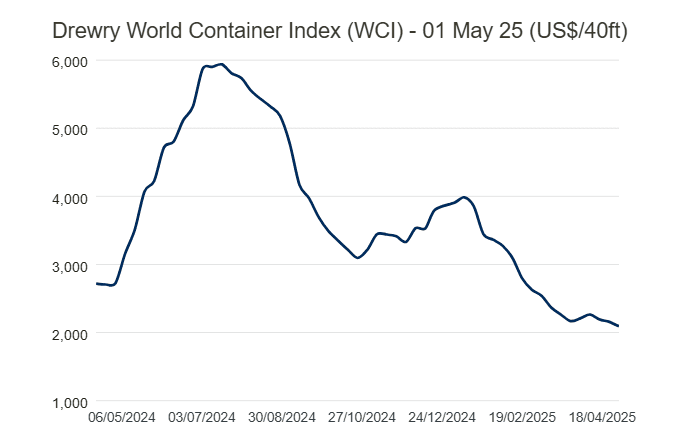

The Drewry World Container Index has reached $2,091 per 40ft container after a reduction of 3%.

United States of America (USA)

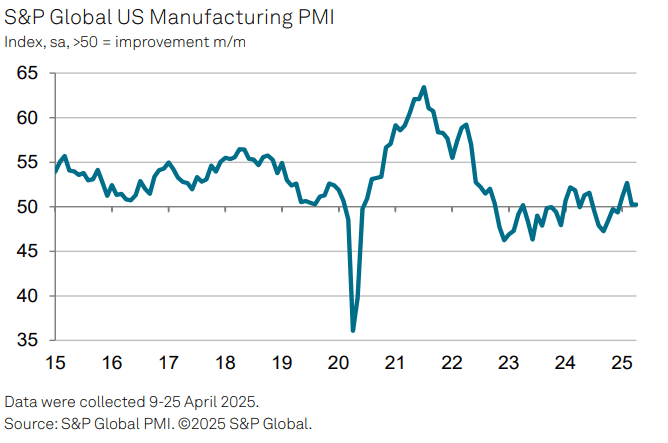

In April, manufacturing activity stagnated due to rising costs and concerns about the future. Factory output declined for the second month, mainly because of tariffs hurting export orders and reduced customer spending. While some producers benefited from demand shifting away from imports, supply chain disruptions and lost export sales limited gains. Business confidence dropped to its lowest point in 10 months, and input costs surged due to tariffs, supply shortages, and a weaker dollar. Manufacturers responded by increasing prices and cutting jobs to protect their margins.

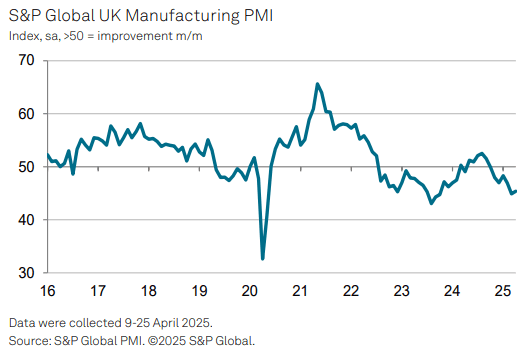

United Kingdom (UK)

UK manufacturing struggled in the second quarter due to global market challenges, rising costs, and trade uncertainty. April saw declines in output, orders, exports, and business confidence, with overseas demand, particularly from the US, Europe, and China, weakening. US tariffs added to trade volatility, and manufacturers faced a 28-month high in purchase price inflation, driven by rising raw material costs and domestic pressures like higher National Insurance and wages. In response, manufacturers raised prices and cut non-essential spending.

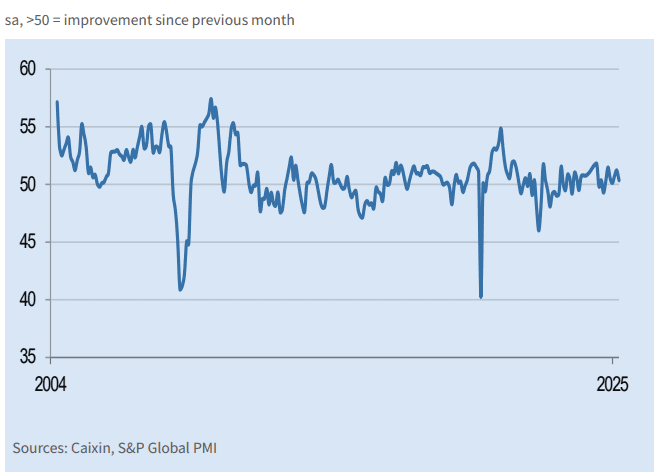

China

China’s manufacturing growth slowed in April due to declining export orders, mainly from tariffs, and weaker domestic demand. The PMI fell to 50.4, signaling slower growth. Firms reduced inventory, shed jobs, and lowered selling prices to share cost savings. Despite challenges, manufacturers remained hopeful for future growth, but business confidence dropped to its third-lowest level since 2012.

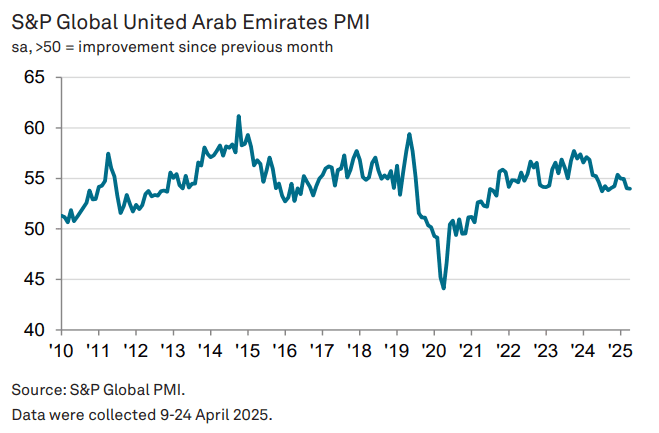

United Arab Emirates (UAE)

The April PMI data showed a significant increase in hiring activity in the non-oil private sector, reaching its highest level in 11 months. This rise in employment was mainly driven by companies trying to reduce their growing backlogs, which had increased but at the slowest pace in six months. While job creation was higher, it was still modest overall, suggesting that some companies might be facing challenges in recruitment. The PMI reading of 54.0, unchanged from March, indicates continued strong improvement in business conditions, with companies optimistic that sustained demand and increasing backlogs will lead to further growth in the coming months.

Related Articles

Global Logistics and Shipping Update – August 2025

Logistics Outlook for IMEA in the Second Half of 2025 As we approach the second half of 2025, busine

July 2025 Global Freight & Supply Chain

Middle East Ocean Freight and Port Operations Stable Operations with Ongoing Risk Monitoring Ocean f

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Post a comment

You must be logged in to post a comment.